|

In May of 2002, the Florida Legislature passed a new statute defining fire safety standards for high-rise buildings. At the next scheduled annual fire inspection of your building, you will be officially notified about the necessity of installing a Full Sprinkler System or establishing an acceptable Engineered Life Safety System as an alternative! Your building will have to pony up between $15,000-$25,000 to a "Fire Safety" engineering firm to compose an acceptable plan that will meet the statutory requisites. A second expense is the actual cost (roughly $800,000 - $3,200,000 - depending on several factors) of implementing the approved plan within the next 11 years. Ouch! Is this life saving legislation or an ill-conceived pork barrel project dumped on us in the dead of night? What follows is a chronological history of this issue starting in the Spring of 2002 through the present. In May of 2002, the Florida Legislature passed a new statute defining fire safety standards for high-rise buildings. At the next scheduled annual fire inspection of your building, you will be officially notified about the necessity of installing a Full Sprinkler System or establishing an acceptable Engineered Life Safety System as an alternative! Your building will have to pony up between $15,000-$25,000 to a "Fire Safety" engineering firm to compose an acceptable plan that will meet the statutory requisites. A second expense is the actual cost (roughly $800,000 - $3,200,000 - depending on several factors) of implementing the approved plan within the next 11 years. Ouch! Is this life saving legislation or an ill-conceived pork barrel project dumped on us in the dead of night? What follows is a chronological history of this issue starting in the Spring of 2002 through the present.

Fire Safety Plan

The 2002 Florida Legislature passed a new statute that redefined fire safety standards applicable to high-rise buildings. When a high-rise condominium or cooperative undergoes its next scheduled annual fire inspection, the association will be officially notified about the necessity for installing a Full Sprinkler System or establishing an acceptable Engineered Life Safety System as an alternative! This brief summary will add some perspective to the issues and enumerate the players. The 2002 Florida Legislature passed a new statute that redefined fire safety standards applicable to high-rise buildings. When a high-rise condominium or cooperative undergoes its next scheduled annual fire inspection, the association will be officially notified about the necessity for installing a Full Sprinkler System or establishing an acceptable Engineered Life Safety System as an alternative! This brief summary will add some perspective to the issues and enumerate the players.

| Former Fort Lauderdale Fire

Marshal Steve Kastner |

Our former local Fire Marshal, Steve Kastner, convened a meeting on July 10, 2002 at the Galt Mile Community Center in an effort to quell some of the confusion surrounding this enigmatic mandate. The legislation itself was a mixture of the existing Florida Fire Prevention Code inherent to the Fire Prevention and Control (Title XXXVII, Chapter 633) section of the Florida State Statutes, the Florida Administrative Code Chapter 4A60, and certain NGO (non-governmental organization) engineered Life Safety and Fire Safety codes. Strangely enough, self-serving provisions drafted by Sprinkler Associations and the Plumbers and Pipefitters Union were melded into the mandate. The legitimate NGO involved was the NFPA (National Fire Protection Association) and the adopted codes were NFPA 101 (Life Safety Code) and NFPA 1 (Fire Safety Code). The NFPA is an organization that creates and updates regulatory codes and markets them to legislative organs that do not have the expertise, the resources, or the inclination to develop their own. In contrast, Sprinkler Associations are industry trade organizations dedicated to enriching its corporate membership. The part of the statute that compels our interest is the section that addresses �Hi-Rise Buildings�. The statutory definition of a High-Rise Building is structure that is at least 75 feet high. A total of 60 buildings in Fort Lauderdale fit this description including all of our Association members. Statewide, thousands of associations would be forced to comply with the Sprinkler Statute.

The exceptions to the mandate to install a Full Sprinkler System apply to buildings that either 1) provide exterior access to every dwelling (connected balconies or catwalks that ultimately outlet to the street) or 2) have an approved Engineered Life Safety System. While several of our members �dodged the bullet� in that their buildings include exterior access, the majority of Association buildings faced installing the alternative Engineered Life Safety System to satisfy the statute. While less onerous than the full sprinkler retrofit, the alternative was also a significant fiscal hardship. The exceptions to the mandate to install a Full Sprinkler System apply to buildings that either 1) provide exterior access to every dwelling (connected balconies or catwalks that ultimately outlet to the street) or 2) have an approved Engineered Life Safety System. While several of our members �dodged the bullet� in that their buildings include exterior access, the majority of Association buildings faced installing the alternative Engineered Life Safety System to satisfy the statute. While less onerous than the full sprinkler retrofit, the alternative was also a significant fiscal hardship.

By definition, this Engineered Life Safety System was formulated to provide a level of protection equal to or better than a full sprinkler system. It consisted of 3 integral components. Partial automatic sprinkler protection in certain common areas and one sprinkler head through the front door into each dwelling unit was requisite. Unless already installed, buildings needed to retrofit an integrated smoke detection and alarm system. Lastly, a system of approved compartmentation (fire rated doors, fire rated walls, etc.) was warranted to help restrict a fire from spreading. The building systems impacted by these requirements (in addition to installing new standpipes, plumbing pipes and sprinkler heads) included the fire alarm system (smoke and sensor), the emergency generator, the fire pump, the elevator recall system, and any compartmentation upgrades required to mollify subsequent penetration (plug holes in certain walls, close off certain areas, upgrade fire ratings of certain doors, etc.) All told, the projected cost ranged from $1.2 million to $4 million, depending on the size of the structure, its existing fire safety features and the sizable expense of aesthetic renovation for any ceilings, walls and floors wherein the new plumbing elements were integrated. By definition, this Engineered Life Safety System was formulated to provide a level of protection equal to or better than a full sprinkler system. It consisted of 3 integral components. Partial automatic sprinkler protection in certain common areas and one sprinkler head through the front door into each dwelling unit was requisite. Unless already installed, buildings needed to retrofit an integrated smoke detection and alarm system. Lastly, a system of approved compartmentation (fire rated doors, fire rated walls, etc.) was warranted to help restrict a fire from spreading. The building systems impacted by these requirements (in addition to installing new standpipes, plumbing pipes and sprinkler heads) included the fire alarm system (smoke and sensor), the emergency generator, the fire pump, the elevator recall system, and any compartmentation upgrades required to mollify subsequent penetration (plug holes in certain walls, close off certain areas, upgrade fire ratings of certain doors, etc.) All told, the projected cost ranged from $1.2 million to $4 million, depending on the size of the structure, its existing fire safety features and the sizable expense of aesthetic renovation for any ceilings, walls and floors wherein the new plumbing elements were integrated.

The notification process began immediately. All potentially affected buildings received a �courtesy notification� in the form of a letter from Steve Kastner, the former local Fire Marshal, to alert them to the ensuing requirements. Official notification was issued at the time of the annual fire inspection for each building. Upon being officially notified it was recommended to retain the services of a Fire Protection Engineer, evaluate the building, compare options (check with insurance carrier), and develop a report including a generalized plan of action. Each building had 180 days to respond to the notification by submitting an �Intent to Comply� letter. This letter needed to include Condominium Board of Directors approval, the name of the selected Fire Protection Engineer, the chosen method of compliance, a copy of the Engineered Life Safety Report, and a general compliance timeline. After the �Letter of Intent� was submitted, the jurisdictional authority had 60 days to respond. The notification process began immediately. All potentially affected buildings received a �courtesy notification� in the form of a letter from Steve Kastner, the former local Fire Marshal, to alert them to the ensuing requirements. Official notification was issued at the time of the annual fire inspection for each building. Upon being officially notified it was recommended to retain the services of a Fire Protection Engineer, evaluate the building, compare options (check with insurance carrier), and develop a report including a generalized plan of action. Each building had 180 days to respond to the notification by submitting an �Intent to Comply� letter. This letter needed to include Condominium Board of Directors approval, the name of the selected Fire Protection Engineer, the chosen method of compliance, a copy of the Engineered Life Safety Report, and a general compliance timeline. After the �Letter of Intent� was submitted, the jurisdictional authority had 60 days to respond.

