Pre-Special Session Maneuvering in Tallahassee

Legislature Prepares for Special Session on Insurance

|

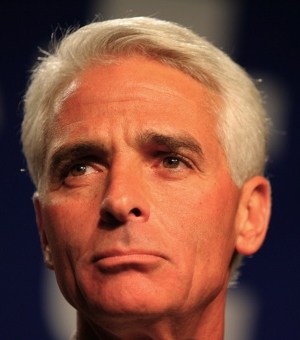

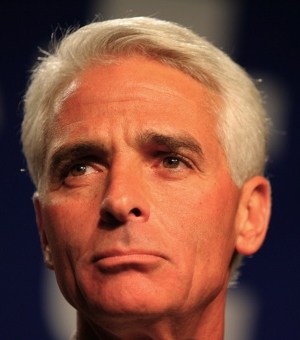

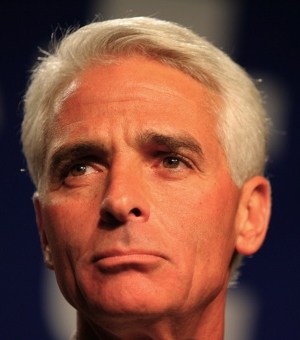

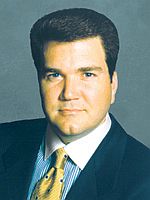

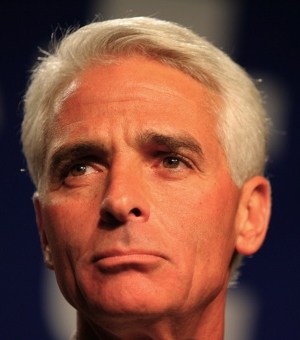

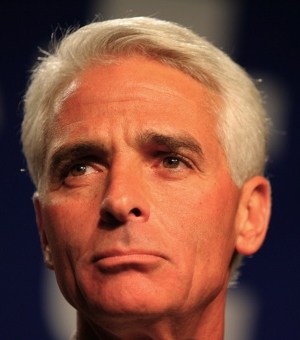

| NEW GOVERNOR CHARLIE CRIST |

January 15, 2007 - Its Here! A long-awaited Special Session convened in Tallahassee to either tackle the runaway property insurance crisis or stage a frustrating exercise in futility fraught with politically useful sound bites. On January 9th, a joint proclamation was released by Governor Charlie Crist, Senate President Ken Pruitt and House Speaker Marco Rubio announcing that the 7 days from January 16th to January 22nd would be devoted to 4 issues.

- Legislation to reduce current property insurance premiums in this state.

- Legislation to reduce the future rate of growth in property insurance premiums in this state.

- Legislation to improve the availability and stability of property insurance in this state.

- Legislation relating to building codes in the State of Florida.

|

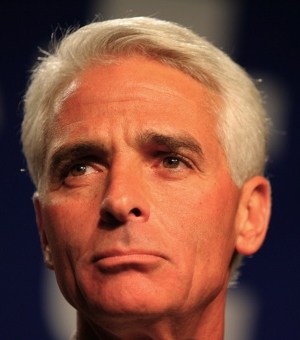

NEW SENATE PRESIDENT

KEN PRUITT |

The legislature passed up a chance to start work on this critical issue in December. The Florida Property and Casualty Insurance Reform Committee, empanelled by former Governor Bush last June, finalized a 230 page report on November 15th. Although Bush asked the legislature to consider the Committee�s recommendations in a December Special Session, Pruitt and Rubio, in deference to Governor-elect Crist, decided to wait for his official installation as the State�s chief executive in January. To be fair, Statehouse Representative Ellyn Bogdanoff said that it made sense to delay the undertaking until recently elected Representatives and Senators acclimated to their new environment in Tallahassee and had a chance to familiarize themselves with the issues surrounding skyrocketing property insurance premiums.

|

NEW HOUSE SPEAKER

MARCO RUBIO |

While acceding to a January Special Session, new Speaker Rubio wanted to get a jump on the problem. He convened a 3-day bipartisan Property Insurance Conference on December 4th wherein more than one hundred Statehouse Representatives took turns addressing what was repeatedly termed �the greatest threat to the State�s economy.� The conference was available to the computer literate public on the internet. During the conference, topics considered included the �Science of Storms�, �How We Got Here�, �Economics of Insurance�, �Reinsurance�, �Mitigation�, �Citizens Insurance� and �Insurance Capitol Build-up�.

In a surprising move, on January 11th, Rubio requested that the 5 main Hurricane Modeling firms to release hurricane loss projects models for review by the House. Reinsurers drastically raised costs to carriers who passed them through to the insurance buying public. While they gave several reasons for their gargantuan increases, central to their rationale was the data received from these modeling firms predicting unremitting annual catastrophes. Questioning the soundness of their data in view of the hurricane-free past year, it appears that reinsurers are �overreacting�.

In a surprising move, on January 11th, Rubio requested that the 5 main Hurricane Modeling firms to release hurricane loss projects models for review by the House. Reinsurers drastically raised costs to carriers who passed them through to the insurance buying public. While they gave several reasons for their gargantuan increases, central to their rationale was the data received from these modeling firms predicting unremitting annual catastrophes. Questioning the soundness of their data in view of the hurricane-free past year, it appears that reinsurers are �overreacting�.

|

SPEAKER MARCO RUBIO PRESIDES AS CLERK

OPENS JANUARY 16th SPECIAL SESSION |

Cutting to the chase, Rubio said, �There is a great deal of uncertainty about these models and whether they are being used to unjustifiably raise insurance rates. I am pleased that all five organizations have agreed to work with us on making sure that Floridians are receiving a fair deal.� In response, Risk Management Solutions of Newark, CA, Eqecat Inc. of Oakland, CA, Applied Research Associates of Raleigh, NC, AIR Worldwide of Boston and the Florida Office of Insurance Regulation were all asked to release copies of their hurricane loss projection models and the underlying assumptions contained in those models to the House for review. A working group of experts will thoroughly review the models for accuracy and scrutinize the model�s assumptions.

While Rubio was pushing the House to make progress, Pruitt�s Senate also developed some pre-session work product. The Senate Banking and Insurance Committee released a 153-page Hurricane Preparedness and Property Insurance bill. Since it isn�t as yet published, it lacks a bill number. A summary of the bill aspects that impact associations are as follows:

The bill would rescind the approved rate filing that took effect on January 1, 2007, and requires Citizens (Citizens Property insurance Corporation) to provide refunds to persons who have paid this new rate. The bill also freezes rates at the December 31, 2006, level for the remainder of 2007;

The bill would rescind the approved rate filing that took effect on January 1, 2007, and requires Citizens (Citizens Property insurance Corporation) to provide refunds to persons who have paid this new rate. The bill also freezes rates at the December 31, 2006, level for the remainder of 2007;

The bill deletes the provision that makes non-homestead policyholders ineligible for coverage by Citizens effective March 1, 2007 unless coverage is rejected by at least three surplus lines insurers (unregulated rates and forms) and 1 authorized insurer;

The bill delays until 2008 the requirement that Citizens impose up to a 10% of premium assessment on all non-homestead policyholders if a deficit occurs;

Delays until 2008 the requirement that Citizens impose a 10% renewal surcharge on all Citizens policyholders (including non-homestead) after a deficit if the first 10% surcharge on non-homestead policyholders is not sufficient;

Requires insurers to offer policyholders the option to exclude windstorm coverage subject to a signed rejection by all names policyholders on a form approved by OIR (Office of Insurance Regulation) with specified disclosures (condominium associations are still required by statute to carry windstorm coverage). Eliminates the maximum allowable deductibles but retains requirement for insurers to offer 2%, 5% and 10% deductibles;

Requires insurers to offer policyholders the option to exclude windstorm coverage subject to a signed rejection by all names policyholders on a form approved by OIR (Office of Insurance Regulation) with specified disclosures (condominium associations are still required by statute to carry windstorm coverage). Eliminates the maximum allowable deductibles but retains requirement for insurers to offer 2%, 5% and 10% deductibles;

Authorizes Citizens to write multi-peril policies (as well as wind-only policies) in the areas eligible for coverage in the High Risk Account;

