|

Every year, we send an assortment of well-educated men and women to Florida�s State Capitol to represent us. They speak for us, act on our behalf, educate themselves about importatnt issues, learn how to work together and try to execute productive resolutions. If they like the job, they run for re-election. Sometimes, their reasons for being there differ from those given to their constituents prior to Election Day; their actions become inconsistent with their promises while questions about their legislative intentions are buried in a blizzard of platitudes. When this occurs, its usually a good time to consider �changing the guard�.

| | STATE OF FLORIDA |

To be effective, politicians must master a spectrum of communication skills. The art of defining an issue and exhorting the need for a piece of palliative legislation in the same breath is known as �spin�. Depending on how its utilized, �spin� can be either a tool or a weapon; it can rally support for a good cause or create just enough confusion to allow a fox into the henhouse. To be effective, politicians must master a spectrum of communication skills. The art of defining an issue and exhorting the need for a piece of palliative legislation in the same breath is known as �spin�. Depending on how its utilized, �spin� can be either a tool or a weapon; it can rally support for a good cause or create just enough confusion to allow a fox into the henhouse.

| | REP. CHIP LaMARCA |

In order to determine whether or not your representatives still speak for you, you must examine their work product. To properly diagnose or �unspin� an issue, simply read the actual legislation. If you don�t have the time or patience to peruse the dry legislative text, review an authoritative summary. Corresponding with your representatives is another alternative to directly examining legislative content. Every year, legislation affecting Galt Mile residents oozes out of Tallahassee, often unnoticed. The issues surrounding that legislation will be explained in this section. Before next year�s legislative session, the articles will be relegated to the site�s Tallahassee Archives, setting the stage for the new session. Email, write, FAX or telephone your Statehouse Representative and your Senator with the specific obstacles that any issue or legislative effort hold for you. To find all the contact information for the Galt Mile�s political representatives in Tallahassee or elsewhere, go to the Report Card.

| | SENATOR GARY FARMER |

| GEORGETOWN HISTORIAN

CARROLL QUIGLEY |

Galt Mile Residents are currently represented by George Moraitis in the Florida Statehouse and Gary Farmer in the Florida Senate. Notwithstanding their official �party� affiliations, their primary responsibility is to YOU. They are obligated to exercise their voting power and influence the outcomes of certain issues based upon the feedback they recieve from their constituents - US. If they don't - as exclaimed by Georgetown University Professor Carroll Quigley while considering the virtues of Democracy - we can �Throw the rascals out.�

After familiarizing ourselves with the legislative land mines planted during the annual session and unifying behind issues that benefit the entire neighborhood, we can send our political representatives in Tallahassee a clear and unconflicted wish list. Furthering their constituents' agenda will have a far greater impact on their future political ascendency than their party affiliations - or ours. This pro-active formula also shields our community from the paralysis of partisan gridlock that might otherwise belabor efforts to enact favorable legislation. By sending a few strategically timed emails, we can thwart bills conceived to abridge our rights, erode home rule and drain association budgets. Not a bad day's work! After familiarizing ourselves with the legislative land mines planted during the annual session and unifying behind issues that benefit the entire neighborhood, we can send our political representatives in Tallahassee a clear and unconflicted wish list. Furthering their constituents' agenda will have a far greater impact on their future political ascendency than their party affiliations - or ours. This pro-active formula also shields our community from the paralysis of partisan gridlock that might otherwise belabor efforts to enact favorable legislation. By sending a few strategically timed emails, we can thwart bills conceived to abridge our rights, erode home rule and drain association budgets. Not a bad day's work!

| | DOLPHIN SCULPTURE AT ENTRANCE TO THE STATE CAPITOL COMPLEX |

Click To Top of Page

|

|

|

2009 Legislative Session

Judges Jump when Banks Bark

| | DONNA BERGER ESQ |

December 29, 2009 -  On November 30, 2009, association attorney and activist Donna Berger sent an email recounting a November 24th blog she wrote about banking industry in-court maneuvers that have associations frantically trotting a legal hamster wheel. The blog entry speaks to institutionalized tactics promulgated by banks to forestall taking title to foreclosed properties. Among the battery of methodologies deployed by the banking industry are legal motions that are akin to monkey wrenches thrown into the judicial process. On November 30, 2009, association attorney and activist Donna Berger sent an email recounting a November 24th blog she wrote about banking industry in-court maneuvers that have associations frantically trotting a legal hamster wheel. The blog entry speaks to institutionalized tactics promulgated by banks to forestall taking title to foreclosed properties. Among the battery of methodologies deployed by the banking industry are legal motions that are akin to monkey wrenches thrown into the judicial process.

Banks are circumventing association arguments and encumbering foreclosure proceedings with court ordered delays by filing ex parte motions. Usually reserved for urgent matters where requiring notice would subject one party to irreparable harm, ex parte motions are requests for emergency rulings on behalf of or involving only one party to a legal matter and in the absence of and usually without notice to the other party. Occasionally concomitant with divorce or separation petitions, they preclude a parent or partner from skipping town with jointly held assets or the kids while the parties await a turn on the docket. Banks are circumventing association arguments and encumbering foreclosure proceedings with court ordered delays by filing ex parte motions. Usually reserved for urgent matters where requiring notice would subject one party to irreparable harm, ex parte motions are requests for emergency rulings on behalf of or involving only one party to a legal matter and in the absence of and usually without notice to the other party. Occasionally concomitant with divorce or separation petitions, they preclude a parent or partner from skipping town with jointly held assets or the kids while the parties await a turn on the docket.

In addition to creatively reconfiguring these preemptive emergency requests to delay foreclosure actions, they use the more traditional tactics of flooding the court with capricious motions to vacate and thwarting scheduled sales by simply not showing up! Donna intimates that these maneuvers would fail were it not for some degree of collaboration by accommodating judges. While it is possible that judges are oblivious to the part they play in exacerbating the burden on every one of the association�s unit owners, the regularity with which courts cooperate with these overtly abusive tactics supports that their complicity is �informed�. In addition to creatively reconfiguring these preemptive emergency requests to delay foreclosure actions, they use the more traditional tactics of flooding the court with capricious motions to vacate and thwarting scheduled sales by simply not showing up! Donna intimates that these maneuvers would fail were it not for some degree of collaboration by accommodating judges. While it is possible that judges are oblivious to the part they play in exacerbating the burden on every one of the association�s unit owners, the regularity with which courts cooperate with these overtly abusive tactics supports that their complicity is �informed�.

Recently, the courts leveled a groin kick to strapped associations. In �U.S. Bank National Association as Trustee for the Benefit of Harborview 2005-10 Trust Fund v. Tadmore, 2009 WL 4281301, 34 FLW D2505 (Fla. 3rd DCA 2009)�, the Third District Court of Appeal for Miami-Dade rejected the idea that equity and fairness are adequate reasons for requiring lenders to pay association fees while a foreclosure case is still pending against the unit owner. Recently, the courts leveled a groin kick to strapped associations. In �U.S. Bank National Association as Trustee for the Benefit of Harborview 2005-10 Trust Fund v. Tadmore, 2009 WL 4281301, 34 FLW D2505 (Fla. 3rd DCA 2009)�, the Third District Court of Appeal for Miami-Dade rejected the idea that equity and fairness are adequate reasons for requiring lenders to pay association fees while a foreclosure case is still pending against the unit owner.