| | Former FL Fire Marshal Sink |

| | Former Fire Marshal Gallagher |

The actual compliance installation deadline for the original mandate was JANUARY 1, 2014 (12 Years From January 1, 2002). This was a county-wide process and the statutory requirements were state-wide. Former Fort Lauderdale Fire Marshal Steve Kastner stated that he realized that this presented an unforeseen burden to all of the affected Associations and promised his department�s cooperation and flexibility with regard to guidance and enforcement. He volunteered to address any Association to help clarify the requirements and their implementation. After examining the mandate's actual benefits and liabilities, reviewing its cloudy legislative background, exploring adverse insurance ramifications, uncovering a rat's nest of conflicting interests among the players and investigating our member Associations� alternatives, the Galt Mile Community Association decided to oppose the mandate and support the enactment of legislation to forgo the statute's onerous requirements. Particularly disturbing to the neighborhood association's Advisory Board was the fact that Florida's retrofit statute was the only one in the nation without an exemptive "Grandfather Clause" for existing associations that were fully compliant with State and local Fire Safety regulations.

| | FL CFO & Fire Marshal Atwater |

The Fire Marshal distributed a data sheet containing the contact information of four recommended Fire Safety Engineering Firms. He emphasized the fact that a "Fire Protection Engineer" is a uniquely credentialed engineering specialty. The cost for this mandatory preliminary study was projected to incrementally add between $15,000 and $25,000 to any retrofit assessment.

| Fort Lauderdale Fire

Marshal David Raines |

When sprinkler legislation for high-rise associations was initially enacted in 2002, the Florida State Fire Marshal was Tom Gallagher, who also served as State Treasurer. A few years later, he was replaced by Alex Sink. Six months after the 2010 sprinkler retrofit relief bill was signed into law, Jeffrey Atwater - our former District 25 State Senator - was elected as Florida's Chief Financial Officer. As Florida CFO, Atwater also serves as State Treasurer and State Fire Marshal. Closer to home, when the sprinkler statute was first passed, our local Fort Lauderdale Fire Marshal was Steve Kastner. When he took a similar position in another jurisdiction, his responsibilities in the Fort Lauderdale Fire Prevention Bureau were assumed by Fire Marshal David Raines, who was serving when the 2010 opt-out legislation was enacted into law. The address of the Fort Lauderdale Fire Prevention Bureau is 300 Northwest First Avenue, Fort Lauderdale, Florida 33301, Phone: (954) 828-6370.

Click To Top of Page

|

|

|

Fire Safety Controversy Heats Up

- March 8, 2003 -

The residents of the Galt Mile community are currently tolerating an exasperating and expensive ordeal that accompanies the massive renovation efforts required to bring their 20-30 year old buildings into the 21st century. Replacing the roof, waterproofing the building and the grounds, renovating the balconies, modernizing the elevators, resurfacing the driveway, rehabilitating the garage, performing an exhaustive list of structural repairs, painting the building, renovating the lobby, installing water towers, HVAC repairs, smoke and sensor upgrades, and hundreds of other expensive projects along with the necessary code upgrades that accompany each project has ravished the patience and the wallets of thousands of condo dwellers along the Galt Ocean Mile. The specter of another million-dollar project unceremoniously dumped on the top of this construction quagmire would have to be, at the very least, a clear and uncontested necessity. The residents of the Galt Mile community are currently tolerating an exasperating and expensive ordeal that accompanies the massive renovation efforts required to bring their 20-30 year old buildings into the 21st century. Replacing the roof, waterproofing the building and the grounds, renovating the balconies, modernizing the elevators, resurfacing the driveway, rehabilitating the garage, performing an exhaustive list of structural repairs, painting the building, renovating the lobby, installing water towers, HVAC repairs, smoke and sensor upgrades, and hundreds of other expensive projects along with the necessary code upgrades that accompany each project has ravished the patience and the wallets of thousands of condo dwellers along the Galt Ocean Mile. The specter of another million-dollar project unceremoniously dumped on the top of this construction quagmire would have to be, at the very least, a clear and uncontested necessity.

The Florida legislature�s midnight gift to residents of high-rise buildings throughout the state, the mandate to install a Full Sprinkler System or establish an acceptable Engineered Life Safety System as an alternative, leaves us with two issues that need to be addressed. The necessity and the price tag. The cost of statutory compliance in Broward County is on two levels. Within 180 days of your building�s annual fire inspection, you will have to pony up between $15,000-$25,000 to a �Fire Safety� engineering firm to compose an acceptable plan that will meet the statutory requisites. The second level is the actual cost (neighborhood of $800,000 - $1,200,000) of implementing the approved plan within the next 11 years. Ouch!

This is where some of the confusion starts. At a 7/10/2002 �Town Hall� style meeting convened at the Beach Community Center by our local Fire Marshal, Steve Kastner, we were informed of the 180-day requirement to proffer an acceptable Engineered Life Safety System. Marshal Kastner was peppered by questions about the necessity and the efficacy of a plan prepared today for implementation in eleven years from now. If a Fire Safety Engineer drew up a plan for your building in 1991, the obsolete plan would have to be completely redrawn anew today. Any responsible Board would recognize the 1991 plan to be uselessly out of date! He responded that the plan should be an �outline� or a �guide� in that the technology available during the next eleven years would almost certainly evolve and alter the basic tenets of any effective plan. The notion that the Fire Marshal was demanding a plan that would be obsolete before it was implemented triggered widespread confusion among the audience. Why would the Fire Marshal require the expenditure of a substantial amount of money toward a plan that would have to be redrawn as the technology evolved? His response was that the Fire Marshal�s office needed �verification that compliance with the statute was being taken seriously� by the various Associations. Hmmm...

The NFPA 1 Fire Safety Code for high-rise buildings (7.3.2.21.2.1) actually states, �Each building owner shall, within 180 days of receiving notice, file an intent to comply with this regulation with the authority having jurisdiction for approval. The authority having jurisdiction shall review and respond to the intent to comply submittal within 60 days of receipt.� All that�s required in the code is the filing of an �intent to comply�. Demanding the premature submittal of an �Engineered Life Safety System� was actually the handiwork of our Fire Marshal, not the statutory code. Wouldn�t a signed affidavit agreeing to comply by the Association�s Board impart the same comfort level to the Fire Marshal�s office as a virtually useless (and expensive) Engineered Life Safety System plan that would most certainly have to be redrawn (and re-expensed) prior to implementation?

Marshal Kastner stated several times that the plan �should be drawn flexibly to accommodate new technology as it becomes available.� The only circumstance under which this mandated plan would not be a complete waste of money is through its immediate implementation. If an Association ignored the Fire Marshal�s admonition to �utilize the eleven year implementation period to take advantage of developing technology� and decided instead to install the plan�s system immediately, they would experience a trade-off. In exchange for being the first building on the block with an approved system, they would have the most antiquated and obsolete system by the statutory deadline! If they accept the Fire Marshal�s advice to wait for the technology to improve, they have to pay for another plan to be executed just prior to implementation. What�s wrong with this picture?

If you can comfortably digest this mysterious fiscal appetizer, you are ready for the main course. No one can put a price on life. No responsible Condo or Co-op Association would resist installing an effective Life Safety system. The NFPA (National Fire Protection Association) has compiled a one-size-fits-all set of Fire and Life Safety standards that our legislature, in its wisdom, transformed into law without our input. The same standards apply whether you live in Miami or the Everglades, big city or small town, eight-story building or an eighty-story skyscraper, next door to a fire station or in the middle of the swamp. These regulatory codes, NFPA 101 (Life Safety Code) and NFPA 1 (Fire Safety Code), have been accepted in all fifty states because they are comprehensive and flexible. One minor detail that the proponents of this statute repeatedly omit is the fact that this code was developed primarily for use in NEW BUILDINGS! Every single state that adopted the NFPA codes also included a grandfather clause to accommodate all their existing structures with one glaring exception, the State of Florida. In fact, all of our sister states hold that something as important as this demands a customized combination of Fire and Life Safety systems that should be developed from the ground up. Intrinsic components should be based upon the structures age, configuration, demographics, size, structural composition, location, and a variety of other factors that a competent Fire Safety Engineer might consider. The NFPA codes were not designed for use in retrofitting older pre-existing high-rise structures. Every state in the union recognized this except the State of Florida!