Broadens the current authority of condominium associations to form a self-insurance fund by including other homeowner associations and eliminating the requirement that the group be formed for purposes other than insurance;

Authorizes the OIR to waive or lower the deposit requirement for reinsurers licensed in other countries. This is extremely important since there are currently only two reinsurers in the State that write policies for the commercial/residential category in which common property falls;

Offers insurers significant additional FHCF (Florida Hurricane Catastrophe Fund) dollars; and

The bill deletes the requirement that rates for Citizens be noncompetitive and no lower than the top 20 insurers but retains the requirement that a property is ineligible for coverage if an offer of coverage is received from an authorized insurer at approved rates.

|

LT. GOVERNOR TONI JENNINGS HEADS

PROPERTY INSURANCE REFORM COMMITTEE |

Many of the provisions contained in the bill were also considered in the Reform Committee�s recommendations and addressed by Statehouse participants in Rubio�s Property Insurance Conference. These preliminary efforts are intended to help coalesce the various approaches to the problem into a viable answer. A substantial part of any legislative package will include provisions designed to undo some of the damage anticipated by the passage of Senate Bill 1980 last year. While it remains to be seen whether the legislature is able to rebuild an effective insurance strategy and hit the Special Session�s four designated targets, it appears that they are taking the threat to the State�s economy more seriously than during the past few years.

Rubio�s pre-session conference and calling for the modeling companies to demonstrate that their prognostications aren�t little more than voodoo intimates that he doesn�t intend to allow the industry to �regulate itself� into unprecedented windfall profits at our expense while our representatives quizzically scratch their heads.

|

| SENATOR JEFFREY ATWATER |

District 25 Senator Jeffrey Atwater sits on the Senate Banking and Insurance Committee Chaired by Senator Bill Posey and Vice Chaired by Senator Ted Deutch - the Senate Committee that fired this year�s first volley at the problem. His substantial background in banking and insurance should underwrite his commitment to resolving the crisis for his Galt Mile constituents. Many of last year�s legislative efforts excluded common interest ownership structures. At several meetings with GMCA officials, Atwater stated that people living in associations would be beneficiaries of any legislation improving the insurance climate.

|

| Representative Ellyn Bogdanoff |

District 91 Statehouse Representative Ellyn Setnor Bogdanoff also has a significant insurance background. The new House Republican whip made a similar commitment to Galt Mile constituents. Following last years session, she started collecting input from constituents about their insurance concerns and invited their ideas and opinions for a legislative resolution. As the input rolled in, she compiled it into an outline intended for use as a basis for legislation. The outline was continuously updated and sent to those constituents participating in her email outreach program. Not surprisingly, it contains many of the same concepts developed by Governor Bush�s �Blue Ribbon� committee and those expressed during the 3-day House Conference. However, her offering was created months earlier. In meetings with GMCA officials and the Advisory Board, she likewise committed to insure that common interest ownership housing would be included in any legislative offering.

While the average premium increase for property owners across the state is a whopping 47%, Galt Mile homeowners are facing 250% to 350% premium hikes. If the average homeowner is in a bind, Galt Mile homeowners are being molested and forced from their homes. The silver lining is that our voices in both legislative houses have committed to using their special expertise in the insurance field to either contribute to a legislative return to insurance sanity or help refine a grass roots solution currently being developed for association members. We, and they, should have a better idea of the legislature�s intention following the Special Session. More to come...

While the average premium increase for property owners across the state is a whopping 47%, Galt Mile homeowners are facing 250% to 350% premium hikes. If the average homeowner is in a bind, Galt Mile homeowners are being molested and forced from their homes. The silver lining is that our voices in both legislative houses have committed to using their special expertise in the insurance field to either contribute to a legislative return to insurance sanity or help refine a grass roots solution currently being developed for association members. We, and they, should have a better idea of the legislature�s intention following the Special Session. More to come...

Would you like to see events as they unfold? Please Click Here to view the Special Session - LIVE!

Would you like to see events as they unfold? Please Click Here to view the Special Session - LIVE!

Click To Top of Page

The Big Show

Special Session on Insurance in Tallahassee

January 28, 2007 - A gun loaded with political pink slips pointed at their heads, State officials in Tallahassee spent the week of January 16th trying to find a cure for the toxic shock syndrome afflicting Florida homeowners. It took a new Governor, a new Statehouse Speaker (with a new majority whip), a new Senate President, a new Chief Financial Officer, a last gasp mandate from Florida property owners and the imminent prospect of the State slipping into an irreversible economic coma for Tallahassee to signal a �code blue� and page �Dr. Allcome�. The State�s third consecutive Special Session was the charm. After spending 3 years hoping that the insurance crisis would clear up like an inconvenient rash, the denizens of our State Capitol performed emergency surgery on a festering malignancy threatening Florida�s fiscal future. Like a marriage between the royal progeny of warring medieval clans, the insurance crisis also forced bipartisan cooperation usually reserved for national catastrophes.

January 28, 2007 - A gun loaded with political pink slips pointed at their heads, State officials in Tallahassee spent the week of January 16th trying to find a cure for the toxic shock syndrome afflicting Florida homeowners. It took a new Governor, a new Statehouse Speaker (with a new majority whip), a new Senate President, a new Chief Financial Officer, a last gasp mandate from Florida property owners and the imminent prospect of the State slipping into an irreversible economic coma for Tallahassee to signal a �code blue� and page �Dr. Allcome�. The State�s third consecutive Special Session was the charm. After spending 3 years hoping that the insurance crisis would clear up like an inconvenient rash, the denizens of our State Capitol performed emergency surgery on a festering malignancy threatening Florida�s fiscal future. Like a marriage between the royal progeny of warring medieval clans, the insurance crisis also forced bipartisan cooperation usually reserved for national catastrophes.

|

SPEAKER MARCO RUBIO, GOV CHARLIE CRIST, SEN BILL POSEY, LT.

GV JEFF KOTTKAMP, SEN PRES KEN PRUITT AND SEN JEFF ATWATER |

As expected, the Special Session didn�t cure the insurance crisis. However, it hit all 4 issues enumerated in the January 9th joint proclamation by Governor Charlie Crist, Senate President Ken Pruitt and House Speaker Marco Rubio. It produced legislation to reduce current property insurance premiums, reduce their future rate of growth, improve the availability and stability of property insurance and plug holes in the State�s building code. The amount of temporary palpable relief offered by the legislation depends upon where you live, who your carrier is, the vulnerability of your domicile and how its ownership is structured. While anticipated regulatory changes for Citizens (Citizens Property insurance Corporation) and the overall insurance industry will hopefully excise some of the premium fat, most of the projected savings result from postponing and rearranging public payouts. On January 1, 2008 or upon confronting a serious �event�, many of the public wounds dressed by this compromise will be reopened.

The eleventh hour overhaul impacts several areas critical to ratepayers - 1) cost reduction, 2) mitigation, 3) consumer protections and options, 4) new insurance company requirements and 5) market incentives. This is how it breaks down:

The eleventh hour overhaul impacts several areas critical to ratepayers - 1) cost reduction, 2) mitigation, 3) consumer protections and options, 4) new insurance company requirements and 5) market incentives. This is how it breaks down:

The cost savings come from postponed/eliminated increases, statutory streamlining and making cheaper money available to carriers who must then pass through the savings.

Private insurers must pass on all of the savings realized from increased access to Florida Hurricane Catastrophe Fund�s (FHCF or CAT Fund) below-market reinsurance rates. The expected average rate savings of 25% (for those using private carriers - 38%, State Farm - 14%, Citizens - 3%) disappears when this reinsurance availability expires after two years.

Private insurers must pass on all of the savings realized from increased access to Florida Hurricane Catastrophe Fund�s (FHCF or CAT Fund) below-market reinsurance rates. The expected average rate savings of 25% (for those using private carriers - 38%, State Farm - 14%, Citizens - 3%) disappears when this reinsurance availability expires after two years.- The legislation foresees a 10% reduction in Citizens premiums from the sale of incremental multi-peril policies once the existing �windstorm only� limitation in high-risk areas is removed.

- Elimination of the statutory requirement that its rates be the highest and of the private reinsurance costs factored into its rate filings, along with changes made to the way Citizens manages its risks, pays for its capital and calculates its expenses purports additional rate cuts of 5% to 15%.