After tolerating a year of bank delays in a foreclosure case, an association filed a motion to compel the bank to move forward within a certain time frame or pay assessments (maintenance fees) on the unit. Judge Scott J. Silverman of the Eleventh Judicial Circuit of Florida for Miami-Dade granted the Association�s motion, ordering the bank to diligently proceed within thirty (30) days or start paying the $939.56 monthly maintenance fee. After tolerating a year of bank delays in a foreclosure case, an association filed a motion to compel the bank to move forward within a certain time frame or pay assessments (maintenance fees) on the unit. Judge Scott J. Silverman of the Eleventh Judicial Circuit of Florida for Miami-Dade granted the Association�s motion, ordering the bank to diligently proceed within thirty (30) days or start paying the $939.56 monthly maintenance fee.

Since banks are bound by statute to assume assessment responsibilities only after acquiring title to a property, the appellate Court characterized the obligation to pay assessments as a sanction and zapped the ruling. In a December 2, 2009 Opinion, the court ragged the association for not exhausting more traditional means available to address delay, such as filing for a Show Cause order. Contending that the association was therefore not entitled to extraordinary relief, the appellate Court reversed the Order and sent the association back to the drawing board. In its opinion, the appellate Court made the cynical observation that �in its quest to do equity, a court cannot trammel the legal rights of the parties.� Since banks are bound by statute to assume assessment responsibilities only after acquiring title to a property, the appellate Court characterized the obligation to pay assessments as a sanction and zapped the ruling. In a December 2, 2009 Opinion, the court ragged the association for not exhausting more traditional means available to address delay, such as filing for a Show Cause order. Contending that the association was therefore not entitled to extraordinary relief, the appellate Court reversed the Order and sent the association back to the drawing board. In its opinion, the appellate Court made the cynical observation that �in its quest to do equity, a court cannot trammel the legal rights of the parties.�

| JUDGE SCOTT

J. SILVERMAN |

Of course, a legislative resolution would move the playing field out of the courthouse. Unfortunately, the banking industry was able to leverage its standing as the State�s most powerful lobby to curtail every relevant bill filed during the last legislative session.

| | SENATOR MIKE FASANO |

During the 2009 regular legislative session, Tallahassee experienced the staggering influence wielded by the banking lobby. By delaying assumption of title, banks forestall assessment obligations to the association for foreclosed units, forcing the other unit owners to pay the bank�s share. Although thousands of associations pleaded for legislative relief from the banking industry�s dilatory foreclosure strategy, Florida Statehouse and Senate leaders warned lawmakers that any bill threatening banks with additional costs will suffer desiccation on the calendar. Following the announcement, several fast-moving, popular bills were hung out to dry.

| | SENATOR JEREMY RING |

New Port Richey Republican Senator Mike Fasano filed Senate Bill 880 (SB 880), extending lender liability to the lesser of 12 months of past due fees and special assessments or 20 percent of the mortgage amount if payment to the association is made within 30 days of taking title. The cap would vanish after the 30-day deadline. Senator Jeremy Ring, a Parkland Democrat, filed Senate Bill 998 (SB 998), requiring lenders to take title on investor-owned units within 12 months of filing foreclosure, with no penalty for that year of engineered delay. As the session progressed, at least a dozen other bills providing similar relief options were folded into major filings best positioned for passage.

| J. THOMAS CARDWELL - FLA

BANKERS ASSN COUNSEL |

In a monument to contradiction, after first maintaining that he hadn�t seen any evidence of bank delays in taking title, general Counsel J. Thomas Cardwell of the Florida Bankers Association enumerated several reasons for delays that he just claimed were �nonexistent�. Cardwell said �Lenders are only trying to help keep homeowners in their properties,� asserting that the foreclosure foot-dragging is simply the industry�s way of actualizing altruistic foreclosure moratoriums. Wagging the dog, he proceeded to blame homeowners for bogging down the court system by mounting time-consuming defenses.

Contending that the relief bills were squelched to benefit Condominium owners, Cardwell stated �These bills could severely damage the ability to obtain financing on condos, and because of that, would do much more damage to condos and condo associations than they would do good.� Mid-way through the session, after the bills had clearly gained sufficient support and momentum for passage, bank lobbyists handed legislative leaders a non-negotiable ultimatum. The industry threatened to hike interest rates on Florida condo loans or stop writing condo mortgages altogether if changes were made to the current law. Overnight � and despite its penalty-free construction � Ring�s bill withered. Since lenders refused to risk losses incremental to the collateral devaluation already reddening their books, Fasano�s bill was also euthanized. Contending that the relief bills were squelched to benefit Condominium owners, Cardwell stated �These bills could severely damage the ability to obtain financing on condos, and because of that, would do much more damage to condos and condo associations than they would do good.� Mid-way through the session, after the bills had clearly gained sufficient support and momentum for passage, bank lobbyists handed legislative leaders a non-negotiable ultimatum. The industry threatened to hike interest rates on Florida condo loans or stop writing condo mortgages altogether if changes were made to the current law. Overnight � and despite its penalty-free construction � Ring�s bill withered. Since lenders refused to risk losses incremental to the collateral devaluation already reddening their books, Fasano�s bill was also euthanized.

In essence, after his employers threatened to dismantle the condo market if any expediting legislation were passed, Cardwell had the temerity to plead that lawmakers heed the consequences on behalf of those homebuyers facing a sudden dearth of mortgage financing.

During the post-session, association advocates have been meeting with legislators in preparation for another run at the banks. Since the banking lobby continues to sit atop Mount Ararat in Tallahassee, legislative relief still faces an obstacle fueled by virtually unlimited resources. Nonetheless, Berger�s email considers taking action that could provide a modicum relief in the courts. Outlining how the banks have successfully dodged legal redress, her blog entry is as follows: [editor]

What tactics do banks use to stall their foreclosure actions?

I haven�t talked to a single person (other than my banker) who doesn�t want to either (a) make banks pay more back assessments to community associations in which they hold mortgages or (b) make banks expedite their foreclosure actions.

We are obviously at cross purposes with most banks who have absolutely no incentive whatsoever to take back title to these properties. What happens when the bank takes back title especially to a property that has no equity?

The bank must first pay the statutorily required back assessments (6 months in a condominium association and 12 months in a homeowners� association);

The bank must start paying regular and special assessments on that property like every other owner in the community; and

The bank must incur additional liability as a property owner to maintain, insure and repair that property and market it for sale.

What happens when the bank delays taking title back to the property?

The rest of the owners in the community continue to maintain the value of the bank�s collateral by paying to maintain and insure the overall community (fixing the roof, maintaining the landscaping, etc.); and

The property is waiting for them to take back when the market rebounds.

The question then is how are banks managing to stall their foreclosure actions? Some are using the judicial process cleverly by filing ex parte motions. An ex parte motion asks for a court order before the other party (the association) has an opportunity to be heard on the request. An ex parte motion in a child custody hearing where a parent could flee the jurisdiction is one thing but an ex parte motion to set aside the bank�s Final Judgment because there is no equity in the unit??