Are We Getting Hosed?

Basically we face two dilemmas. Firstly, we are being forced to spend $15,000-$25,000 to create an alternative Engineered Life Safety plan that we will have to spend again at the time we implement it. Why? To prove that we take the statute seriously? Secondly, we are being forced to accomplish a million dollar statutory retrofit according to a set of codes that were clearly not designed for pre-existing structures. Why? Florida is the only state in the union that is forcing existing structures to retrofit a system designed for new buildings. Every other state respected eminent domain and allowed existing buildings to design a sound Fire and Life Safety plan based upon the actual needs of the individual structures as determined by an authorized Fire Safety Engineer. Basically we face two dilemmas. Firstly, we are being forced to spend $15,000-$25,000 to create an alternative Engineered Life Safety plan that we will have to spend again at the time we implement it. Why? To prove that we take the statute seriously? Secondly, we are being forced to accomplish a million dollar statutory retrofit according to a set of codes that were clearly not designed for pre-existing structures. Why? Florida is the only state in the union that is forcing existing structures to retrofit a system designed for new buildings. Every other state respected eminent domain and allowed existing buildings to design a sound Fire and Life Safety plan based upon the actual needs of the individual structures as determined by an authorized Fire Safety Engineer.

The Galt Mile Community Association has been wrestling with these dilemmas for the past year. Every member Association has scrupulously adhered to every statutory fire and life safety code. According to GMCA President Robert Rozema, �In our 35 year history, not one life has been lost to fire.� In addition, Mr. Rozema points out that �none of the property damage incurred by fire would have been prevented by the sections of the code that we disagree with. Every one of our Associations is willing to have a Fire Safety Engineer create and implement a comprehensive plan that works. However, the plan needs to be customized to fit the different needs of each structure. The necessity and placement of sprinklers, fire walls, and alarm systems should be left to the Fire Safety Engineer and approved by the Fire Marshal, not determined by a set of codes that were clearly never intended to be retroactively implemented. Florida is currently the only state that is making this irrational demand. While we agree with the intent of the legislation, we feel that it�s incomplete. Hopefully, our legislators will fix the statute so that we can get on with installing and upgrading effective Life and Fire Safety systems.�

Our representatives recognize our dilemma and are attempting to rectify the adjunctive problems. They face one nagging obstacle. Because of the recent highly publicized fire related disasters, the legislature is concerned about being painted as �soft on fire safety� if they try to excise the flawed sections of the statute. The attempts to correct the inequities in the legislation have been portrayed in the media with buzzword bylines like �Condos trying to Water Down Sprinkler Law�. In a recent article by Nicole White in the 3/6/2003 edition of the Miami Herald, she quotes Miami Beach Fire Chief Floyd Jordan as stating that �If that club in Rhode Island had a sprinkler system, not a single person would have died.� The unfortunate victims of that disaster were watching an indoor pyrotechnics (fireworks) display in an enclosed room that was loaded with highly combustable artifacts, substandard containment, and insufficient egress. Our situation is hardly analogous. The Alternative Engineered Life Safety system postulated by Fire Marshal Kastner calls for only one sprinkler head at the entry foyer of a residence. If the club in Rhode Island installed the system recommended for our high-rise buildings, not one life would have been saved! This kind of misrepresentation in the press creates a politically untenable environment for any representative trying to correct the flaws in the legislation.

The legislative session in Tallahassee convened on March 4, 2003. It is a 60-day session and there are currently two bills, one in the House and one in the Senate, which are being considered to address high-rise buildings. One bill attempts to exempt all buildings constructed on or before January 1, 2002 but leaves the granting of the exemption to the local authority having jurisdiction. The other bill would allow a vote of 2/3 of the total voting interests in the community to opt out of the retrofitting requirements. Rep. Connie Mack, R-Fort Lauderdale, is a sponsor of the house bill. He has stated that the bill is about giving condo owners the right to choose. On 3/5/2003 it was presented to the members of the House Judiciary Committee. As a result of the media pressure mentioned earlier, it received tepid support.

Grass roots support for this type of legislation would have a substantial impact on its fruition. Contacting your representative to convey support will help the effort immeasurably. Please take a moment and send a letter or an e-mail to Connie Mack to encourage him to pursue his efforts. Click Here to send Representative Mack an E-mail of support! Click Here to access comprehensive contact information (including Capitol and District addresses and telephone numbers) for Representative Connie Mack. Thank you for caring.

Fighting Fire With Fire

We can�t afford to let this issue be decided by journalists who are clearly not in the least bit as concerned about our safety as they are in waging a �politically correct� crusade that provides editorial grist for their mills. Since our legislators are not going to get the facts or our input surrounding this problematic legislation from the media, we have to turn to another vehicle to alert them to our concerns.

| | Donna D. Berger Esq. |

One of the country�s premier legal condominium specialists, the well-known firm of Becker & Poliakoff, P.A., has offered to take up the gauntlet. At the March 3rd meeting of the Galt Mile Community Association�s Presidents Council, Donna D. Berger Esq. of Becker & Poliakoff addressed the 25 Presidents of the member Associations' Boards. She indicated that the Firm would spearhead the lobbying effort necessary to correct this legislation. In return for a relatively small contribution by the Associations affected by this flawed statute, the prestigious firm would do the required heavy lifting. This is a no brainer.

Ms. Berger offered the firm�s three finest lobbyists to vanguard the effort, Bernie Friedman, Yolanda Cash Jackson, and Keith M. Poliakoff. Bernie Friedman is the Shareholder in charge of the Firm�s Government Relations Department. Mr. Friedman is widely recognized as one of Florida�s most influential attorneys due to his years of experience, knowledge of the government process and his access to key decision makers. Yolanda Cash Jackson is an experienced Governmental law and Commercial litigation attorney who concentrates her practice in the area of Governmental Relations. Ms. Jackson has an excellent working rapport with several of the State�s leading elected officials and policymakers. As the former Chair of the Florida Hurricane Catastrophe Fund, she has participated in high-level public policy decisions in Tallahassee. Keith M. Poliakoff practices in the Firm�s Governmental Law group and has substantial knowledge and experience in representing clients before governmental entities. As previously mentioned...a no brainer.

In that the token contribution ($1000.00) requested of each condo or coop would be much less than the assessment that any individual resident would have to pay if this unfair statute is enforced, the price is more than fair (how much would a million dollar assessment from your building for a useless system cost you?). The only factors that could sink this effort are ignorance and bickering. If we can avoid the �common cold of Homeowner Associations�, the insidious �let George do it� syndrome, a warchest large enough to sponser success will be forthcoming. If the individual Associations focus on familiarizing themselves with this important issue and work together, we have an excellent opportunity to correct this problem. Association Presidents and Board members have a clear responsibility to their residents. Every high-rise condo and coop owner in Florida should encourage their Boards to participate in this effort!

For additional information contact Attorney Donna D. Berger Esq. of Becker & Poliakoff, P.A. at (954) 985-4163. She can be contacted by E-mail at [email protected]. Becker & Poliakoff, P.A. is located at 3111 Stirling Road in Fort Lauderdale, Florida 33312-6525. The mailing address is P.O. Box 9057, Fort Lauderdale, Florida 33310-9057. Phone: (954) 987-7550, Fax: (954) 985-4176, Toll Free: (800) 432-7712.

Click To Top of Page

Fire Safety Update

- March 22, 2003 -

As stated previously, there are two bills being considered in the legislature designed to address the inadequacy of the �Fire Safety� legislation that was passed. The following information is from Donna Berger, an attorney from the firm of Becker & Poliakoff.