- Elimination of the 21% increase due in January and the 56% rate increase scheduled for March represents an immediate savings to every policy holder.

The bill provides greater access to disaster recovery resources and offers savings proportional to lower risk resulting from mitigation and building code strengthening.

The plan uses $100 million in new federal money from the Florida Small Cities Community Development Block Grant Program Fund to supplement the $250 million in the My Safe Florida Home program that provides subsidized home inspections and matching construction grants for single-family homeowners.

The plan uses $100 million in new federal money from the Florida Small Cities Community Development Block Grant Program Fund to supplement the $250 million in the My Safe Florida Home program that provides subsidized home inspections and matching construction grants for single-family homeowners.- An objective grading system will be used by carriers to evaluate hurricane mitigation measures when determining rates. Trained authorized wind mitigation inspectors will ascertain and confirm the effectiveness of these measures and customers can channel the savings into either lowering premiums or deductibles.

- Non-insured homeowners will join insured homeowners in qualifying for $5,000 home-strengthening matching grants.

- Home-strengthening matching funds will be made available for repairs to existing structures that are prerequisite to the installation of mitigation measures.

The bill provides a host of consumer options to insurance buying property owners that directly impact premium costs and deductibles.

With the approval of any mortgage and/or lien holders and a written statement demonstrating an understanding of risk and intent, consumers may exclude windstorm coverage from their policies, increase deductibles and/or not cover the contents of their home to lower premiums.

With the approval of any mortgage and/or lien holders and a written statement demonstrating an understanding of risk and intent, consumers may exclude windstorm coverage from their policies, increase deductibles and/or not cover the contents of their home to lower premiums.- Allow homeowners to choose quarterly and semi-annual installment plans to pay the premium, subject to OIR approval.

- Allow insurance companies to provide discounts to policyholders who obtain multiple lines of coverage through the same insurance company

- Require an Insurance Consumer Advocate to provide an annual report card on insurance companies, including information on complaints and payment timeliness. The report will use a letter grade under guidelines set by the Financial Services Commission.

A list of new insurance company requirements was designed to make carriers more responsive and elicit an accurate picture of consumer rights and obligations.

|

| INSURANCE REFORM DEMONSTRATION |

An insurance company�s CEO or CFO and actuary must sign an oath confirming the veracity of representations made in their rate filings.- Require insurance companies to evaluate the hurricane-security of a structure rather than the date of construction when determining risk.

- Suspend until December 31, 2008 the �use and file� procedure for rate increases, disallowing the practice of charging customers increased rates prior to receiving approval.

- As of January 1, 2008, any insurance company that writes homeowners policies in other states and writes auto insurance in Florida must also sell homeowners insurance in Florida, unless already provided through an affiliate.

- Require insurance companies to issue payment or denial of claims within 90 days following a storm.

- Companies that take over policies from Citizens can increase rates up to 25 percent, but those policyholders can decide to stay in Citizens if they prefer.

To promote rate restraint by competitive pressures, the only self-sustaining market incentive, the bill removes regulatory barriers to risk pooling among similar entities, to self-insurance for multi-family dwellings, to the collateral requirement for non-U.S. insurance companies.

- Allow risk pooling of �like� entities, such as hospitals, municipalities, condominium associations, and not-for-profit corporations.

- Loosen restrictions on multi-family dwellings, condominium associations, and other such entities that self-insure (cooperatives, neighborhood, community & civic associations, common interest domiciles).

- Limit insurance requirements in the Condominium Act to �residential condominiums.� Also specify that �adequate insurance� for a group of at least three communities operating as residential condominiums, cooperatives, homeowners� associations, or timeshares must be adequate to cover a 250-year PML (total projected loss) windstorm event.

- To better fill the reinsurance �gap�, allow foreign reinsurance companies the same market access as domestic reinsurance companies provided they meet Florida�s regulatory standards.

|

| NEW GOVERNOR CHARLIE CRIST |

The wide-ranging 167-page compromise package containing the above summarized provisions was largely developed during the session�s final weekend. In a 116 to 2 vote, it was adopted by the Statehouse at 5:15 PM on Monday afternoon (January 22nd). It was passed in the Senate at 5:29 PM by a 40 to 0 vote. Since half of Citizens� roughly 1.3 million policyholders live in Broward, Palm Beach and Miami-Dade counties, every South Florida politician was on board.

|

| REPRESENTATIVE DAN GELBER |

The only meaningful immediate rate relief in the plan relies heavily on the doubling of FHCF (CAT Fund) reinsurance availability and a litany of mind-bending concessions from Citizens Insurance. At the onset of the Special Session, despite the flood of �do-or-die� sound bites by every legislator in the State, battle lines were being drawn based on risk - not partisan ideology. While the original work product included scores of untested provisions aimed at enticing the commercial insurance industry back into the State, relieving the unprecedented burden carried by Citizens, enacting consumer options/protections and otherwise tweaking regulatory excesses, it foretold little immediate rate relief. Minority House leader Dan Gelber (D - Miami) explained the problem.

|

| SENATOR JEFFREY ATWATER |

Since lower risk inland property owners are mostly covered by commercial carriers, their representatives oppose increasing their constituents� exposure to the heavy statewide assessments used to bail out Citizens when a big hurricane hits anywhere in the state. They actively sought to keep Citizens off the table. However, Governor Crist�s Administration vociferously backed a provision universally supported by South Florida representatives designed to bring substantial relief to customers of Citizens. With a potential veto looming over the toothless package, several South Florida legislators stepped up to the plate.

|

| SENATOR STEVE GELLER |

Senator Jeffrey Atwater, who represents the Galt Mile, approached Senate President Ken Pruitt to elicit the green light to beef up immediate rate relief for his Broward and Palm Beach constituency, the majority of whom are covered by Citizens. He said, �I asked Ken, �Do I have authority to go back to the table, to start writing up some new ideas?�� Atwater described Pruitt�s answer, �He said, �Go!�� Atwater said that he then met with Citizens officials and asked, �What can we offer?� He described what happened next, �They must not have gotten any sleep. They came back with a memo at 8 a.m. the next day [Friday].� Although Senate President Pruitt and Statehouse Speaker Rubio supported Atwater�s expansion of Citizens to provide the rate relief sought by the District 25 Senator and the Governor, when Crist suggested a further expansion to accommodate disenchanted private carrier customers seeking a switch to Citizens, Rubio objected. As a Citizens customer, Rubio described the State�s insurer of last resort as �the worst insurance company in the state.�

|

REPRESENTATIVE

JACK SEILER |

While Atwater delivered the Citizens rate rollbacks desperately needed to relieve the fiscal strain on his constituents, Representative Jack Seiler, (D-Wilton Manors), and State Senator Steve Geller, (D-Hallandale Beach) strategized an expansion of the State�s CAT Fund (FHCF) to provide low cost reinsurance to carriers who pass the savings through to customers. Despite Geller�s status as the Senate Democratic leader and Seiler�s reputation as a talented moderate realist, their address on the other side of the aisle nearly buried what eventually became the other great source of immediate relief. Charlie Crist serendipitously overheard Seiler describing their concept to the Governor�s chief of staff George LeMieux when Crist exclaimed, �I like it. I like it. Let�s do it. That�s going to help the people, right?�

|

MAJORITY WHIP

ELLYN BOGDANOFF |

House Majority whip Ellyn Bogdanoff, the Galt Mile�s voice in the Statehouse, also made significant contributions to the agreement. Large tracts of the 167 page overhaul were her handiwork. Collecting input from constituents during the past year that she compiled into legislative work product, Bogdanoff outlined many of the technical improvements contained in the bill months ago. A Citizens customer - like Speaker Rubio - she summarized her disappointment with the State�s insurance carrier, �For too long now, Floridians covered by Citizens have been paying too much premium for too little service.� The Special Session afforded her the opportunity to present a comprehensive package that was melded into the overall legislation.

What does all this mean to Galt Mile association homeowners? The vast majority of relief portended in this bill goes to single family homeowners covered by private carriers (averaging 21.8% � according to legislative analysts). At the end of the day, the relief for condos covered by Citizens may amount to an 8% break on the heels of a 300% increase. If not for Senator Atwater, we wouldn�t have even gotten that!