What other tactics are lenders� counsel employing lately? They are moving to vacate the certificate of title, moving to vacate final judgments (discussed above), moving multiple times to reschedule the foreclosure sales or simply not showing up to scheduled sales or canceling the sale date unilaterally by putting these options into their Final Judgments. Of course, there are defenses to these tactics that the association can raise but most don�t have the money or energy to fight the banks.

Interestingly, lender�s counsel usually must convince the Court that no defendant will be prejudiced by the granting of the ex parte motion being requested. An association not hurt after years of waiting for the bank to foreclose and to have a new owner start paying its fair share of assessments only to be delayed once again by legal maneuvering? It�s hard to believe any trier of fact would easily buy that argument.

Posted by

Donna D. Berger, Esq.

7:53 AM on November 24, 2009

| | CHIEF JUSTICE PEGGY A. QUINCE |

Berger�s concluding statement hits the nail on the head. In cases wherein the motion was granted, either the judge overlooked requiring assurances that the action wouldn�t unfairly compromise the association�s case or the bank attorney blatantly misrepresented the facts. Seeking a resolution to this anathematic abuse of the legal system, she prefaced her email to members of the Community Advocacy Network Advisory Council (a consulting panel of association activists in which the Galt Mile Community Association participates) by stating �Most judges simply are unaware that the banks� ex parte motions are not, in fact, harmless as they are being told. My question to the Council is how do you suggest getting this information in the hands of our judiciary so they become wise to the issues and start scrutinizing these motions and tactics a little closer?� In wrapping up her preface with �Forwarding the blog to the chief judges around the State is one idea. Any others?� � Berger seemingly answers her own question.

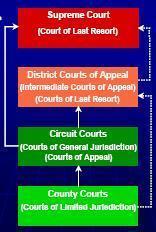

In Florida�s State Court structure, the 322 judges in the State�s 67 County Courts handle cases involving tort contracts, small claims (up to $5000), real property (from $5000 to $15,000), miscellaneous civil issues, misdemeanors, preliminary hearings, traffic and other violations (except parking, which is handled administratively). Although Certified Questions (writs of certiorari, prohibition, mandamus, quo warranto, habeas corpus, etc.) can go to the Appellate Court, decisions made by the County Court�s individual judges are appealed to the Circuit Courts. The 599 judges in the State�s 20 Circuit Courts hold jury trials (except in appeals) for torts, contracts, real property in excess of $15,000, miscellaneous civil, mental health, probate/guardianship/estate, civil appeals, domestic relations (family law matters), felonies, criminal appeals and juvenile (dependency and delinquency) cases. Depending on the case, Circuit Court decisions are appealed to the Appellate Court or the State Supreme Court. In Florida�s State Court structure, the 322 judges in the State�s 67 County Courts handle cases involving tort contracts, small claims (up to $5000), real property (from $5000 to $15,000), miscellaneous civil issues, misdemeanors, preliminary hearings, traffic and other violations (except parking, which is handled administratively). Although Certified Questions (writs of certiorari, prohibition, mandamus, quo warranto, habeas corpus, etc.) can go to the Appellate Court, decisions made by the County Court�s individual judges are appealed to the Circuit Courts. The 599 judges in the State�s 20 Circuit Courts hold jury trials (except in appeals) for torts, contracts, real property in excess of $15,000, miscellaneous civil, mental health, probate/guardianship/estate, civil appeals, domestic relations (family law matters), felonies, criminal appeals and juvenile (dependency and delinquency) cases. Depending on the case, Circuit Court decisions are appealed to the Appellate Court or the State Supreme Court.

62 judges sit in 3-judge panels on the State�s 5 District Courts of Appeal. Headquartered in Tallahassee, Lakeland, Miami, West Palm Beach, and Daytona Beach, the Appellate Courts have mandatory jurisdiction in civil, noncapital criminal, administrative agency, juvenile, original proceeding, interlocutory decision cases as well as discretionary jurisdiction for all of these except for administrative agency cases. Decisions can be appealed to the 7 justices that sit �en banc� in the State�s Supreme Court. The State�s Court of last resort, The State�s Court of last resort, Florida�s Supreme Court case types include mandatory jurisdiction in civil, capital criminal, criminal administrative agency, juvenile, disciplinary, advisory opinion cases and discretionary jurisdiction in civil, noncapital criminal, administrative agency, juvenile, disciplinary, advisory opinion, original proceeding, interlocutory decision cases. Their case load includes Constitutional questions, Bond Validations, Public Utility cases, validity of statutes and decisions affecting a class of constitutional/statutory officers. 62 judges sit in 3-judge panels on the State�s 5 District Courts of Appeal. Headquartered in Tallahassee, Lakeland, Miami, West Palm Beach, and Daytona Beach, the Appellate Courts have mandatory jurisdiction in civil, noncapital criminal, administrative agency, juvenile, original proceeding, interlocutory decision cases as well as discretionary jurisdiction for all of these except for administrative agency cases. Decisions can be appealed to the 7 justices that sit �en banc� in the State�s Supreme Court. The State�s Court of last resort, The State�s Court of last resort, Florida�s Supreme Court case types include mandatory jurisdiction in civil, capital criminal, criminal administrative agency, juvenile, disciplinary, advisory opinion cases and discretionary jurisdiction in civil, noncapital criminal, administrative agency, juvenile, disciplinary, advisory opinion, original proceeding, interlocutory decision cases. Their case load includes Constitutional questions, Bond Validations, Public Utility cases, validity of statutes and decisions affecting a class of constitutional/statutory officers.

Although directly alerting the State�s Chief Judges will help edify jurists prospectively misinformed that the bank�s ex parte motions are harmless, it will also convey that their decisions are being scrutinized by a sizable audience, not just the usual handful of engaged attorneys. Since this problem is largely national in scope, another possible option would be to contact the Conference of Chief Justices (CCJ) with this information. Among their projects is a Best Practices Institute charged with identifying and promoting practices that enhance the effective administration of justice as part of �a broad strategy to improve court performance and better serve the public.� To improve public trust and confidence, the CCJ also initiated a Public Trust and Confidence Forum. To help start the ball rolling, contact information for the Chief Justice of the State�s Supreme Court and the Chief Judges for the five District Courts of Appeal are listed below. Although directly alerting the State�s Chief Judges will help edify jurists prospectively misinformed that the bank�s ex parte motions are harmless, it will also convey that their decisions are being scrutinized by a sizable audience, not just the usual handful of engaged attorneys. Since this problem is largely national in scope, another possible option would be to contact the Conference of Chief Justices (CCJ) with this information. Among their projects is a Best Practices Institute charged with identifying and promoting practices that enhance the effective administration of justice as part of �a broad strategy to improve court performance and better serve the public.� To improve public trust and confidence, the CCJ also initiated a Public Trust and Confidence Forum. To help start the ball rolling, contact information for the Chief Justice of the State�s Supreme Court and the Chief Judges for the five District Courts of Appeal are listed below.

| CHIEF JUDGE

PAUL M. HAWKES |

Florida Supreme Court � Chief Justice Peggy A. Quince

500 South Duval Street, Tallahassee, Florida 32399-1925

Telephone: (850) 922-5624

http://www.floridasupremecourt.org/justices/quince.shtml

First District Court of Appeal � Chief Judge Paul M. Hawkes

301 S. ML King Blvd., Tallahassee, Florida 32399-1850

Telephone: (850) 487-1000

http://www.1dca.org/judges/hawkes.html

Second District Court of Appeal � Chief Judge Darryl C. Casanueva

1005 E. Memorial Blvd., Lakeland, FL 33801

Telephone: (863) 499-2290

http://www.2dca.org/Judges/Bio/casanueva.shtml

| CHIEF JUDGE

JUAN RAMIREZ, JR. |

Third District Court of Appeal � Chief Judge Juan Ramirez, Jr.