The legislative session in Tallahassee convened on March 4, 2003; it is a 60-day session. There are many, many issues competing for the legislators� attention, primarily education and classroom overcrowding. One of our goals is to ensure that the NFPA-1 Fire Prevention Code as it is applied to existing buildings appears on their radar. One vehicle for this goal is House Bill 165 which is sponsored by Representative Connie Mack. This legislation would allow a vote of 2/3 of the total voting interests in a condominium or cooperative association to opt out of the automatic sprinkler retrofit requirements. The companion bill, Senate Bill 1978, sponsored by Senator Lynn, would also provide the 2/3 opt-out provision for existing high-rises. The legislative session in Tallahassee convened on March 4, 2003; it is a 60-day session. There are many, many issues competing for the legislators� attention, primarily education and classroom overcrowding. One of our goals is to ensure that the NFPA-1 Fire Prevention Code as it is applied to existing buildings appears on their radar. One vehicle for this goal is House Bill 165 which is sponsored by Representative Connie Mack. This legislation would allow a vote of 2/3 of the total voting interests in a condominium or cooperative association to opt out of the automatic sprinkler retrofit requirements. The companion bill, Senate Bill 1978, sponsored by Senator Lynn, would also provide the 2/3 opt-out provision for existing high-rises.

HB 165 was temporarily postponed the first time it came up in Committee on March 5th but passed the Judiciary Committee March 12th. The voting fell along party lines with all Republicans voting for the Bill and all Democrats opposing it. The fight is far from over. HB 165 has a number of additional committees to pass through and must be approved by both the House and the Senate before being sent to the Governor for approval. Not surprisingly, it is being met with substantial opposition by the firefighters union, the fire marshals and the pipe fitters� union.

We urge each of you and your membership to e-mail Representative Mack to voice your strong support for HB 165. Click Here to send Representative Mack an E-mail demonstrating your support of his efforts!

To support the effort in a more substantial fashion, inquire of your Board of Directors whether or not they are participating in this effort. To learn more about the status of this critical legislation, Click Here to e-mail Donna Berger of Becker & Poliakoff to request a retainer form. This will permit your Association access to the most current information about the struggle to correct the deficiencies inherent in the existing legislation.

Click To Top of Page

Legislative History

- May 4, 2003 -

April Fools Fire Safety Hijinx

Tallahassee Style Tallahassee Style

| | Rep. Connie Mack |

April 16, 2003 - The progress of the House (HB 165) and Senate (SB 1978, SB 592) bills carrying the legislative relief we support was slow but steady. Representative Connie Mack�s (R - Fort Lauderdale) House bill passed the Judiciary Committee (YEAS 12 NAYS 6) on 3/12/2003, the Commerce Committee (YEAS 16 NAYS 2) on 3/24/2003, the Commerce & Local Affairs Appropriations Subcommittee (YEAS 10 NAYS 1) on 4/11/2003, and was forwarded for review to the Appropriations Committee. Senator Evelyn Lynn (R - Ormand Beach) sponsored the Senate�s version (SB 1978) of Representative Mack�s bill. After passing the Senate�s Comprehensive Planning Committee (YEAS 6 NAYS 2) on 4/7/2003, it was sent for consideration to the Banking and Insurance Committee. Unfortunately, the waters were muddied by what appeared to be a partisan political knee-jerk.

| | Sen. Steven Geller |

Senator Steven Geller (D - Hallandale Beach) offered a competing bill that would require condominium associations to get city approval before they vote against retrofitting their building with the expensive safety systems (opting out). For all practical purposes, this additional requirement would nullify any prospective relief supposedly offered by the amendment. The plumbers and pipe fitters union, the American Fire Sprinkler Association, and the fire marshals have retained an army of lobbyists to fend off any modification to the legislation that would adversely effect their clients. Requiring the approval of the city (the local fire marshal) is akin to asking the wolf to help decide what Bo Peep should pack in her picnic basket.

Fortunately, Senator Geller relented after being swamped by angry feedback from constituents. He agreed to remove the approval of local authority from the opting out process delineated in his bill. He assented to developing compromise language to replace the dogmatic connection to the local fire marshal�s office. Geller�s bill (SB 592) passed Commerce, Economic Opportunities, and Consumer Services Committee (YEAS 9 NAYS 0) on 3/13/2003, Regulated Industries Committee (YEAS 8 NAYS 3) on 3/24/2003, the Judiciary Committee (YEAS 5 NAYS 4) on 4/14/2003, and was placed on the Senate Calendar on 4/16/2003.

The Home Stretch

| | Sen. Evelyn J. Lynn |

May 24, 2003 - When the dogmatic language in his bill was excised, Senator Geller arrived at an accommodation with Senator Lynn and they united behind Geller�s SB 592. The Banking and Insurance Committee, where Senator Lynn�s bill was on the agenda, postponed its consideration on 4/17/2003 and it subsequently died in Committee on 5/2/2003. The newly co-sponsored Geller bill (SB 592) was placed on the Special Order Calendar on 4/23/2003. The bill was placed before the FULL SENATE on Thursday, April 24th for a vote. This bill contains the legal basis for the opt-out provision that will allow unit owners to opt out of the full sprinkler retrofit as well as the life safety system. It successfully passed the Florida Senate at 4:18 P.M. with 36 YEAS, 2 NAYS (Campbell and Dawson), and 2 Abstentions, after which it was forwarded to the House. It was referred to the House Calendar on April 28th and substituted for HB 695 (its original House companion sponsored by Representatives Robert Allen and Faye Culp). On April 30th it was read the second time (in the House) and added to the Special Order Calendar. On May 1st the House voted on the Senate bill. The bill PASSED (114 YEAS, 0 NAYS) on the third reading and a message of notification was sent to the Senate.

Concurrently, on 4/22/2003 at 6:15 PM Representative Mack�s House bill (HB 165) was withdrawn from the Appropriations Committee and placed on the House Calendar. It was added to the second reading Calendar on April 23rd and to the Special Order Calendar on April 25th. The bill was read the second time on April 28th after which it was added to the Third Reading Calendar. After being read the third time shortly after 8 A.M. on April 30th, it traveled directly to the House floor for a vote. A few minutes later it PASSED (YEAS 66 NAYS 28) after the third reading. Representative Mack�s bill (HB 165), now companion to Geller and Lynn's SB 592, was delivered to the Senate on May 1st, after its success in the House. On the next day, May 2nd, it was scheduled for review by Comprehensive Planning (which Geller chairs) and the Banking and Insurance Committee. Since Geller�s bill had already passed the House and the Senate by May 1st, Mack�s bill became superfluous and died in Geller�s Comprehensive Planning Committee on May 2nd.

This legislative tough man contest yielded one bill and three also-rans. The surviving SB 592, sponsored by Senator Steven Geller (D) and co-sponsored by Senator Evelyn Lynn (R) and Representative Dudley Goodlette (R), requires Governor Jeb Bush�s signature to transform the bill into law. The companion House bill HB 695, sponsored by Representative Faye Culp (R), was folded into its Senate counterpart on April 28th, three days prior to passage by the House. On May 14th SB 592 was signed by the officers and sent to the Governor. The Governor had 15 days take one of three possible actions. He could have signed the bill into law, vetoed the bill, or done nothing! Had he elected to do nothing, the bill would have automatically become law. On May 21st, the Governor finally approved the bill! Stay Tuned...

Click To Top of Page

What Does This All Mean?