In exchange for the 8% discount, we've all become "co-signers" - guaranteeing to pay for Citizens� future indebtedness. Under the conditions of this "rescue", a major storm could not only wipe out the CAT fund but also force residents to pay steep yearly assessments on home, auto and other insurance policies to make up for it. In essence, we�ve put up all of our other insurance policies as collateral. In the event of storm damage, any benefits paid might more accurately be characterized as loans. Since Tallahassee may actually be a suburb of the Twilight Zone, if we want a solution, it appears that we must first create one!

More to come...

Special Session Links

Click To Top of Page

Atwater on Special Session

Our Senator Explains Some of the Changes to the Florida Insurance Environment

|

| ANGRY HOMEOWNERS PROTEST AGAINST RUNAWAY RATES |

February 2, 2007 - Facing an army of angry property owners suffering from crushing insurance costs, Governor Charlie Crist�s new Administration and the new legislative leadership in Tallahassee convened a special session on property insurance on January 16th. Despite the pre-Election Day blizzard of campaign chatter promising relief for homeowners and significant progress toward re-establishing a competitive insurance environment, the highly publicized session quickly deteriorated into a regional tug-of-war. The powerful central and northern Florida politicians whose inland constituency is largely covered by commercial carriers opposed exposing their voters to the additional heavy assessments that Citizens charges to offset their payouts after a storm. Since a majority of South Floridians have been funneled into Citizens, only a reorganization of the State�s insurance company could loosen their rate squeeze. With two days left, the deadlocked session offered South Florida homeowners nothing. For the third year, Tallahassee would again prove impotent.

|

GALT MILE'S TALLAHASSEE VOICES

SENATOR JEFFREY "Jeff" ATWATER &

REPRESENTATIVE ELLYN BOGDANOFF |

Like Gary Cooper in High Noon, Senator Jeffrey Atwater refused to succumb to overwhelming odds. Rather than allow the session to become another exercise in futility, he sought to break the standoff. He elicited permission from Senate President Ken Pruitt to bring Citizens back to the table and wrangle some concessions. Drawing on his considerable experience as a Bank President with extraordinary insurance credentials, Atwater made the parties listen to reason. Realizing that it would take years before his constituents would benefit from the session's legislative changes, Atwater negotiated a postponement of the huge rate hikes that would immediately lambast his Broward and Palm Beach neighbors. Responding to the widespread confusion surrounding the objectives achieved during the Special Session, Senator Atwater sent his take on the final bill to his Galt Mile constituency. Read On!

Good News for Property Owners

|

| SENATOR JEFFREY ATWATER |

As a result of the Florida Legislature�s special session on property insurance reform, some very good things happened for the state�s beleaguered property owners � especially the folks covered by Citizens Property Insurance.

Believe me, I understand. Two of my neighbors � a couple who have lived in their modest home for nearly 40 years � were forced to go without insurance because a private insurer, as Florida law encouraged, took over their Citizens windstorm policy and tried to raise the premium by more than 145 percent. I can�t tell you how deeply that disturbed me. I vowed that after our January special session no Floridian ever again would be forced to gamble on the roof over their head. Thankfully, a majority of the Legislature agreed.

Here�s how the reform works if you are a Citizens policy holder: No longer can an insurance company force you out of your Citizens policy. You now have a say in the matter. You can choose to stay with Citizens, accept a take out offer, or shop around for a better premium. And, frankly, electing to stay with Citizens could be the better move. Why? Because the company is no longer a �last resort� insurer. It can now operate more competitively by writing multi-peril policies in high-risk areas such as ours. Gone are those controversial wind-zone boundaries that have split Palm Beach and Broward Counties down the middle; all commercial and residential property owners � whether on the coast or inland � will be able to buy coverage for windstorms and other perils from Citizens Property Insurance. As a result, Citizens policy holders will see true relief from their skyrocketing premiums.

|

SEN STEVEN GELLER, REP JACK SEILER, GOV CHARLIE CRIST HOUSE

SPEAKER MARCO RUBIO, SEN JEFFREY ATWATER AND REP JOE

GIBBONS VISIT WITH CONSTITUENTS SUFFERING FROM RATE SHOCK

CHARLIE AND BECKY ISIMINGER (FAR LEFT) |

Also, lawmakers rescinded the Citizens Property Insurance rate increase of 21% from earlier this year and required the company to give you a rebate if you already paid the higher rate. We also eliminated another 56% rate hike request that was scheduled to begin March 1.

If your windstorm coverage is written by a private company, these new reforms will provide rate relief by way of lower reinsurance costs. We expanded the successful Hurricane Catastrophe Fund to make more stable, inexpensive reinsurance � that�s back-up coverage � available to these companies. The new law requires insurance companies to pass on its savings from using the Catastrophe Fund directly to policyholders. The additional reinsurance coverage will encourage private insurers to make new insurance available at these affordable rates.

Additionally, we have begun reducing the cost of future hurricanes by accelerating funding for retrofitting existing homes with such protections as hurricane shutters. Insurers now will have to offer you a reduction in your deductibles if you take wind mitigation measures.

|

| Ends CHERRY-PICKING |

Finally, our reform eliminates what�s known as �cherry-picking,� a practice insurers were using in Florida only, to sell safe, profitable policies such as auto coverage, but not property insurance � even though they offer property coverage in other states. This wasn�t fair to Floridians. Outlawing this practice will help ensure that homeowners insurance is more available to our residents.

You might be wondering how quickly these savings will be reflected in your insurance bills. As far as I am concerned, that relief cannot come soon enough! Fortunately, for private policy holders you should begin to see reductions as early as June and July. If you are a Citizens policy holder, by March 1, your rates will be lowered back to what you were paying in December of 2006 and refund checks will begin to arrive to those policy holders who have already paid the higher rates. By April, Citizens hopes to have their rates lowered even further as a result of the recent changes made by the legislature. Citizens will provide refunds for those changes as well!

|

STATEHOUSE SGT-AT-ARMS ERNEST SUMNER AND SENATE

SGT-AT-ARMS DONALD SEVERANCE DROP THEIR HANDKERCHIEFS

TO SIGNAL 'SINE DIE' - THE END OF THE SPECIAL SESSION |

These are just a few of the highlights from the special session on property insurance. I consider it a solid beginning, but expect more during the 2007 Legislative Session. The property insurance crisis is the single greatest threat to the economy of our state. It began when eight hurricanes battered us and insurance companies paid $36 billion in claims in 2004 and 2005. Even more frightening, weather forecasters have told us this period of increased hurricane activity could last another 10 to 20 years. We in the Legislature have more work to do. We know it and you deserve it. We will continue to apply ourselves to this task!

For more information on this legislation and how it may affect you please contact my office in Palm Beach County at (561) 625-5101 or in Broward at (954) 847-3518. You can also send me an email at [email protected].

Senator Jeffrey Atwater

District 25

As the dust settles over the next six months, Galt Mile association members will learn the actual extent and imminence of the relief they can expect from Atwater�s gambit. Homeowners covered by private carriers will have to wait until the summer before actualizing any benefit from the Special Session.

Citizens was created as an insurer of last resort. Operating under the assumption that any entity having to rely on Citizens was doing something wrong, statutes were designed to punish their clients. Laws mandating that their rates be kept artificially onerous were created to "encourage" clients to find any commercial alternative. Often, that meant fixing some neglected building component or installing some reasonable threat mitigation. Citizens would grudgingly accept this high-risk insurance riffraff with the understanding that they do whatever was necessary to attract a commercial carrier. To drive home the point, Citizens was saddled with statutory requirements that they be the most expensive, least responsive carrier in the State. By making the "Citizens" experience adequately repulsive, property owners would be properly motivated to achieve and maintain commercial eligibility.

Citizens was created as an insurer of last resort. Operating under the assumption that any entity having to rely on Citizens was doing something wrong, statutes were designed to punish their clients. Laws mandating that their rates be kept artificially onerous were created to "encourage" clients to find any commercial alternative. Often, that meant fixing some neglected building component or installing some reasonable threat mitigation. Citizens would grudgingly accept this high-risk insurance riffraff with the understanding that they do whatever was necessary to attract a commercial carrier. To drive home the point, Citizens was saddled with statutory requirements that they be the most expensive, least responsive carrier in the State. By making the "Citizens" experience adequately repulsive, property owners would be properly motivated to achieve and maintain commercial eligibility.