2001 S.W. 117 Ave., Miami, Florida 33175

Telephone: (305) 229-3200

http://www.3dca.flcourts.org/Judges/25-Ramirez.shtml

Fourth District Court of Appeal � Chief Judge Robert M. Gross

1525 Palm Beach Lakes Blvd., West Palm Beach, FL 33401

Telephone: (561) 242-2000

http://www.4dca.org/judges/gross.shtml

Fifth District Court of Appeal � Chief Judge David A. Monaco

300 South Beach Street, Daytona Beach, FL 32114

Telephone: (386) 255-8600

http://www.5dca.org/Judges/Monaco/Monaco_page.shtml

Go to http://www.flcourts.org/courts/circuit/circuit.shtml for links to all 20 Florida Circuit Courts and http://www.flcourts.org/courts/county/county.shtml for links to Florida�s County Courts. [editor]

Click To Top of Page

Revived Claims Could Fill Condo Coffers

Buckley Towers Verdict Changes Legal Landscape

October 31, 2009 - October 31, 2009 -  For some Galt Mile Community Association members, this information may represent an opportunity to bring closure to a painful, abusive and unrequited process endured several years ago on the heels of Florida�s devastating serial hurricanes. For others, it might offer a last pull at their property insurance slot machine. Notwithstanding the motive, it could seriously enhance the association�s fiscal viability. For some Galt Mile Community Association members, this information may represent an opportunity to bring closure to a painful, abusive and unrequited process endured several years ago on the heels of Florida�s devastating serial hurricanes. For others, it might offer a last pull at their property insurance slot machine. Notwithstanding the motive, it could seriously enhance the association�s fiscal viability.

Following the serial hurricanes of 2004 and 2005, many Galt Mile associations entered into a long slow waltz with their property insurance carriers. Dozens of damage claims were submitted since the summer of 2004, when the State was suddenly subjected to insurance industry convulsions that trebled windstorm rates overnight. Over the next few years, associations detailed their claims progress at monthly GMCA Presidents Council meetings, a strategy implemented to share tactics useful for expediting benefits. Following the serial hurricanes of 2004 and 2005, many Galt Mile associations entered into a long slow waltz with their property insurance carriers. Dozens of damage claims were submitted since the summer of 2004, when the State was suddenly subjected to insurance industry convulsions that trebled windstorm rates overnight. Over the next few years, associations detailed their claims progress at monthly GMCA Presidents Council meetings, a strategy implemented to share tactics useful for expediting benefits.

Some fortunate associations never sustained enough damage to reach their deductible limit while those that barely exceeded their deductibles filed relatively modest claims. Others were heavily victimized by the storms, with damage in the $millions. In 2004 and 2005, the insurance industry issued an ultimatum to Tallahassee, threatening to leave the State unless approved for virtually unlimited rate increases. When state regulators balked, almost every admitted windstorm carrier hit the road, abandoning the Florida property and casualty market. Some fortunate associations never sustained enough damage to reach their deductible limit while those that barely exceeded their deductibles filed relatively modest claims. Others were heavily victimized by the storms, with damage in the $millions. In 2004 and 2005, the insurance industry issued an ultimatum to Tallahassee, threatening to leave the State unless approved for virtually unlimited rate increases. When state regulators balked, almost every admitted windstorm carrier hit the road, abandoning the Florida property and casualty market.

By the end of 2005, Australian carrier QBE was the only admitted alternative to Citizens Property Insurance Corporation, Florida�s taxpayer-supported carrier of last resort. When QBE constricted their eligibility requirements, their only Galt Mile client qualified to renew was Regency Tower, having installed impact rated windows and doors throughout. Insurance carriers pay most legitimate claims expeditiously to maintain good will � ordinarily a competitive necessity. As the only game in town, QBE had nothing to lose by continuously delaying claims via incessant requests for irrelevant documentation, purposely valuing damage loss below the hurricane deductible or denying legitimate claims due to eligibility exemptions not listed in the policy. By the end of 2005, Australian carrier QBE was the only admitted alternative to Citizens Property Insurance Corporation, Florida�s taxpayer-supported carrier of last resort. When QBE constricted their eligibility requirements, their only Galt Mile client qualified to renew was Regency Tower, having installed impact rated windows and doors throughout. Insurance carriers pay most legitimate claims expeditiously to maintain good will � ordinarily a competitive necessity. As the only game in town, QBE had nothing to lose by continuously delaying claims via incessant requests for irrelevant documentation, purposely valuing damage loss below the hurricane deductible or denying legitimate claims due to eligibility exemptions not listed in the policy.

Firmly ensconced in the catbird seat, QBE began requiring evidentiary documentation far in excess of that ordinarily submitted. They also summarily rejected marginally defective claims, such as those with minor �typos�. When the rebuffed claims were meticulously prepared anew by professionals and resubmitted, QBE rejected them out of hand, arbitrarily shifting eligibility standards. On March 13, 2006, the Florida Department of Financial Services (DFS) organized a condominium mediation program which provided a forum to discuss outstanding claims directly with a representative of the Association�s insurance carrier. A mediator detailed exactly what the client had to provide in order to receive their benefit. Although associations fully complied with the mediator�s requisites, QBE continued to disallow claims with impunity. Firmly ensconced in the catbird seat, QBE began requiring evidentiary documentation far in excess of that ordinarily submitted. They also summarily rejected marginally defective claims, such as those with minor �typos�. When the rebuffed claims were meticulously prepared anew by professionals and resubmitted, QBE rejected them out of hand, arbitrarily shifting eligibility standards. On March 13, 2006, the Florida Department of Financial Services (DFS) organized a condominium mediation program which provided a forum to discuss outstanding claims directly with a representative of the Association�s insurance carrier. A mediator detailed exactly what the client had to provide in order to receive their benefit. Although associations fully complied with the mediator�s requisites, QBE continued to disallow claims with impunity.

| | BUCKLEY TOWERS WINS $20 MILLION |

Ultimately, frustrated associations settled for a fraction of their damage costs. Others unconditionally capitulated upon learning that carriers had been dodging payment without consequence for years. A few doggedly persistent associations such as Coral Ridge Towers East, Southpoint and Galt Ocean Club, which played claims ping-pong with the company from 2004 to 2007 with little progress, finally negotiated settlements.