- May 24, 2003 -

Senate Bill SB 592

The Actual Language The Actual Language

ATTENTION ATTENTION  The following article contains lay (non-legal) commentary on actual legislation that is currently the law of the land. As with all such commentary, the only meaningful legal interpretation should be that of your Association's attorney. The article, while benefitting from some general legal input, is not meant to replace or in any way substitute for legal representation. The intention of this offering is to allow everyone access to the raw text for the purpose of better understanding the basis for your attorney�s legal opinion The following article contains lay (non-legal) commentary on actual legislation that is currently the law of the land. As with all such commentary, the only meaningful legal interpretation should be that of your Association's attorney. The article, while benefitting from some general legal input, is not meant to replace or in any way substitute for legal representation. The intention of this offering is to allow everyone access to the raw text for the purpose of better understanding the basis for your attorney�s legal opinion

The amendment designed to modify the demands made by the 2002 Fire Safety legislation and empower condominium and cooperative owners with control over the decisions that affect their safety was signed into law by Governor Bush on May 21st. It does NOT mean that we are out of the woods. The amendment co-sponsored by Senators Geller and Lynn (SB 592) does allow condominiums to opt out of the exigencies wrought by the January 1, 2002 Fire Safety Legislation. The law contains identical language in a subsequent section for cooperatives.

The actual language is as follows, �Notwithstanding the provisions of chapter 633 or of any other code, statute, ordinance, administrative rule, or regulation, or any interpretation of the foregoing, an association, condominium, or unit owner is not obligated to retrofit the common elements or units of a residential condominium with a fire sprinkler system or other engineered life safety system in a building that has been certified for occupancy by the applicable governmental entity, if the unit owners have voted to forego such retrofitting and engineered life safety system by the affirmative vote of two-thirds of all voting interests in the affected condominium.� So far, so good. A two-thirds vote should opt a condominium out of the legislative mandate to pay a Fire Safety Engineer for developing an �Minimum Alternative Life Safety Plan� that wouldn�t be used for eleven years (at which point it would be obsolete). The actual language is as follows, �Notwithstanding the provisions of chapter 633 or of any other code, statute, ordinance, administrative rule, or regulation, or any interpretation of the foregoing, an association, condominium, or unit owner is not obligated to retrofit the common elements or units of a residential condominium with a fire sprinkler system or other engineered life safety system in a building that has been certified for occupancy by the applicable governmental entity, if the unit owners have voted to forego such retrofitting and engineered life safety system by the affirmative vote of two-thirds of all voting interests in the affected condominium.� So far, so good. A two-thirds vote should opt a condominium out of the legislative mandate to pay a Fire Safety Engineer for developing an �Minimum Alternative Life Safety Plan� that wouldn�t be used for eleven years (at which point it would be obsolete).

The law elaborates, �However, a condominium association may not vote to forego the retrofitting with a fire sprinkler system of common areas in a high-rise building. For purposes of this subsection, the term �high-rise building� means a building that is greater than 75 feet in height where the building height is measured from the lowest level of fire department access to the floor of the highest occupiable story. For purposes of this subsection, the term "common areas" means any enclosed hallway, corridor, lobby, stairwell, or entryway.� Aye, there�s the rub. Since every member Association of the Galt Mile Community Association is cloistered in a �high-rise building� (by definition), this caveat universally applies. While we may opt out of that part of the NFPA 1 Life Safety Code and the NFPA 101 Fire Safety Code that demands sprinklers inside the units, we are seemingly still subject to the amendment�s requirement that emplaces sprinklers in the common areas of the building. The text continues, �In no event shall the local authority having jurisdiction require completion of retrofitting of common areas with a sprinkler system before the end of 2014.� This, of course, applies to condominiums that elect not to opt out of the statutory requirements or determine that they have a legal responsibility to install sprinklers into the common areas. The law elaborates, �However, a condominium association may not vote to forego the retrofitting with a fire sprinkler system of common areas in a high-rise building. For purposes of this subsection, the term �high-rise building� means a building that is greater than 75 feet in height where the building height is measured from the lowest level of fire department access to the floor of the highest occupiable story. For purposes of this subsection, the term "common areas" means any enclosed hallway, corridor, lobby, stairwell, or entryway.� Aye, there�s the rub. Since every member Association of the Galt Mile Community Association is cloistered in a �high-rise building� (by definition), this caveat universally applies. While we may opt out of that part of the NFPA 1 Life Safety Code and the NFPA 101 Fire Safety Code that demands sprinklers inside the units, we are seemingly still subject to the amendment�s requirement that emplaces sprinklers in the common areas of the building. The text continues, �In no event shall the local authority having jurisdiction require completion of retrofitting of common areas with a sprinkler system before the end of 2014.� This, of course, applies to condominiums that elect not to opt out of the statutory requirements or determine that they have a legal responsibility to install sprinklers into the common areas.

The housekeeping segment of the legislation goes on to say, �A vote to forego retrofitting may not be obtained by general proxy or limited proxy, but shall be obtained by a vote personally cast at a duly called membership meeting, or by execution of a written consent by the member, and shall be effective upon the recording of a certificate attesting to such vote in the public records of the county where the condominium is located. The association shall provide each unit owner written notice of the vote to forego retrofitting of the required fire sprinkler system, in at least 16-point bold type, by certified mail, within 20 days after the association�s vote. After such notice is provided to each owner, a copy of such notice shall be provided by the current owner to a new owner prior to closing and shall be provided by a unit owner to a renter prior to signing a lease.� Again, two-thirds of the unit owners must vote to opt out, after which they must be notified �in at least 16-point bold type, by certified mail� within 20 days of the vote.

Once a decision to opt out is arrived at as a result of the vote, the Association has the responsibility to perform some additional housekeeping. It follows that, �As part of the information collected annually from condominiums, the division shall require condominium associations to report the membership vote and recording of a certificate under this subsection and, if retrofitting has been undertaken, the per-unit cost of such work. The division shall annually report to the Division of State Fire Marshal of the Department of Financial Services the number of condominiums that have elected to forego retrofitting.� The �Opt Out� status of a building becomes effective when a certificate reflecting the vote is actually recorded into the public records of Broward County. They, in turn, must notify the State Fire Marshal (currently Tom Gallagher) as to the number of buildings that have elected to opt out.

Additionally, the amendment addresses the �Certificate of Compliance� in the following manner, �Certificate of compliance.--There shall be a provision that a certificate of compliance from a licensed electrical contractor or electrician may be accepted by the association's board as evidence of compliance of the condominium units with the applicable fire and life safety code.� A certificate from either a licensed electrical contractor or electrician affirming that the individual condominium units are in compliance with the fire and life safety code replaces the demand for a report from a Fire Safety Engineer in the original legislation.

What's Next?

This amendment very clearly relieves condominium owners of certain onerous financial requirements that are meted out in the original legislation. This affects the owners on several levels. It initially obviates the need for a $15,000 - $25,000 �Engineered Life Safety System� to be composed by a certified Fire Safety Engineer. It removes the cost attached to sprinkler heads in each unit along with the adjunctive plumbing. While our buildings are already in compliance with a majority of the ancillary requirements component to the �Alternative Engineered Life Safety System�, such as a hard-wired fire alarm system, fire rated corridor doors, transfer grills, generators, etc., the expense of expanding these systems into the units has been curtailed.

While the financial demands on Condominium owners have been substantially diminished by this amendment, the remaining requirements, at first glance, seem extensive and expensive. However, upon closer scrutiny, this appears not be the case! The original legislation refers to the NFPA 1 Life Safety Code and the NFPA 101 Fire Safety Code as the defining guidelines for requirements governing the installation of sprinklers. The concept of sprinklers uniquely installed into the common areas of a building is foreign to the NFPA code! Since the statutory directive is to �follow the NFPA code� and there is no section of NFPA code that addresses the installation of sprinklers only in the common area, there is technically no need to opt out of that particular requirement. Bottom line - When you opt out of the overall retrofit and the �Engineered Alternative Life Safety System�, you are out...of everything! Don�t Forget...the only opinion that matters is THAT OF YOUR ASSOCIATION�S ATTORNEY!

There is another factor that might impact an Association�s decision about if and when they might consider �opting out�. Included in the amendment are new insurance ramafications that could substantially influence an Association�s premiums. For instance, the �Legislature requires a report to be prepared by the Office of Insurance Regulation of the Department of Financial Services for publication 18 months from the effective date of this act, evaluating premium increases or decreases for associations, unit owner premium increases or decreases, recommended changes to better define common areas, or any other information the Office of Insurance Regulation deems appropriate.� This report might recommend increases or decreases in premiums based upon an Association�s intentions relative to Fire Safety.