Suddenly, the insurance environment changed and South Florida�s sole remaining admitted carrier (QBE) explained to customers that because nervous reinsurers were cutting their ante by a whopping 75%, they could only afford to cover new buildings. Inhabitants of structures more than a few years old (a majority of South Florida homeowners) were shunned and indiscriminately dumped into Citizens. Although its new clientele weren't insurance outcasts rejected from the commercial market because of some construction deficiency or maintenance indiscretion, they faced the same punitive fiscal measures that Citizens affords all their customers.

|

| ATWATER WELCOMES GALT MILE VISITORS TO TALLAHASSEE |

Whether Florida homeowners were victims of a meteorological twist of fate, an insidious industry strategy to do away with rate regulation or bureaucratic ineptitude in Tallahassee, buildings that were eminently insurable a few years ago were abandonned through no fault of their own. No purpose would be served by beating them into submission with punitive rate hikes. Atwater realized that Citizens� mandate needed to change. Instead of continuing as a last resort with a statutory strategy of severely discouraging continued participation, he envisioned its transition into a viable, efficient, competitive company offering a full line of insurance products. If Atwater�s perception of Citizens as a full service profit center is actualized, it could provide the missing competitive ingredient required to attract commercial carriers back to the State. It would also provide a model for other States facing similar dilemmas.

Whether the session work product will provide meaningful relief to Galt Mile associations remains to be seen. However, were it not for Jeffrey Atwater�s final push to morph Citizens into a full service insurance vehicle instead of a repository for rejects, it is likely that the session would have been the third in three years to be characterized by unrelenting failure.

More to come...

To contact the Senator, Click Here. To read the actual Conference Committee Amendment for HB 1A, Click Here!

To contact the Senator, Click Here. To read the actual Conference Committee Amendment for HB 1A, Click Here!

Click To Top of Page

Legislative Update

Representative Ellyn Bogdanoff, District 91

|

| Representative Ellyn Bogdanoff |

February 6, 2007 - District 91 Statehouse Representative Ellyn Setnor Bogdanoff, the Galt Mile Community�s voice in the Florida Statehouse, fulfilled a commitment to constituents during the mid-January Special Session in Tallahassee. Last year, she promised that if Tallahassee didn�t address the insurance crisis, she would recast it as her top priority. THEY DIDN�T. SHE DID. Appointed to the important position of �Majority Whip� by incoming House Speaker Marco Rubio, Ellyn orchestrated the December pre-session House Insurance Conference during which scores of Representatives took the opportunity to educate themselves about the issue. At a November lunch meeting, Ellyn said, �Newly elected Representatives must acclimate to the Capitol and familiarize themselves with the issues. To get the most out of the Special Session, every legislator must be fully conversant with every aspect of the problem.� Not surprisingly, a majority of the provisions agreed to at the Special Session were first thoroughly reviewed during the three-day House Insurance Conference. Also, much of the content ultimately included in the Special Session�s surviving legislation was taken from bills co-sponsored by Ms. Bogdanoff.

As is her practice, she kept constituents apprised of events as they unfolded. The following message summarizes Ellyn�s take on the legislature�s recent performance.

�Over the past few months, I have talked with many of you and I heard the same concern: our community is slowly eroding under the twin threats of property insurance and taxes.

We are past the point of half-measures and band-aids. That is why in January, the Legislature convened for a special session on insurance reform. As the Majority Whip, my office was charged with putting together a bipartisan conference in December to prepare for the special session and study Florida�s property insurance market. Over 100 members of the House, Republicans and Democrats, participated and presented their ideas for reform.

It was a challenging week, but the results of our efforts in the Special Session will provide meaningful and responsible rate relief to all Floridians. Although there are many components to the bill, I wanted to highlight a few.

- First, after speaking with our neighbors who live in condominiums and co-ops, I made it my priority to remove regulatory barriers to risk pooling and self-insurance for multi-family dwellings.

- Second, we expanded the Florida Catastrophe Fund, which will stimulate the private market and reduce rates.

- Third, we substantially reduced rates for those who have no other market but Citizens Insurance Corporation by rolling back the rates to the 2006 levels and providing additional reductions.

- Fourth, we committed to support the efforts of those homeowners who choose to mitigate damage by hardening their homes, and directed state regulators to establish a home grading system so homeowners will know what credits to expect.

- Fifth, we created greater transparency in the premium notices, and

- Last, we advised companies that sell homeowner�s insurance in another state and choose to write in Florida that they will no longer be allowed to sell auto only. They will be required to sell homeowner�s insurance as well (cherry picking).

For a comprehensive review of the insurance reforms, please email or call my office and I will send you a copy of the Whip�s Brief, which summarizes the new law.

We will continue to work on insurance issues in the 2007 Regular Session with an eye on long-term reform.

Next, we will tackle the property tax issue, and I can assure you that any changes will be broad and reduce the burden to both homeowners and businesses. I will keep you posted on this issue and many others that we will address in the 2007 Legislative Session. Please do not hesitate to call my office at (954) 762-3757. Our office hours are 9 am to 5 pm, Monday through Friday, and I am always available by email. If you would like me to add you to my email list and receive weekly updates from the Capitol, please let me know by emailing me at [email protected] or by calling our office.

Thank you again for allowing me to serve you.�

District 91

P.S. - On Monday, February 12th, the Legislature will host two Public Hearings on Property Tax Reform. From 9:00 AM to 12:00 noon at the Duncan Theatre of the Lake Worth Campus of Palm Beach Community College, (4200 Congress Avenue, Lake Worth) and from 6:00 PM to 9:00 PM at Bailey Hall on the Broward Community College Central Campus (3501 SW Davie Road, Davie). Legislators will be on hand to listen to your thoughts on this issue. For more information, call Representative Ellyn Setnor Bogdanoff at 954-762-3757 or CLICK HERE to email.

Click To Top of Page

Atwater, Bogdanoff & Teel Solicit Galt Association Input

Explore Insurance & Property Tax Relief

|

GALT MILE LAWMAKERS REPRESENTATIVE ELLYN

BOGDANOFF AND SENATOR JEFFREY ATWATER |

March 17, 2007 - On Thursday, March 1st, Senator Jeffrey Atwater, Representative Ellyn Bogdanoff and Commissioner Christine Teel hosted a meeting at the Beach Community Center. Inviting civic and Association leaders from the member co-ops and condos of the Galt Mile Community Association, they solicited �grass roots� input about issues threatening to undermine Florida�s economic viability and its popularity as a place to live. Laying the groundwork for the initial topic, Senator Atwater pointed out that for the first time, Florida emigration exceeded immigration - more people were leaving than moving to the State! Both of our State Legislators agreed that the underlying reasons for this untenable situation are skyrocketing property insurance costs and an unsustainable property tax formula.

|

SPEAKER MARCO RUBIO, GOV CHARLIE CRIST, SEN BILL POSEY, LT.

GV JEFF KOTTKAMP, SEN PRES KEN PRUITT AND SEN JEFF ATWATER |

Senator Atwater explained the obstacles he had to overcome during the recent Special Legislative Session on Property Insurance prior to being afforded the opportunity to alter the traditional Citizens formula and refocus its mission. Having received the �go ahead� from Governor Charlie Crist and Senate President Ken Pruitt, Atwater spearheaded a reconfiguration of Citizen�s business model, transforming it from a repository for the commercially uninsurable into a full service competitive company featuring a viable profit center. The �windstorm only� limitation in high risk areas (such as everything east of I-95 in Broward County) was rescinded, allowing Citizens to market the more profitable multi-peril policies to windstorm customers. They zapped the 21% increase imposed in early January and eliminated another 56% increase scheduled for March 1st. Customers satisfied with rates lowered by these and many other changes, are no longer subject to being dumped upon having been accepted by a commercial carrier. They can remain with Citizens or accept an alternative offer. Legislators also loosened the purse strings of the Florida Hurricane Catastrophe Fund, making available more low-cost reinsurance dollars to carriers that must pass the savings to rate-payers.