Last week, Managing Partner Donna Berger of Katzman Garfinkel Rosenbaum (KGR), who also serves as the Executive Director of the Community Advocacy Network (CAN), wrote an article offering forsaken associations a second (or third) bite at the apple. According to Berger, even damages sustained in 2004 are still recoverable. Last February, KGR partner Daniel Rosenbaum won a $20 million verdict against QBE for Buckley Towers, a 40-year old Miami-Dade condominium facing county condemnation for structural deficiencies caused by Hurricane Wilma. In September of 2007, the Chalfonte Condo Apartment Association of Boca Raton was similarly awarded $8.14 million. Located a few blocks south of the Galt Mile, Vantage View also won a $1.5 million jury verdict for hurricane-related damages. Last week, Managing Partner Donna Berger of Katzman Garfinkel Rosenbaum (KGR), who also serves as the Executive Director of the Community Advocacy Network (CAN), wrote an article offering forsaken associations a second (or third) bite at the apple. According to Berger, even damages sustained in 2004 are still recoverable. Last February, KGR partner Daniel Rosenbaum won a $20 million verdict against QBE for Buckley Towers, a 40-year old Miami-Dade condominium facing county condemnation for structural deficiencies caused by Hurricane Wilma. In September of 2007, the Chalfonte Condo Apartment Association of Boca Raton was similarly awarded $8.14 million. Located a few blocks south of the Galt Mile, Vantage View also won a $1.5 million jury verdict for hurricane-related damages.

The article is as follows: [editor]

Association Financial Problems:

Pursuing Unresolved Casualty Claims May Be the Solution

By: Donna D. Berger, Esq.

| | DONNA BERGER ESQ |

If your community is struggling today to meet its financial obligations in light of a growing number of delinquencies, it might be time to revisit the issue of any storm damage that may have impacted you several years ago. Many associations do not readily see the connection between storm damage that hurt them several years ago and their current economic woes but that connection may be closer than you think.

The following hurricanes battered the State of Florida:

Charlie - August 13, 2004; Frances - September 4, 2004; Ivan - September 16, 2004; Jeanne - September 26, 2004; Katrina - August 24, 2005; and Wilma - October 25, 2005

Many boards submitted claims for storm damage and were told that their claims did not reach their deductible level. Others received some money from their carriers but not nearly enough to pay for repairs and were forced to specially assess their members for those costs that weren�t covered. Incredibly, a few associations never even made claims because they either felt they did not meet the deductible or they feared having their coverage canceled or their rates raised. Quite simply, a board of directors cannot accurately assess the amount of damage that a community may have suffered without a thorough inspection by properly trained experts.

For far too many communities, the storms that ravaged Florida in 2004 and 2005 created a hole from which they never dug out. The special assessments that their members were forced to pay for damage that should have been covered by their insurance carriers made them less able to bear the current real estate market conditions.

However, all is not lost for those communities who understand the insurance process and take the time to pursue their rights. Typically you have five (5) years to make a claim with your insurance company after a casualty loss so even the oldest storm claim listed above is STILL RIPE unless your claim was cut short by a FIGA deadline, an appraisal award or a release agreement you signed which specifically used the word �release�. However, all is not lost for those communities who understand the insurance process and take the time to pursue their rights. Typically you have five (5) years to make a claim with your insurance company after a casualty loss so even the oldest storm claim listed above is STILL RIPE unless your claim was cut short by a FIGA deadline, an appraisal award or a release agreement you signed which specifically used the word �release�.

In order to understand whether or not your association walked away from insurance proceeds that were rightfully owed to you, it is important to understand how most insurance companies operate. It does not benefit the insurance company�s bottom line to make you whole for any claim you may submit so they are hoping you will accept less money than you deserve or they are hoping that you will simply forget that you still have rights to assert a substantial claim for money that you may be owed. It is even better for them if you do not submit a claim at all. The way insurers achieve these goals is to perpetuate the following myths:

| | CHALFONTE IN BOCA RATON AWARDED $8.14 MILLION |

If you file a claim you will be dropped. This is false. It is illegal under Florida law for insurance companies to drop policyholders for filing claims. Specifically, Section 627.4133(3) provides: �Claims on property insurance policies that are a result of an act of God may not be used as a cause for cancellation or nonrenewal, unless the insurer can demonstrate, by claims frequency or otherwise, that the insured has failed to take action reasonably necessary as requested by the insurer to prevent recurrence of damage to the insured property.�

The reality is that if you do not file a claim and the neighboring property owner files a dozen, you both have the same chance of being dropped if your insurance company decides to reduce its exposure in the State. The neighboring property owner, however, at least had the benefit of filing a claim;

If you file a claim your insurance rates will go up. Again, this is the same issue as #1. Insurance companies must submit rate increases to the State for approval. Whether or not you make a claim will not impact the carrier's business decision to move forward with a proposed rate increase;

Your damage did not come close to exceeding your deductible. This is a common tactic to ensure that policyholders simply give up and pay for insured damage out of their own pockets. Damage visible to the naked eye does not tell the whole story of damage which your personal and real property may have suffered. Trained experts can properly advise you on the full extent of the damage inflicted including structural damage, mold, loss of power, relocation expenses, cleanup and dumpster costs, etc. If your community endured a special assessment to pay for storm damage you may have been on the receiving end of the deductible excuse; and

| | LOCALLY - VANTAGE VIEW GETS $1.5 MILLION |

If you already received a check from your insurance company it is too late to revisit your claim. Unless you signed a release, receiving funds alone does not prevent you from pursuing your carrier for the full extent of damage you suffered.

Unfortunately, a volunteer board of directors is a particularly easy target for the scare tactics outlined above. Many boards simply do not know their rights with regard to casualty claims or are bullied into accepting less than the community, which is ultimately the individual members, deserves.

The statutory deadlines for most of these storm events are nearing. Boards, particularly new ones who were not seated at the time any damage was incurred, would be well advised to have their property inspected as soon as possible in order to provide themselves with the reassurance that they were paid in full by their carrier or to arm themselves with the ammunition needed to recover any amounts still owed.

If you were lucky enough not to suffer any storm damage over the last four tumultuous storm seasons, please keep in mind that every board member bears a fiduciary duty to the membership and that duty includes the proper handling of insurance claims.

Donna D. Berger, Esq. is the Managing Partner of the Ft. Lauderdale Office of Katzman Garfinkel Rosenbaum (KGR) a firm that devotes its practice to the representation of community associations and casualty law. Ms. Berger can be reached at 954-315-0372 or via email at [email protected]. Donna D. Berger, Esq. is the Managing Partner of the Ft. Lauderdale Office of Katzman Garfinkel Rosenbaum (KGR) a firm that devotes its practice to the representation of community associations and casualty law. Ms. Berger can be reached at 954-315-0372 or via email at [email protected].

While Donna Berger is well respected by Galt Mile Community Association members � having participated in many local and statewide actions favorable to condominiums and cooperatives � pursuing a dated insurance claim can be performed by many competent association attorneys. The next time you contact your attorney about the resident that breeds and sells plague rats, ask about reviving any rejected claims. Given the recent court victories against carriers for capricious claims management, the resulting new precedents have substantially improved the legal landscape. When Rosenbaum found the key to QBE�s courthouse roller skates, he unlocked a door that any victimized association can now open. If the Finance Committee expresses concern about legal expenditures, arranging commission-based compensation will fiscally insulate the association and motivate the lawyer. Good luck! � [editor] While Donna Berger is well respected by Galt Mile Community Association members � having participated in many local and statewide actions favorable to condominiums and cooperatives � pursuing a dated insurance claim can be performed by many competent association attorneys. The next time you contact your attorney about the resident that breeds and sells plague rats, ask about reviving any rejected claims. Given the recent court victories against carriers for capricious claims management, the resulting new precedents have substantially improved the legal landscape. When Rosenbaum found the key to QBE�s courthouse roller skates, he unlocked a door that any victimized association can now open. If the Finance Committee expresses concern about legal expenditures, arranging commission-based compensation will fiscally insulate the association and motivate the lawyer. Good luck! � [editor]

Click To Top of Page

Recipe for Retrofit Ripoff

Gov Gets Sprinkler Pseudo-Study

October 16, 2009 - The 2009 legislative session unveiled a bill containing a plethora of insurance provisions filed to undo unworkable laws enacted in earlier sessions. Those laws, such as a requirement for condo owners to purchase nonexistent insurance products (special assessment coverage???) or the one that vests associations with the dubious right to force place individual condo insurance policies (HO-6) are unfortunately still on the books. October 16, 2009 - The 2009 legislative session unveiled a bill containing a plethora of insurance provisions filed to undo unworkable laws enacted in earlier sessions. Those laws, such as a requirement for condo owners to purchase nonexistent insurance products (special assessment coverage???) or the one that vests associations with the dubious right to force place individual condo insurance policies (HO-6) are unfortunately still on the books.