The amendment also delimits an Association�s responsibility to provide primary hazard insurance for any �policy which is issued or renewed on or after January 1, 2004� covering all �portions of the condominium property located outside the units.� The amendment continues, requiring primary coverage for �The condominium property located inside the units as such property was initially installed, or replacements thereof of like kind and quality and in accordance with the original plans and specifications or, if the original plans and specifications are not available, as they existed at the time the unit was initially conveyed; and all portions of the condominium property for which the declaration of condominium requires coverage by the association.� The amendment then offers a more detailed definition of those items �inside the units� that the Association does (or does not) have primary responsibility for. A responsible Board should therefore invite input not only from it�s Association�s attorney, but also from it�s insurance agent. Even if an Association is resolved to �opt-out�, timing the act prodigiously could save big bucks!

In any event, the amendment is an excellent first step. We are clearly in debt to Representative Mack, Senators Geller and Lynn, and the lobbying effort borne by Becker-Poliakoff for delivering such palpable relief in an extremely short period. They fought an uphill battle against substantial political obstacles and a well-organized lobbying effort by the amendment�s opponents. It is reasonable to assume that this opposition, primarily comprised of the Plumbers and Pipefitters Union, The National Fire Sprinkler Association, and the Fire Marshals Association, will be back next year to restore the resources seemingly lost to their clients.

This will require an equally effective response by our representatives. This means relying on Becker-Poliakoff to successfully accomplish three simultaneous objectives. They need to fend off the expected attempts by the same vested interests to resecure that major payday at our expense. The firm has to enlist representation in the legislature to once again �carry the ball� for us and protect those political participants from the unfriendly environment created by the media. In addition to preventing opposition lobbyists from unfavorably redefining the code, they must shepherd the elimination of the �common area sprinkler� requirements through the legislative minefield. It follows that additional condos and coops need to be included to help support Becker-Poliakoff�s upcoming challenge. We also need to disseminate the truth surrounding this issue to defend against the hysteria that was used incessantly by the opposition to intimidate media-sensitive politicians. Condominiums and Cooperatives on the Galt Mile maintain containment, automatic recall, and alarm features sufficient to designate these structures as some of the safest in South Florida. This will require an equally effective response by our representatives. This means relying on Becker-Poliakoff to successfully accomplish three simultaneous objectives. They need to fend off the expected attempts by the same vested interests to resecure that major payday at our expense. The firm has to enlist representation in the legislature to once again �carry the ball� for us and protect those political participants from the unfriendly environment created by the media. In addition to preventing opposition lobbyists from unfavorably redefining the code, they must shepherd the elimination of the �common area sprinkler� requirements through the legislative minefield. It follows that additional condos and coops need to be included to help support Becker-Poliakoff�s upcoming challenge. We also need to disseminate the truth surrounding this issue to defend against the hysteria that was used incessantly by the opposition to intimidate media-sensitive politicians. Condominiums and Cooperatives on the Galt Mile maintain containment, automatic recall, and alarm features sufficient to designate these structures as some of the safest in South Florida.

As explained by Representative Connie Mack, we feel that the decision about the degree of protection warranted by a condominium should be left to its owners. Those that stand to gain or lose from its effectiveness should also determine the type of protection. We are not children requiring the dubious oversight foisted upon us at �midnight� by politicians without our knowledge, input, or consent. Our future response needs to expand upon the intent of the amendment. If the people (and their families) that own and inhabit the �common areas� agree that additional protection is necessary, they will provide it, and in an appropriate manner. As such, the surviving requirement to sprinkler the common areas of our homes should be removed and the decision regarding its necessity left to us. Any misguided attempt at �protecting us from ourselves� will NOT be naively construed as a display of concern for our safety. It will be considered as submission AND/OR remuneration to the lobbying groups that stand to gain hundreds of millions of dollars and heretofore unmatched levels of power over a particular class of property owner. Every building on the Galt Mile has historically exceeded compliance with Fire and Safety Codes. In its three decades of existence, not one life has been lost to fire. Might we suggest that this is a result of conscientious condo owners making numerous correct decisions about the scope and quality of protection necessary for their families, their property, and their lives!

It is always propitious to review the actual text of the amendment when evaluating the advice of an attorney and an insurance agent with regard to an Association's options. Click Here to access the text of the amendment in its entirety. It is always propitious to review the actual text of the amendment when evaluating the advice of an attorney and an insurance agent with regard to an Association's options. Click Here to access the text of the amendment in its entirety.

To participate in the Fire Safety Lobby (to exempt your community from an expensive retrofitting), contact Attorney Donna D. Berger Esq. of Becker & Poliakoff, P.A. at (954) 985-4163 or Toll Free at (800) 432-7712 Ext. 4163. She can be contacted by E-mail at [email protected]. As a participating residence, you�ll recieve automatic access to Becker & Poliakoff's "Fire Safety Update", a web site that delivers current progress data in its appropriate legal context. To participate in the Fire Safety Lobby (to exempt your community from an expensive retrofitting), contact Attorney Donna D. Berger Esq. of Becker & Poliakoff, P.A. at (954) 985-4163 or Toll Free at (800) 432-7712 Ext. 4163. She can be contacted by E-mail at [email protected]. As a participating residence, you�ll recieve automatic access to Becker & Poliakoff's "Fire Safety Update", a web site that delivers current progress data in its appropriate legal context.

Click To Top of Page

Fire Safety Summary

- July 12, 2003 -

July 12, 2003 - Senate Bill 592, after surviving a shaky adolescence last legislative term, developed into a law that�s earned the curiosity of every condominium and co-op in South Florida. While the law allows electronic transmission as a form of notice for not-for-profit corporations; includes e-mail and fax addresses as part of an association�s official records; permits domestication of foreign not-for-profit corporations; significantly revises the insurance provisions found in 718.111(11); and clarifies that any actions arising to enforce condominium documents do not carry a 1-year statute of limitations (5-year statute of limitations is consistent with recent case law), it is most well known for its enigmatic �opt-out� provisions granted to condominium and cooperative owners throughout the State of Florida. July 12, 2003 - Senate Bill 592, after surviving a shaky adolescence last legislative term, developed into a law that�s earned the curiosity of every condominium and co-op in South Florida. While the law allows electronic transmission as a form of notice for not-for-profit corporations; includes e-mail and fax addresses as part of an association�s official records; permits domestication of foreign not-for-profit corporations; significantly revises the insurance provisions found in 718.111(11); and clarifies that any actions arising to enforce condominium documents do not carry a 1-year statute of limitations (5-year statute of limitations is consistent with recent case law), it is most well known for its enigmatic �opt-out� provisions granted to condominium and cooperative owners throughout the State of Florida.

The law that this effort amends required that any high-rise building (75 feet or higher) be retrofitted with an automatic sprinkler system inside each unit by 2014 pursuant to the requirements of the NFPA-1 (National Fire Protection Association) National Fire Prevention Code. There are two exemptions to this requirement: A) if every unit opens onto an open-air walkway with access to two remote stairwells or B) if a building chooses to install an engineered life safety system in lieu of the total retrofit. The engineered life safety system is not clearly defined by the Code but it typically consists of a partial sprinkler system together with various components including a sophisticated fire alarm system, fire-rated corridor and unit doors, self-closing mechanisms on the unit doors, elevator recall system, etc. At best, the alternative is extremely expensive and questionably effective. In addition, once the alternative option is exercised, the local jurisdictional authority (i.e. your local fire marshal) can (and often does) substantially shorten the deadline of 2014.

