Special Dedication to Pio Ieraci

August 5, 2022 was a special day, because we finally realized the dream of recognizing our friend-late community leader Pio Ieraci by designating a section of A1A in his name. Pio was active in the Galt Mile for many years, serving as its president for the past 20 years. It is fitting this section is called the “Pio Iearci Memorial Drive.”

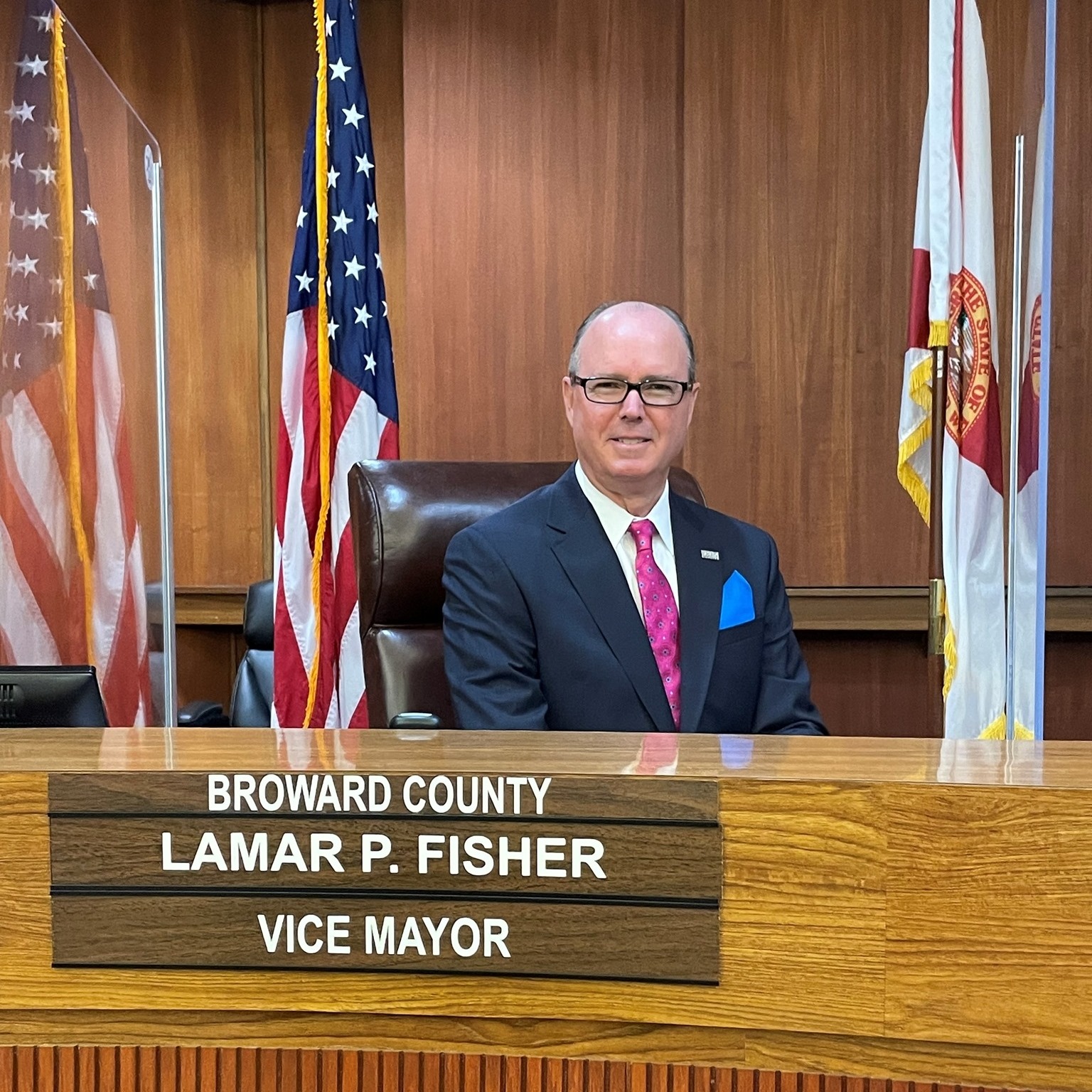

Thank you to State Representative Chip LaMarca, who introduced and heralded the bill through the state legislature creating this designation, Fort Lauderdale Commissioner Heather Thompson Moraitis, Broward County Vice-Mayor Lamar P. Fisher and Fort Lauderdale Mayor Dean Trantalis for your help with the City of Fort Lauderdale resolution and to the Florida Department of Transportation for all of their assistance with the process of implementing the legislation into this designation.

Also thanks Fred Nesbitt for stepping into the impossible shoes of Pio and being the leader of the Galt Mile Community Association. Thanks to Chip’ legislative aide Sammy Verner for working with FDOT from the legislative process to the installation.

Also in attendance at the unveiling ceremony were Pio’s family: Lisa Ieraci, Alessia Ieraci and Daniel Ieraci, as well as many members of the Galt Mile community.

In so many ways, Pio was the Galt Mile – and the Galt Mile was Pio.