It didn�t matter that Senate Bill 714 - AKA the �Association Glitch Bill� - was resoundingly applauded in both the Statehouse and Senate. Neither did the blizzard of support for the bill demonstrated by hundreds of thousands of association members from across the state. In the end, all that mattered were the potential threats it posed to Charlie Crist�s Senatorial campaign stats.

The bill contained a provision that postponed a $multi-million sprinkler retrofit for condo associations until 2025. A law passed in 2002 mandated that associations be fully retrofitted with a building-wide sprinkler system. Due to a state-wide outcry, lawmakers enacted an �opt-out� provision in 2003 (Senate Bill 592), allowing associations to instead install a scaled down �Minimum Alternative Life Safety System� that limited the sprinkler installations to association common areas and the entrance foyer of each unit. The bill contained a provision that postponed a $multi-million sprinkler retrofit for condo associations until 2025. A law passed in 2002 mandated that associations be fully retrofitted with a building-wide sprinkler system. Due to a state-wide outcry, lawmakers enacted an �opt-out� provision in 2003 (Senate Bill 592), allowing associations to instead install a scaled down �Minimum Alternative Life Safety System� that limited the sprinkler installations to association common areas and the entrance foyer of each unit.

| REPRESENTATIVE

CARL DOMINO |

In 2006, House Bill 391 by Representative Carl Domino extended the deadline to retrofit high rise projects with sprinklers from the currently mandated 2014 to 2025. The extra decade would afford unit owners an opportunity to recover from the 2004 and 2005 hurricane repair assessments, mega-deductibles and huge windstorm insurance increases that often required long and/or short term financing. Unit owners in these leveraged associations sought to first amortize their bloated debt service before paying another sizable assessment.

| FORMER GOVERNOR JEB

BUSH VETOES HB 391 |

After successfully surviving comprehensive committee reviews in both legislative bodies, HB 391 was passed out of the House by a vote of 113 Yeas vs. 0 Nays and was passed out of the Senate by a vote of 40 Yeas vs. 0 Nays. Retrofit lobbyists failed to convince lawmakers that investing scarce association resources in limited sprinklers would yield a more productive safety benefit than a comparable investment in hurricane protection. Despite its unanimous support and passage, lame duck Governor Jeb Bush angered condo owners by vetoing the bill, blaming the absence of any official study examining how retrofit costs will impact condominium owners.

| | ELLYN BOGDANOFF FILES HB 419 |

Several years passed before Statehouse Representative Ellyn Bogdanoff filed House Bill 419, a bill addressing a wide range of association issues including back-up generators for elevators, board elections, fire sprinklers, fire alarm systems and Timeshare Condominiums. It sought to correct inequitable insurance provisions, such as the right of an association to force every unit owner to purchase HO-6 insurance (condominium unit insurance) and name the association as a beneficiary. The bill contained the long anticipated postponement of the multi $million fire sprinkler retrofit - similar to the bill vetoed in 2006. Like the earlier legislation, it delayed an onerous mandated condominium assessment from 2014 to 2025.

| | SENATOR DENNIS L. JONES |

Seeking a comparable vehicle in the Senate, Bogdanoff asked Senator Dennis L. Jones to add her bill�s language to his Senate Bill 714, allowing it to be successfully vetted in both houses. Her HB 419 was ultimately folded into Jones�s SB 714 and whizzed through the Florida Statehouse and Senate virtually unchallenged. Legislative pundits in Tallahassee predicted that Crist would sign the critically important bill.

| CHUCK AKERS - EXECUTIVE

DIRECTOR - FFMIA & AFSA

|

Discounting authoritative surveys and studies substantiating that thousands of associations crippled by foreclosures were fighting for solvency, Crist opted to play the odds. The Governor�s advisors surmised that by the time the retrofits decimated condo budgets in 2013 and 2014, he would be long gone from Tallahassee, hopefully ensconced in Washington D.C. Of greater immediacy was a prospective campaign endorsement by the Fire Marshals and Inspectors union. He also wasn�t averse to tapping the bottom line generosity of the deep pocketed Fire Sprinkler Associations.

| FFMIA's & NFSA's

BUDDY DEWAR |

Although he lobbied Governor Crist as Executive Director of the Florida Fire Marshals and Inspectors Association (FFMIA), Chuck Akers is also the Executive Director of the American Fire Sprinkler Association, an industry trade group responsible for boosting sprinkler sales.  Key Fire Marshals Association officials are also employed by the National Fire Sprinkler Association, another sprinkler trade organization behind the original legislation. FFMIA Past President and lifetime member Steven Randall was also the South Central Regional Manager of the National Fire Sprinkler Association (AKA Florida Fire Sprinkler Association) until he retired on July 16, 2009. As for FFMIA lifetime member Buddy Dewar, in addition to pulling a salary as the National Fire Sprinkler Association�s Director of Regional Operations, he�s employed as the Florida Fire Sprinkler Association�s Lobbyist and Legislative Liaison. In a marginally literate final legislative company report, he wrote �The key House sponsor Ellyn Bogdanoff, Ft. Lauderdale, could care less about the safety of her constituents,� whom he maliciously characterized as �rich condo owners in Galt Ocean Mile who wish not to spend one penny on fire safety.� If you want to read it for yourself, Click Here (page 2). Despite Dewer�s antipathy for the Galt Mile and vilification of our Statehouse Representative, the 24,000-member Florida Professional Firefighters Association repudiated his pejorative conjecture, endorsing Bogdanoff�s candidacy for Jeff Atwater�s open District 25 Senate seat on October 20th.) Key Fire Marshals Association officials are also employed by the National Fire Sprinkler Association, another sprinkler trade organization behind the original legislation. FFMIA Past President and lifetime member Steven Randall was also the South Central Regional Manager of the National Fire Sprinkler Association (AKA Florida Fire Sprinkler Association) until he retired on July 16, 2009. As for FFMIA lifetime member Buddy Dewar, in addition to pulling a salary as the National Fire Sprinkler Association�s Director of Regional Operations, he�s employed as the Florida Fire Sprinkler Association�s Lobbyist and Legislative Liaison. In a marginally literate final legislative company report, he wrote �The key House sponsor Ellyn Bogdanoff, Ft. Lauderdale, could care less about the safety of her constituents,� whom he maliciously characterized as �rich condo owners in Galt Ocean Mile who wish not to spend one penny on fire safety.� If you want to read it for yourself, Click Here (page 2). Despite Dewer�s antipathy for the Galt Mile and vilification of our Statehouse Representative, the 24,000-member Florida Professional Firefighters Association repudiated his pejorative conjecture, endorsing Bogdanoff�s candidacy for Jeff Atwater�s open District 25 Senate seat on October 20th.)