The Senator described how the State�s various constituencies reacted to these changes being implemented. Citizens has historically been funded by assessments to all insured property owners. Lawmakers from central and northern counties, in which single family homes primarily covered by private carriers must to pick up their share of any shortfall following a costly storm, fought to keep their constituents exposure to a minimum. During the past two special sessions, this impregnable voting bloc thwarted any attempt to put Citizens on the table. Clarifying that continued adherence to this formula meant sacrificing South Florida, Atwater was able to marshal the necessary state-wide political will to alter Citizens� mandate.

The Senator described how the State�s various constituencies reacted to these changes being implemented. Citizens has historically been funded by assessments to all insured property owners. Lawmakers from central and northern counties, in which single family homes primarily covered by private carriers must to pick up their share of any shortfall following a costly storm, fought to keep their constituents exposure to a minimum. During the past two special sessions, this impregnable voting bloc thwarted any attempt to put Citizens on the table. Clarifying that continued adherence to this formula meant sacrificing South Florida, Atwater was able to marshal the necessary state-wide political will to alter Citizens� mandate.

Representative Bogdanoff confirmed the importance of opening the CAT fund coffers. Carriers have identified a dearth of reinsurance dollars as the 600 pound gorilla of premium increases. She also described the importance to Condominiums and Cooperatives of simplifying requirements for the establishment of private self insurance risk pools. Given the existence of 18,000 Condominium Associations statewide, a huge percentage of the current burden on Citizens will be relieved by the prospect of much lower rates and faster benefit response times in self-directed funds. The legislation was passed to give Associations in communities like the Galt Mile neighborhood a viable alternative to the sky-high premiums currently commanded by Citizens.

Representative Bogdanoff confirmed the importance of opening the CAT fund coffers. Carriers have identified a dearth of reinsurance dollars as the 600 pound gorilla of premium increases. She also described the importance to Condominiums and Cooperatives of simplifying requirements for the establishment of private self insurance risk pools. Given the existence of 18,000 Condominium Associations statewide, a huge percentage of the current burden on Citizens will be relieved by the prospect of much lower rates and faster benefit response times in self-directed funds. The legislation was passed to give Associations in communities like the Galt Mile neighborhood a viable alternative to the sky-high premiums currently commanded by Citizens.

|

| SENATOR JEFFREY ATWATER |

The lawmakers acknowledged the need for these alternatives given the squeeze on Associations by the huge rate hike passed by Citizens last May. The new legislation passed during the special session froze those high rates for a full year. While they won�t be increased, Associations renewing policies through May 1st will suffer these unprecedented premium costs. Simply freezing the 250% - 300% rate jumps relieves none of that fiscal burden, although the special session�s legislative output should help unit owners with their individual policies issued from commercial carriers � if they can find one.

At this juncture, several representatives from cooperatives, including Dr. Robert Drews from Carib�, Dennis Anderson from Coral Ridge Towers and Ralph Hamaker from Coral Ridge Towers South, loosed a uniform complaint. �Why does so much association legislation in Tallahassee neglect cooperatives?� asked Anderson. As Edgewater Arms� Sam Montross and Carol Blanchard nodded in agreement, Anderson protested elephant size loopholes in their constitutional guarantees of equal protection under the law. They were assured by Representative Bogdanoff that cooperatives were specifically included in the new legislation, allowing their participation in such a vehicle.

|

| TAX LEVIES VS. POPULATION AND INCOME GROWTH RATES |

Senator Atwater then nominated property taxes as being the primary cause for flight from Florida. Driving home the severity of the problem, he said, �In August of 2005, some 7000 single family homes were on the market. This past August, that number more than quadrupled to 31,000.� Having distributed fact sheets, Representative Bogdanoff and Senator Atwater reviewed some disquieting inequities in our tax system.

During the ten years from 1996 to 2006, the Florida population increased by 25%, personal income increased by 86% and Florida property taxes increased by 148%. During the same period, County taxes increased by 155%, school taxes by 122% and municipal taxes by a whopping 193%. Ellyn Bogdanoff noted that there is no rational relationship between the cost of operating government and the property values upon which tax assessments are based. The new majority Statehouse whip, she has been instrumental in compiling some alternative mechanisms that might be considered more equitable.

The two state officials first ran through a list of possible adjustments to the existing system, considering their positive and negative consequences.

|

NEW GOVERNOR CHARLIE CRIST

SUPPORTS DOUBLING HOMESTEAD |

Governor Charlie Crist has openly supported a doubling of the Homestead Exemption from $25,000 to $50,000, restoring its savings impact to approximately 1980 level. On the down side, statewide property tax rolls would shrink by 6.6% and small counties with many lower-valued properties would get clobbered.

By allowing homeowners to carry forward their �Save our Homes� benefit, a veritable flood of transactions will ensue. Homeowners threatened with overwhelming tax consequences triggered by the loss of their cumulative �Save our Homes� protection will no longer be trapped in their present circumstances. By making �Save our Homes� either fully or partially portable, people can adjust their residence options to their current needs. However, it would exacerbate the already huge assessment inequities between longtime residents and both newly and non-homesteaded properties. Insofar as this further insulates Homesteaded property owners from local government budget decisions, it will commensurately increase tax liability for non-homesteaded property owners.

By allowing homeowners to carry forward their �Save our Homes� benefit, a veritable flood of transactions will ensue. Homeowners threatened with overwhelming tax consequences triggered by the loss of their cumulative �Save our Homes� protection will no longer be trapped in their present circumstances. By making �Save our Homes� either fully or partially portable, people can adjust their residence options to their current needs. However, it would exacerbate the already huge assessment inequities between longtime residents and both newly and non-homesteaded properties. Insofar as this further insulates Homesteaded property owners from local government budget decisions, it will commensurately increase tax liability for non-homesteaded property owners.

Protection similar to that afforded Homesteaded property owners by the �Save our Homes� constitutional amendment could be provided to non-homesteaded properties. Capping their increases at perhaps 10% would serve to insulate non-homesteaded properties from surges in property values as were recently experienced. Since these value spikes are unusual, this would have little long term impact on overall property assessments. Of course, new businesses still taxed at �just value� would face a competitive disadvantage during periods of accelerated appreciation.

�Save our Homes� benefits could also be extended to all Real Property, completely eliminating the greatest distinction between the protections available to property owners. While helping to level the field for Homesteaded and non-Homesteaded property owners, newly obtained property would still be subject to �just value� assessments. Since overall assessment needs remain the same, leveling the field would shift a relatively larger burden to Homesteaded properties.

�Save our Homes� benefits could also be extended to all Real Property, completely eliminating the greatest distinction between the protections available to property owners. While helping to level the field for Homesteaded and non-Homesteaded property owners, newly obtained property would still be subject to �just value� assessments. Since overall assessment needs remain the same, leveling the field would shift a relatively larger burden to Homesteaded properties.

Capping all property tax growth by statute is regularly considered. It would deflate the effect of property value swings. However, two adverse consequences lower its value as a potential resolution. It would thwart local governments from responding to local needs and emergencies. It could also encourage a greater reliance on fees and targeted assessments.

|

| SEN. JEFF ATWATER ADDRESSES ASSOCIATION LEADERS |

Senator Atwater clarified �the heart of the problem.� Half of Fort Lauderdale�s residents enjoy homestead protection. Since assessments are a zero-sum mechanism, whatever tax burden is relieved on the other half will be borne by the homesteaded properties. What will induce half the population to support a divestiture of some or all of their protection?