The Amendment (SB 592) offers a third choice that only requires the sprinklering of the �common areas� of the building. However, to �opt out� of the original options, it is imperative to follow a carefully drawn legal road map. Two-thirds of the total Association membership must vote to opt out at a duly called association meeting either in person or through the use of a written consent. Proxies are not acceptable for this vote! Once the measure passes, three bases have to be touched before the decision is actualized. A Certificate confirming the Association�s elective result needs to be filed in the public records of the building�s county. Each unit owner must be notified in writing (in 16-point bold print) by certified mail within twenty (20) days about the results of the vote to waive the retrofitting requirement. The third step mandates that the Division of State Fire Marshal of the Department of Financial Services be, in turn, alerted to the certified results of the Association membership�s �opt-out� vote. Since there�s no deadline for this �opt-out� vote and proxies are ARE NOT an option, it seems preferable to time the vote to coincide with the �season� to take advantage of the additional unit owners available for the vote. While this format is easily understood, it is critically important to take each legal step correctly. Achieving this without the guidance and oversight of the Association�s attorney is akin to dancing through a mine field while wearing a blindfold. Attention to legal detail will inoculate the Association against the liability nightmares that derive of trying to �be your own lawyer�. The Association�s attorney is unquestionably the correct point person for this mission. The Association�s Insurance Agent should be the strong right arm.

What's left is an enigma. The one-time opt out vote DOES NOT relieve an Association of having to retrofit sprinklers into the common areas. There are three available definitions of common areas. There�s the traditional definition of common areas found in Chapter 718 (The Condominium Act) and Chapter 719 (Cooperatives) of the Florida Statutes. SB 592 (the Amendment) redefines common areas as �any enclosed hallway, corridor, lobby, stairwell or entryway�. The original legislation directs buildings to use the NFPA 1 and the NFPA 101 Codes as statutory guidelines for installing an acceptable system. To help make this issue as clear as mud, neither NFPA Code addresses (or conceives of) the installation of sprinklers uniquely in the common areas. Aren�t you glad that the Association�s attorney is spearheading this effort!

The Association�s final step is legislative preparation. Few positive events in Tallahassee occur spontaneously. The bill that passed did so because of a concerted hard-fought effort contributed to by numerous concerned Associations. The next legislative session presents a danger and an opportunity. The Pipe Fitters and Plumbers Unions, the Fire Marshals, the National Fire Sprinkler Association, and other groups that stand to lose millions of dollars from this hole in their political pork barrels will undoubtedly desperately try to plug it. This needs to be defended against. Some of the protocols inherent in the amendment are unnecessary burdens designed to feed a hungry bureaucracy rather than relay information. There is no reason to disallow proxies when voting to opt out of the retrofitting. Limited proxies have historically been acceptable substitutes for written consent. There are also more affordable methods of confirmed notification than �certified mail�. These requirements need to be modified. The Association�s final step is legislative preparation. Few positive events in Tallahassee occur spontaneously. The bill that passed did so because of a concerted hard-fought effort contributed to by numerous concerned Associations. The next legislative session presents a danger and an opportunity. The Pipe Fitters and Plumbers Unions, the Fire Marshals, the National Fire Sprinkler Association, and other groups that stand to lose millions of dollars from this hole in their political pork barrels will undoubtedly desperately try to plug it. This needs to be defended against. Some of the protocols inherent in the amendment are unnecessary burdens designed to feed a hungry bureaucracy rather than relay information. There is no reason to disallow proxies when voting to opt out of the retrofitting. Limited proxies have historically been acceptable substitutes for written consent. There are also more affordable methods of confirmed notification than �certified mail�. These requirements need to be modified.

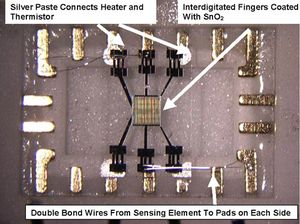

Of greater import is the statutory recognition of acceptably safe alternatives to �the sprinklering of common areas�. Intelligent Fire Detection and Alarm systems have the technological maturity to surpass the protection afforded by �sprinklering common areas�. Automatic recall systems and voice evacuation speakers in the units would provide substantially greater safety at less cost than a half ton of plumbing supplies. It is not surprising that these well-known alternatives have been given short shrift by Plumbing and Pipe Fitters Unions and the Fire Sprinkler Association as well as the beneficiaries of their political contributions. Translating these relevant facts into political reality is a challenge that needs to be met with the same coordinated effort that produced the Amendment. Becker & Poliakoff have their work cut out for them. They�re going to need all the help they can get. We all need to see that they get it! Stay Tuned... Of greater import is the statutory recognition of acceptably safe alternatives to �the sprinklering of common areas�. Intelligent Fire Detection and Alarm systems have the technological maturity to surpass the protection afforded by �sprinklering common areas�. Automatic recall systems and voice evacuation speakers in the units would provide substantially greater safety at less cost than a half ton of plumbing supplies. It is not surprising that these well-known alternatives have been given short shrift by Plumbing and Pipe Fitters Unions and the Fire Sprinkler Association as well as the beneficiaries of their political contributions. Translating these relevant facts into political reality is a challenge that needs to be met with the same coordinated effort that produced the Amendment. Becker & Poliakoff have their work cut out for them. They�re going to need all the help they can get. We all need to see that they get it! Stay Tuned...

The lobbying effort coordinated by Becker-Poliakoff (Click Here for Details) to resituate the responsibility (and decisions) for Fire Safety protection back to the homeowners and their chosen Fire Safety Engineers needs to be broadened. As more condos and co-ops join the effort, more light can be focused on the relevant issues (especially in Tallahassee). To participate in the Fire Safety Lobby (to exempt your community from an expensive retrofitting), contact Attorney Donna D. Berger Esq. of Becker & Poliakoff, P.A. at (954) 985-4163 or Toll Free at (800) 432-7712 Ext. 4163. She can be contacted by E-mail at [email protected]. As a participating residence, you�ll receive automatic access to Becker & Poliakoff�s �Fire Safety Update�, a web site that delivers current progress data in its appropriate legal context. The lobbying effort coordinated by Becker-Poliakoff (Click Here for Details) to resituate the responsibility (and decisions) for Fire Safety protection back to the homeowners and their chosen Fire Safety Engineers needs to be broadened. As more condos and co-ops join the effort, more light can be focused on the relevant issues (especially in Tallahassee). To participate in the Fire Safety Lobby (to exempt your community from an expensive retrofitting), contact Attorney Donna D. Berger Esq. of Becker & Poliakoff, P.A. at (954) 985-4163 or Toll Free at (800) 432-7712 Ext. 4163. She can be contacted by E-mail at [email protected]. As a participating residence, you�ll receive automatic access to Becker & Poliakoff�s �Fire Safety Update�, a web site that delivers current progress data in its appropriate legal context.

Click To Top of Page

Notice Notice

Public Meeting About the Fire Safety Amendment

The Office of the Florida State Fire Marshall, Thomas Gallagher, is convening a Public Meeting to help clarify the tenets of the recently passed Fire Safety Amendment and the original Fire Safety legislation.

Questions and comments from the community will have a substantial influence on the manner and extent to which the Statute will be implemented.

Show Up, Stand Up, Speak Out

- The Date: Wednesday, September 10th, 2003

The Time: 1:00 P.M.

The Place: The Beach Community Center

3351 NE 33rd Avenue in Fort Lauderdale

To Familiarize Yourself with the Agenda Issues... To Familiarize Yourself with the Agenda Issues...

READ ABOUT

The State of Florida Fire Marshal's

Public Meeting

- September 3, 2003 -

| | SFM TOM GALLAGHER |

September 3, 2003 - There is understandable confusion surrounding the options available to high-rise condominiums as a result of the passage of Florida Senator Stephen Geller's Amendment (Senate Bill 592) during the 2003 legislative session in Tallahassee. The original legislation elicited a decision by high rise buildings' Homeowner Associations to either retrofit a full sprinkler system throughout the entire interior or to install an approved �Alternative Minimum Life Safety System� designed by a Fire Safety Engineer. The Fire Safety Engineer does not have the authority to design what's most appropriate for the building, he is constrained by the NFPA #1 Life Safety Code and the NFPA #101 Fire Safety Code. The NFPA Code requires, in addition to a variety of other alarm systems, fire safety systems and equipment, the installation of sprinklers in the common areas of the building and inside each entrance to every unit.