When the �Save our Homes� amendment was enacted in 1992, the notion of rewarding Florida resident-homeowners with special protection by shifting some of the tax burden to those whose primary allegiance lies elsewhere and commercial enterprises received overwhelming support. Little consideration was accorded to the ever-widening gap between the two ownership classifications. This year, those differences have reached a critical mass, threatening the fiscal health of the entire state. The increase projected in Fort Lauderdale�s proposed municipal budget will be fully assessed to non-homesteaded properties while homesteaded properties will actually realize a small decrease. Half the population is footing the bill for everyone. Businesses and other non-homesteaded property owners are no longer urgently pleading for relief, they are leaving. This is not an anecdotal red flag - but a statistical reality. This threat, in and of itself, will not be adequate to elicit enough support to make a sweeping change to the tax formula. Knowing that they would have to pay for the relief needed by their non-homesteaded neighbors, what would it take to win the support of homesteaded property owners? As put by Senator Atwater, �We must find the right sweetener.�

|

FORMER ACTING FT LAUDERDALE

CITY MANAGER ALAN SILVA |

Former Acting Fort Lauderdale City Manager Alan Silva interjected, citing a fatal disconnect in the budget process. Having performed municipal CPR when called upon to prevent a threatened fiscal collapse during the Fort Lauderdale Budget Crisis, Silva has first-hand experience with a systemic dogma. He said, �The people providing input about which services are needed are never the ones that have to foot the bill.� Commissioners are often pressured to campaign for expensive services by groups and/or residents with little or no liability for their costs. He suggested that the taxpayers be given greater direct input into the budget process.

|

REP. ELLYN BOGDANOFF

ADDRESSES PARTICIPANTS |

Representative Bogdanoff repeated another disconnect that she alluded to earlier, one questioning the rationale for the entire system. The taxes needed to finance the cost of government have no relation to the property values upon which they are currently based. Residents asked our Legislators if taxes could be based on some formula other than fluctuating property values. Ellyn Bogdanoff explained, �The Florida Constitution authorizes local property taxes and limits the legislature�s authority to make changes.� She listed some of the obstacles to replacing the current system with a sales tax. If increased to replace property tax revenues, a State sales tax would more than double, making it the nation�s highest - by far. Of course, businesses would have to pay even more than they do under the existing property tax system. Since the current hotel tax is already almost twice the existing sales tax, more than doubling the sales tax would devastate tourism. Local governments would lose any fiscal input or control in a system wholly dependant on a State tax. Without thousands of variances or adjustments for anomalies such as retailers in border areas, they would be disproportionately impacted. A straight-up swap-out doesn�t seem viable.

Representative Bogdanoff said that several proposals for property tax relief were being considered in the Statehouse. She described an attempt to provide statutory relief, �It requires local governments to immediately and meaningfully reduce property tax rates and caps future growth in property tax revenues.� A proposal for Constitutional reform �replaces homestead property taxes with sales tax and establishes revenue caps for both state and local government.� The problems normally attributable to these alternatives are addressed in some legislative options by utilizing surgical rollbacks to achieve equity.

|

SENATOR JEFFREY ATWATER &

REPRESENTATIVE ELLYN BOGDANOFF |

The statutory option requires an immediate reduction in millage rates for all local taxing authorities except school districts and voter-approved millage rates. Property tax rates would be rolled back to the 2000-2001 Fiscal Year and then rolled forward to a revised FY 2007-2008 rate, factoring in population increases and inflation. Future local revenue growth is linked to increases in population and inflation - not property values. Requiring a supermajority vote of the governing authority to exceed the revenue cap should discourage potential abuse. This option could provide immediate tax relief averaging 19% savings ($433 for homestead property and $3,353 for commercial property) on all property owners� next tax bill.

The Constitutional option - implementation of a state sales tax - eliminates all property taxes on homestead property (average savings of $2,283), replacing the lost revenues with a dedicated 2.5% new sales tax. It requires all local entities (including school districts) to limit future growth to population increases and inflation. Exceeding the cap would require a unanimous vote of the governing authority. After embedding the new statutory provisions for rate roll-back in the State Constitution, we could roll back state revenues to the 2000-2001 Fiscal Year and then roll them forward to a new FY 2007-2008 rate, factoring in population increases and inflation. Future state revenue growth is linked to increases in population and inflation. A 2/3 vote of each house would permit a one-year lift of the state revenue cap to address emergencies.

The Constitutional option - implementation of a state sales tax - eliminates all property taxes on homestead property (average savings of $2,283), replacing the lost revenues with a dedicated 2.5% new sales tax. It requires all local entities (including school districts) to limit future growth to population increases and inflation. Exceeding the cap would require a unanimous vote of the governing authority. After embedding the new statutory provisions for rate roll-back in the State Constitution, we could roll back state revenues to the 2000-2001 Fiscal Year and then roll them forward to a new FY 2007-2008 rate, factoring in population increases and inflation. Future state revenue growth is linked to increases in population and inflation. A 2/3 vote of each house would permit a one-year lift of the state revenue cap to address emergencies.

|

FT LAUD COMMISSIONER

CHRISTINE TEEL |

Rolling back revenue levels and bringing them forward again affected only by population growth and inflation will eliminate the huge windfall valuation anomalies responsible for our present sky-high rates. Senator Atwater volunteered �I support the direction taken in the House proposals. We could possibly pass some version of the statutory resolution. For the Constitutional solution to be realized, you would have to agree! Only you can enact a constitutional amendment.�

As time ran out, Senator Atwater, Representative Bogdanoff and Commissioner Teel thanked participants for allowing them to remain on point. Allotting a segment for each problem and focusing undivided attention towards its resolution allowed for a significantly deeper exploration of the issues. Our Legislators requested the opportunity to repeat this format again in the future � to follow through on these painful dilemmas and consider other challenges facing the thousands of Association members living in the Galt Mile neighborhood. The participants universally agreed as the legislators excused themselves, exclaiming that it was time for them �to get to work.�

Click To Top of Page

Foreclosure Fiasco

Anti-Condo Senate Bill SB 714

March 28, 2007 - Senator Gary Siplin filed Senate Bill 714 (SB 714) on January 23, 2007. In its third legislative incarnation in three years, the bill purports to protect people from losing their homes over insignificant debts. That doesn�t accurately describe the effects of the bill. It is a license to steal. It allows homeowners to legally take up to $2,499 out of their neighbor�s pockets - indefinitely. A similar bill was defeated in California a few years back. Governor Schwarzenegger explained his reason for vetoing the legislation, �This bill makes sweeping changes to the laws that govern Common Interest Developments (CID) and the foreclosure process for failure to pay delinquent homeowners assessments. While the intent of this legislation is laudable and intended to protect homeowners from being foreclosed upon for small sums of delinquent assessments, this bill is overly broad and could negatively impact all homeowners living in CIDs. This bill could unfairly result in increased assessments for other homeowners who pay their assessments in a timely manner and may delay the transfer of real property in CIDs due to the lien procedures set forth in the bill.� That�s putting it mildly.

|

| SENATOR GARY SIPLIN |

Foreclosure should always be a means of last resort to collect a debt. Since people�s homes are often their most significant asset, the prospect of losing one�s home over a trivial debt is tragic. Foreclosures and liens are tools to enforce the payment of a debt. In the case of Common Interest Developments such as Condominium Associations, they are the only legal tools available. If you fail to make your car payments, it gets repossessed. Miss a few FP&L bills and the refrigerator becomes a storage chest. If you stiff Bellsouth, your telephone becomes �static art�. Ordinarily, if you don�t pay for services, the services stop... except in Condominiums. To level the risk of depending on many �roommates�, Associations are afforded the right to lien or foreclose on �roommates� that don�t kick in their fair share of the common expenses. When condo owners don�t pay their fair share, the burden falls to all the other owners.

The vast majority of condo owners pay their assessments on time. Of the few who pay late, most pay after the first notice. The extreme minority that remains delinquent falls into two categories - those homeowners undergoing some financial crisis and those that simply refuse to pay. In either case, the resulting shortfall is shifted to the delinquent�s neighbors. Although some can afford the unexpected expense, many on fixed incomes cannot. Condo finance is a zero sum game, if some pay less, others must pay more. The effective result of unpaid assessments is the appropriation of other people�s money without asking their permission - commonly characterized as stealing. The Association must pay its bills and employees whether or not the individual owners pay theirs. To minimize this unfortunate aspect of common interest ownership, owners protect one another by agreeing to place liens and/or foreclose when assessments aren�t paid. This is their only legal remedy.

SB 714�s language is self-explanatory, �A lien foreclosure action or an action to recover a money judgment brought as a result of unpaid condominium association assessments may be brought only in those instances in which the amount in question equals or exceeds $2,500. The association is not entitled to recover attorney�s fees incurred in either a lien foreclosure action or an action to recover a money judgment for unpaid assessments. No foreclosure judgment may be entered until at least 180 days after the association gives written notice to the unit owner of its intention to foreclose its lien to collect the unpaid assessments.�

Since any collection action would be precluded by statute, unpaid assessments amounting to less than $2,500 could be �appropriated� with impunity. The monthly maintenance assessments for thousands of Florida Associations run from $30 to $100. The delinquent�s neighbors will have to �carry� the deadbeat for years before they are permitted to enact a recovery.

Since any collection action would be precluded by statute, unpaid assessments amounting to less than $2,500 could be �appropriated� with impunity. The monthly maintenance assessments for thousands of Florida Associations run from $30 to $100. The delinquent�s neighbors will have to �carry� the deadbeat for years before they are permitted to enact a recovery.

For instance, if an Association�s monthly assessment is $30, the other owners would have to pay the scofflaw�s bills for almost seven years without any prospect of relief. After the seven years, they must continue to pay for another six months after notice is given. Once the seven and a half years pass, they must pay an attorney to foreclose on the lien. They are not permitted to recover the attorney�s fees. If the association members can�t afford to finance the legal expense of foreclosing on the lien the delinquent is permitted to continue living off his neighbors - forever.

Legal fees for lien foreclosures often surpass the value of the delinquencies - sometimes exceeding the value of the unit. The right to foreclose offers no remedy if the non-recoverable cost of foreclosure exceeds the value of the unit. If the other owners decide to spring for the legal fees anyway, a manipulative deadbeat need only limit his debt to $2,499.99 to stave off foreclosure. He can continually owe that amount without risk of being subjected to enforcement actions. Associations will have to pay tens of thousands of dollars to stop each deadbeat from deliberately stealing from the other residents. Even when the delinquent wearies of this abuse and hits the road, the 180-day notification requirement will place the Association squarely at the end of the lien line. The mortgage holder and every debtor listed in a bankruptcy proceeding will take precedence over the Association�s standing.

The bottom line: If this bill passes, no Association could ever be made �whole�. It deliberately and irrationally punishes every other homeowner living in the Condo Association, who must either absorb the delinquent�s debt or pay irretrievable legal expenses to enforce collection. The bill doesn�t protect the unfortunate victims of irresponsible foreclosures by applying reasonable guidelines. It prevents an Association from collecting assessments... any assessments. As such, it victimizes every owner except the delinquent. All scofflaws must do to escape their debt is to NOT PAY IT! In effect, the first $2,500 assessed by an Association would be a plea to make a voluntary contribution, payable at the member�s discretion. Incomprehensibly, the bill further punishes the residents who pay their assessments on time by forcing them to pay the cost of collecting from those who don�t! It is impossible to cite another example of a lienholder that cannot collect attorney�s fees when enforcing its lien.

Siplin is also playing a constitutional shell game. Current law states, �The association may bring an action in its name to foreclose a lien for assessments in the manner a mortgage of real property is foreclosed and may also bring an action to recover a money judgment for the unpaid assessments without waiving any claim of lien.� By eliminating an Association�s right to foreclose and their right to act to collect money damages in amounts less than $2,500, Senator Siplin is removing every remedy available to an Association to collect a debt. The Constitution demands that every right have a viable remedy. By definition, a right without a remedy is, in fact, not a right. By removing the Association�s only collection remedy, the Senator is depriving the Association of its right to collect a debt. Since Senator Siplin is an attorney, it is reasonable to assume that this consequence is not unintended.

A well-known banker illustrated a more insidious ramification of the legislation. The mortgage application process includes an inquiry to the condo association about its outstanding receivables. If an Association�s balance sheet demonstrates substantial uncollected and/or uncollectible funds, lenders will classify the collateral as insufficient to secure their investment. The mortgage will be declined. The banker predicts that the bill would portend the end of Florida�s condo mortgage market. Only purchasers flush with cash could participate. Given the likelihood for abuse by this bill, the impending fiscal �train wreck� would exclude condominiums from mainstream financing.

SB 714 is patently absurd. While protecting homeowners from whimsical foreclosures is laudable, force feeding their debts to their neighbors is hardly a viable solution. An attorney formerly of the Miami Public Defender�s Office remarked, �Siplin must know that you can�t stop foreclosures by declaring a permanent legislative debt holiday.� Siplin has repeatedly stated, �There are a lot of condos not only in South Florida but throughout the state. This will bring relief to the whole state.� While mischaracterizing his bill as legislative altruism, he neglects to explain that his bill doesn�t expunge the debt; it functionally transfers it to the other owners! The �relief� that the Senator provides to the delinquent becomes everyone else�s burden. In a meeting with condo owners last year, Senator Jeffrey Atwater stated, �A bill designed to protect deadbeats to the detriment of everyone else is clearly unworkable.� The voice of reason!

At the end of the day, there is still no viable legislative solution to the issue. While no responsible association should opt to institute foreclosure proceedings to collect a trivial debt, simply making all assessments uncollectible sweeps the problem under the rug. Some associations have appointed special appellate committees charged with verifying the need to foreclose any unit. The committee is empowered to evaluate the circumstances surrounding the debt and, when appropriate, recommend alternatives to foreclosure. The committee can approve payment plans that enable the homeowner to address arrears or postpone action upon confirmation of impending alternative financing. The Association is made whole, the homeowner avoids incremental legal fees and foreclosures on liens against trivial debts never see the light of day. Unless a homeowner�s financial problems are so severe that no accommodation could address the debt, everybody wins.

Click To Top of Page

Representative Bogdanoff�s Tallahassee Update

Representative Ellyn Bogdanoff, District 91

|

REPRESENTATIVE

ELLYN BOGDANOFF |

April 4, 2007 - Ellyn Setnor Bogdanoff, the Galt Mile Community�s District 91 Statehouse Representative, updated constituents in late March about the status of legislation moving through the House and Senate. Wearing two hats, she must balance her duties as Majority Whip with her responsibility as our voice in Tallahassee. Tackling windstorm insurance and runaway property taxes affords her the opportunity to simultaneously fulfill both obligations. Since edifying Civic and Association leaders about nascent legislation earmarked to ameliorate these dilemmas at a grass roots �research� meeting with Senator Jeffrey Atwater earlier in March, statutory property tax legislation has been advancing through the House. Subsequent committee modifications to the property tax bill HB 7001, referenced in her �Whip�s Highlights�, extends special protection to fiscally constrained counties, hospital districts, and Children�s Services Councils (School Districts are already exempted in the original bill). These new exemptions reduce the overall tax reduction by about $326 million from the original $5.8 billion tax reduction for a new total reduction of $5.5 billion.

In addition to property tax reform, Representative Bogdanoff touches on bills affecting Cable industry customers and Public Records Exemption legislation designed to thwart Identity Theft. Read on:

Week  Two

Two

�We have been off to a very hectic start and have tackled some major issues. The year began with insurance during Special Session and we are now on to property taxes. I have attached the Whip�s Highlights so you can see the changes made to the property tax bill that passed out of committee this week. However, we are committed to broader reform and hope that we can do even more.

|

| BOGDANOFF FROM STATEHOUSE |

Although we know the statutory fix we just passed will provide immediate relief, the Constitutional changes that we are proposing are where the real reform takes place. I encourage you to visit www.nomorepropertytax.com and let me know what you think. This is a great website that will likely answer your questions and also outlines the plan. I sent many of you the original brief but there have been some proposed changes that we are still working through. Mainly, we are looking at rolling back to 03-04 instead of 01-02 under the Constitutional proposal as well as eliminating some, if not all of the tangible personal property on business. We are also prepared to deal with the appraisal issue regarding the current �highest and best� use versus �current use.� We sure could use your voice in the fight.

Let�s see, we also passed out of Policy and Budget, the repeal of the Communications Service Tax and a bill that creates greater competition in the cable market. I guess you can say we had a very �taxpayer friendly� week. All measures will head to the House floor soon.

I wrote an op-ed this week on the Public Records Exemption bills that seem to be controversial, at least where the newspapers are concerned. It is attached it if you are interested. I believe it is important to protect our private information, and there is a balance between open government and making our citizens' private information available for sale or pubic consumption. The bill needs work, but I strongly believe the intent is on point.

I was on the radio with Jim Defede Friday morning at 8, spent 9 hours in a committee meeting and then headed home for my friend�s birthday party. I hope to get in an hour of tennis today, the weather is incredible.