Some condominiums immediately took advantage of the amendment's "opt-out" provision, deciding to forego either of the two choices. These courageous condominiums went to their respective attorneys and asked, �What do we have to do next?� This is where the confusion proliferates. Some attorneys pointed to that portion of the amendment that requires the installation of sprinklers in the building�s �common areas�, advising their clients to install them even if their Fire Safety Engineer felt that any safety benefit derived of their installation to be marginal. Some attorneys indicated that there was no need to do anything else after opting out, alluding to the marked lack of specificity in the NFPA code with regard to sprinklering only �common areas�.

The Fire Marshall for the State of Florida, Tom Gallagher, will send some key Staff personnel to attend a meeting at the Beach Community Center on Wednesday, September 10th at 1:00 PM. Mr. Gallagher's Staffers are expected to cast some light on this enigmatic issue. Mr. Gallagher is straddling a tricky political tightrope. On one end is a politically aligned group of vested interests comprised of the Fire Sprinkler Association (which hopes to sell hundreds of millions of dollars worth of equipment), the Plumbers and Pipe fitters Union (which hopes to install hundreds of millions of dollars worth of equipment), and the Fire Marshal�s Association (which hopes to oversee the sales and installations). On the other end are high-rise building residents, legions of condominium and coop owners and apartment occupants (who have to foot the bill). They want the right (with the benefit of their Fire Safety Engineers) to select and install Fire Safety systems that are customized to their individual needs instead of the mandated �boilerplate� systems of questionable effectiveness.

The Public meeting is one of a series of meetings sponsored by the Fire Marshall�s office. Members of the Fire Marshall�s staff are blanketing the state in an effort to accomplish two goals. Ostensibly, the reason for the �Public Meetings Campaign� is to clarify the Fire Marshal�s position with regard to the dogmatic (and expensive) amendment. The second, less publicized, reason for this omnibus campaign is to collect feedback from Mr. Gallagher�s constituency. After explaining the Fire Marshal�s position to the Public Meeting attendees throughout the State, the Staff members hope to explain the public�s opinion to Mr. Gallagher.

The audiences promise to be weighted heavily with two categories of high-rise dweller, the confused and the angry. The political ping-pong surrounding the original legislation, the subsequent amendment and the broad spectrum of interpretations assigned to both have left hundreds of thousands of condo and coop owners in a daze. The �stealth� passage of the original legislation coupled with the huge expense attached to its implementation has understandably engendered substantial public ire.

To add fuel to this fire, both sides are in a state of �statutory flux�. The Fire Sprinkler Association, the Plumbers and Pipe Fitters Union, and the Fire Marshalls Association intend to return to Tallahassee next year to insure their �big payday�. Thousands of homeowner associations also expect to defend their right to decide for themselves which measures would be most effective to secure their own safety.

If you are either confused or angry, you should feel comfortable at the September 10th public meeting. This is your opportunity to convey your sentiments to the �powers that be� in Tallahassee. Several Association attorneys anticipate attending for the purpose of asking the Staff personnel pointed questions about the amendment. Local Fire officials are also expected to attend, hoping to receive both clarification and a taste of public opinion. It should be an interesting afternoon.

Click Here to learn more about the new Fire Safety Amendment. Click Here to understand the basis for the confusion surrounding the Fire Safety issue.

If you serve on the Board of Directors or the Board of Governors of a Condominium Association, please consider attending this meeting. If you are a resident of a condominium, ask your Board members if they plan on attending...it could save you a substantial amount of money! If you serve on the Board of Directors or the Board of Governors of a Condominium Association, please consider attending this meeting. If you are a resident of a condominium, ask your Board members if they plan on attending...it could save you a substantial amount of money!

The State of Florida Fire Marshal's

Public Meeting Washes Out

- September 10, 2003 -

| | FORT LAUDERDALE BEACH COMMUNITY CENTER |

On Wednesday, September 10th, roughly 150 Galt Mile residents attended a disappointing Public Information Workshop presented by the Florida Division of State Fire Marshal, Bureau of Fire Prevention at the Beach Community Center. The purpose of the workshop, in Fort Lauderdale Fire Marshal Steve Kastner�s words, was to �educate condominium associations throughout the State on the recent changes to the Florida Statutes regulating the retrofitting of high-rise residential properties�. The presentation was one of many organized by the State Fire Marshal�s office across Florida. The series of Public Meetings was contemplated to help mollify the anger fed by confusion surrounding the 2002 Fire Safety Statute and the subsequent Fire Safety Amendment (Senate Bill 592). The confusion has spread from the condos and co-ops trying to understand the Statute�s impact to the local Fire Marshal�s office. The stated purpose of the workshop was never achieved.

The staffer stated, for example, that the installation of an approved retrofitting plan had to be completed by 2014. The text of the Amendment actually states that �In no event shall the local authority having jurisdiction require completion of retrofitting of common areas with a sprinkler system before the end of 2014.� The difference between the staffer�s statement and the text of the Amendment was not lost on the audience. The law does not require a completed installation by 2014; it instead constrains the local authority from demanding that the sprinkler portion of the statute be operational by 2014. The local authority can elect to require completion of retrofitting, if they so choose, by the end of 2015...or 2016...or never! The overwhelmed staff member, when faced with the discrepancies between the text on the �fact sheets� and the actual law, stated that he �just got sent down here to do this (referring to the presentation).� He apologetically continued, �This law is in a state of flux. The Fire Marshal�s office, along with most local fire authorities, is awaiting clarification from the legislature.� This disarming admission was followed by three simultaneous reactions. A dozen waving audience hands came down, two dozen more went up, and an attorney in the audience stated that she had participated in the drafting of the amendment and would be willing to shed some much-craved light on the subject. The staffer stated, for example, that the installation of an approved retrofitting plan had to be completed by 2014. The text of the Amendment actually states that �In no event shall the local authority having jurisdiction require completion of retrofitting of common areas with a sprinkler system before the end of 2014.� The difference between the staffer�s statement and the text of the Amendment was not lost on the audience. The law does not require a completed installation by 2014; it instead constrains the local authority from demanding that the sprinkler portion of the statute be operational by 2014. The local authority can elect to require completion of retrofitting, if they so choose, by the end of 2015...or 2016...or never! The overwhelmed staff member, when faced with the discrepancies between the text on the �fact sheets� and the actual law, stated that he �just got sent down here to do this (referring to the presentation).� He apologetically continued, �This law is in a state of flux. The Fire Marshal�s office, along with most local fire authorities, is awaiting clarification from the legislature.� This disarming admission was followed by three simultaneous reactions. A dozen waving audience hands came down, two dozen more went up, and an attorney in the audience stated that she had participated in the drafting of the amendment and would be willing to shed some much-craved light on the subject.

| | Donna D. Berger Esq. |

The relieved staffer invited the attorney, Donna D. Berger Esq. from the Law Firm of Becker & Poliakoff, P.A., to the podium in hopes of allaying the mounting disappointment infecting the audience. Ms. Berger quickly responded to several questions that had stymied the staffer and stated that in view of the transitional status of the Statute and the Amendment, she felt that the attempt by the State Fire Marshal�s office to clarify this statutory moving target at this point was premature. She explained that she had attended several other versions of this presentation in other parts of the State and they all had two things in common. Firstly, they were fraught with statements that were inaccurate or completely incorrect. Secondly, they were all different. In Largo and Daytona, for instance, Associations were incorrectly advised that they had to install approved systems almost immediately. Apparently, the information divulged at the various presentations depended, in large part, upon the individual staff member�s personal knowledge or opinion of the subject matter. The staffer agreed, explaining that the inconsistent nature of these Public Meetings reflected the obscure result of the compromises that fostered both the legislation and the Amendment. He acceded that the public �would be better served by reconvening these meetings after a few more legislative sessions.