| | GOVERNOR CRIST ANNOUNCES SB 714 VETO |

A student of history, Crist took a page from former Governor Jeb Bush�s playbook. He vetoed the bill and ordered the Department of Business and Professional Regulations (DBPR) to study a retrofit�s cost impact on condos and coops. Hoping that the study would help justify his controversial veto, the Governor�s veto message also directed the DBPR�s Division of Florida Condominiums, Timeshares, and Mobile Homes (Division) to research any insurance cost reductions that he presumed were associated with these installations.

| DBPR SECRETARY

CHUCK DRAGO |

On September 28, 2009, DBPR Secretary Chuck Drago notified Governor Crist that his Department wrapped up their study. DBPR invited input from Florida�s fire service industry, condominium community advocacy organizations, the Office of the State Fire Marshal, the Office of Insurance Regulation, Citizens Property Insurance Company, fire sprinkler installers and representatives of insurance companies. Two participating association advocacy groups were the Community Advocacy Network (CAN) and the Community Association Leadership Lobby (CALL). The Community Advocacy Network (CAN) represents 2500 associations and is headed by Donna Berger, an association attorney with Katzman Garfinkel Rosenbaum. Berger also originally initiated the Community Association Leadership Lobby while employed by Becker Poliakoff - which represents approximately 4,500 condominium associations. When she left for Katzman Garfinkel Rosenbaum and started CAN, Yeline Goin and David G. Muller succeeded Berger as CALL�s Co-Directors. Also testifying on behalf of cash-strapped condos and coops was Harry Charles, President Emeritus of the Space Coast Communities Association, an umbrella organization with 269 member associations on central Florida�s east coast.

Based upon a DBPR database review of condominium construction dates, the Division learned that of the 5600 projects affected by the mandated retrofit, only a handful had already complied. The database demonstrated the costs attendant to the two prospective installation options - a full sprinkler retrofit and the partial retrofit (AKA the �Minimum Alternative Life Safety System�) � varied widely, ranging from $503 per unit to $8633 per unit. While impacted by a structure�s layout, material construction, existing standpipe locations, and other structural factors, costs depended primarily on whether the water lines were simply dropped from the ceiling as exemplified by low-income public housing, or effectively hidden to meet the association�s aesthetic objectives. It is highly unlikely that Galt Mile associations will tolerate the exposed pipes that earmark the more modest estimates. Based upon a DBPR database review of condominium construction dates, the Division learned that of the 5600 projects affected by the mandated retrofit, only a handful had already complied. The database demonstrated the costs attendant to the two prospective installation options - a full sprinkler retrofit and the partial retrofit (AKA the �Minimum Alternative Life Safety System�) � varied widely, ranging from $503 per unit to $8633 per unit. While impacted by a structure�s layout, material construction, existing standpipe locations, and other structural factors, costs depended primarily on whether the water lines were simply dropped from the ceiling as exemplified by low-income public housing, or effectively hidden to meet the association�s aesthetic objectives. It is highly unlikely that Galt Mile associations will tolerate the exposed pipes that earmark the more modest estimates.

| | CAN DIRECTOR DONNA BERGER |

CALL Co-Director Yeline Goin wasn�t surprised by the sparse association participation, stating �Many associations are taking a wait and see approach, hoping the Legislature will provide relief by extending the date or removing the requirement altogether.� The primary reason for this resistance is the cost. CAN Executive Director Donna Berger agreed that retrofit costs are the limiting factor, noting �Many associations have held off retrofitting because they simply do not have the funds to do so," citing foreclosures as having constricted the fiscal capabilities of many associations.

| | GARY POLIAKOFF |

In a letter he wrote to the Governor blasting the advice Crist received prompting a veto of SB 714, Condo Attorney Gary A. Poliakoff asked, �With all due respect, exactly who did your advisors assume will be forced to pay the special assessments to retrofit a condominium where 40 percent to 50 percent of the units are in default in payment of their assessments, or in mortgage foreclosure?�

| | CALL CO-DIRECTORS YELINE GOIN AND DAVID MULLER |

Pursuing Crist�s strategy ofsoftening public reaction to the prohibitive cost, DBPR hoped Citizens Insurance and the Office of Insurance Regulation would demonstrate that retrofitted buildings would realize an offsetting savings in insurance premiums. Citizens reported that �A 5% sprinkler credit is applied if a building is fully sprinklered and the ISO (Insurance Services Office), a leading provider of information about property and liability risk, confirms the building has an approved sprinkler system.� A condominium with sprinklers in the common areas only (one of the two legal options) may or may not realize any benefit, depending in part on whether they are rated specifically or as a class by ISO. Since specific rates are based on the individual risk characteristics of a building (construction, layout, materials, occupancy, protection, exposure, etc.), prospective reductions are arbitrary at best � depending primarily on the innate altruism of the insurance actuary. If rated as component to a construction class, they would be summarily rejected.

| FORMER DEPUTY INSURANCE

COMMISSIONER LISA MILLER |

However, when insurance carriers granted reductions for Florida associations fully retrofitted with fire sprinklers, the price impact on their overall policies was insignificant because the discounts applied only to the modest �all other perils� portion of their property and casualty policies, not the expensive windstorm portion. After confirming that the 5% premium discount described by Citizens is negligible since it applies only to the �all other perils� portion of an insurance policy, former Deputy Insurance Commissioner Lisa Miller added �An ISO considers a building that is partially sprinklered the same as a building without sprinklers, from a rating perspective.� As a result, ISO will recommend that partially retrofitted Associations receive no discount and fully sprinklered buildings see a small break on their minor multi-peril costs. Additionally, since heeding the advice of ISO is voluntary, subject to the proprietary policies of individual insurance companies, carriers perceiving a captive clientele will be predisposed to blowing off any reduction.

Having failed to provide the cost offsets sought by the Governor, the Division segued to three conclusions and recommendations that supposedly facilitate compliance, starting with an alternative explanation for the perfunctory posture of associations confronted by the retrofit deadline. In the report�s Executive Summary, the DBPR frames how association budgeting practices affect any decision to retrofit by explaining, �Inherently focused on the challenges of the present, a mandate five (5) years from now for many associations likely appears to be in the distant future. Further, considering that in five years, with two year staggered terms, an association�s board could be entirely different than the membership elected this winter. Addressing a mandate not realized until five (5) years from now is likely a lesser priority than the challenges of today�most notably collecting regular assessments and addressing a significant wave of foreclosures.� The Division ultimately defines the stumbling block, �Under the circumstances, the prospect of adding any additional costs for most associations would be difficult to propose, and perhaps result in a recall of the association�s board.� Having failed to provide the cost offsets sought by the Governor, the Division segued to three conclusions and recommendations that supposedly facilitate compliance, starting with an alternative explanation for the perfunctory posture of associations confronted by the retrofit deadline. In the report�s Executive Summary, the DBPR frames how association budgeting practices affect any decision to retrofit by explaining, �Inherently focused on the challenges of the present, a mandate five (5) years from now for many associations likely appears to be in the distant future. Further, considering that in five years, with two year staggered terms, an association�s board could be entirely different than the membership elected this winter. Addressing a mandate not realized until five (5) years from now is likely a lesser priority than the challenges of today�most notably collecting regular assessments and addressing a significant wave of foreclosures.� The Division ultimately defines the stumbling block, �Under the circumstances, the prospect of adding any additional costs for most associations would be difficult to propose, and perhaps result in a recall of the association�s board.�

To cure this obstacle, the Division enigmatically recommends, �Over the next five (5) years the Division via inserts in the billing statements, educational presentations, and electronic communication, will significantly increase awareness of the impending sprinkler retrofit mandate.� Having admitted that despite awareness of the mandate, association boards are unavoidably preoccupied with financial survival, how does sending an insert in the annual billing statement and email reminders that the deadline is approaching resolve an association�s fiscal constraints? Perhaps when a board announces that the building�s water is being shut off to save up for a sprinkler head in every unit foyer, they can simultaneously distribute copies of those inserts and emails to their members. Strike one. To cure this obstacle, the Division enigmatically recommends, �Over the next five (5) years the Division via inserts in the billing statements, educational presentations, and electronic communication, will significantly increase awareness of the impending sprinkler retrofit mandate.� Having admitted that despite awareness of the mandate, association boards are unavoidably preoccupied with financial survival, how does sending an insert in the annual billing statement and email reminders that the deadline is approaching resolve an association�s fiscal constraints? Perhaps when a board announces that the building�s water is being shut off to save up for a sprinkler head in every unit foyer, they can simultaneously distribute copies of those inserts and emails to their members. Strike one.

Secondly, the Division concludes �that installation costs vary depending on multiple factors including the initial condition of the association�s standpipe, the type of installation performed (common areas only or common areas and units), and any aesthetic considerations the association may want to incorporate into the existing d�cor.� Secondly, the Division concludes �that installation costs vary depending on multiple factors including the initial condition of the association�s standpipe, the type of installation performed (common areas only or common areas and units), and any aesthetic considerations the association may want to incorporate into the existing d�cor.�

Admonishing that �Multiple variables impact the costs of installing a fire sprinkler system and understanding that the statute provides an alternative to a fire sprinkler system in the form of an �other engineered lifesafety system�,� the Division recommends that �best management practices for condominium associations retrofitting with a fire sprinkler system should be established as associations consider their options.� Basically, if you can�t cough up the money to bury the pipes, acclimate to the prospect of living in a tenement. Strike two. Admonishing that �Multiple variables impact the costs of installing a fire sprinkler system and understanding that the statute provides an alternative to a fire sprinkler system in the form of an �other engineered lifesafety system�,� the Division recommends that �best management practices for condominium associations retrofitting with a fire sprinkler system should be established as associations consider their options.� Basically, if you can�t cough up the money to bury the pipes, acclimate to the prospect of living in a tenement. Strike two.

While the first two recommendations rise to the level of tepid drivel, the third effort offers the illusion of merit. Spotlighting the insurance industry�s refusal to confer any rate benefit for installing the less expensive partial sprinkler system, the DBPR suggests that �The Legislature may wish to address the uncertainty of a premium discount when associations opt to install sprinklers in the common areas only.� Every scrap of testimony supports that premium discounts for partial installations are hardly �uncertain�, they are nonexistent. While the first two recommendations rise to the level of tepid drivel, the third effort offers the illusion of merit. Spotlighting the insurance industry�s refusal to confer any rate benefit for installing the less expensive partial sprinkler system, the DBPR suggests that �The Legislature may wish to address the uncertainty of a premium discount when associations opt to install sprinklers in the common areas only.� Every scrap of testimony supports that premium discounts for partial installations are hardly �uncertain�, they are nonexistent.

The DBPR acknowledges that �if a fire sprinkler system has been installed in accordance with nationally accepted fire sprinkler design standards adopted by the Office of Insurance Regulation and if the fire sprinkler system is maintained within nationally accepted standards, Chapter 627.0654, Florida Statutes, mandates a premium discount.� Since the �Minimum Alternative Life Safety System� provided for in Chapter 718.112(2)(l) of the Florida Statutes doesn�t rise to the standard described in Chapter 627.0654, the DBPR suggests �the Legislature may want to harmonize the two chapters,� hopefully providing a modicum of relief for associations installing fire sprinklers only in the common areas. The DBPR acknowledges that �if a fire sprinkler system has been installed in accordance with nationally accepted fire sprinkler design standards adopted by the Office of Insurance Regulation and if the fire sprinkler system is maintained within nationally accepted standards, Chapter 627.0654, Florida Statutes, mandates a premium discount.� Since the �Minimum Alternative Life Safety System� provided for in Chapter 718.112(2)(l) of the Florida Statutes doesn�t rise to the standard described in Chapter 627.0654, the DBPR suggests �the Legislature may want to harmonize the two chapters,� hopefully providing a modicum of relief for associations installing fire sprinklers only in the common areas.

Two adamantine obstacles burden the DBPR�s proposition. Unless the rate reduction targeted by their recommendation can be applied to the overall insurance premium and not just the anorectic multi-peril portion of the association�s policy, it will never serve as anything more than a shallow public relations gesture. Secondly, since the State is still desperately trying to lure admitted carriers back to Florida�s largely abandoned property & casualty market (despite a 28% rate increase, State Farm is dropping 800,000 property policies and hitting the road), prospects for such costly legislation surviving industry opposition are reasonably comparable to those of a snowball in hell. Two adamantine obstacles burden the DBPR�s proposition. Unless the rate reduction targeted by their recommendation can be applied to the overall insurance premium and not just the anorectic multi-peril portion of the association�s policy, it will never serve as anything more than a shallow public relations gesture. Secondly, since the State is still desperately trying to lure admitted carriers back to Florida�s largely abandoned property & casualty market (despite a 28% rate increase, State Farm is dropping 800,000 property policies and hitting the road), prospects for such costly legislation surviving industry opposition are reasonably comparable to those of a snowball in hell.

| SEN GELLER, REP SEILER, GOV CHARLIE CRIST, SPEAKER

RUBIO AND SEN JEFF ATWATER PASS INSURANCE BILL |

On January 16, 2007, Governor Charlie Crist�s new Administration prompted Senate President Ken Pruitt and Statehouse Speaker Marco Rubio to convene a special legislative session on property insurance. Despite the Governor�s pre-Election Day campaign promises of premium relief for homeowners and significant progress toward re-establishing a competitive insurance environment, the lawmakers were unilaterally stonewalled by the well-organized insurance industry. If not for Jeff Atwater�s eleventh hour reshuffling of Citizens� policy mission from safety net to full-service carrier and the temporary postponement of two scheduled statewide Citizens assessments, the Governor would have come away empty handed. In exchange for these face-saving concessions, the State had to loosen the CAT fund�s purse strings, adding $12 billion to the existing $16 billion in below market reinsurance for carriers (wholly underwritten by taxpayers) with the caveat that the savings be passed to ratepayers. The session produced an 8% premium discount on the heels of a 300% increase.

| GOVERNOR CRIST AND COMMISSIONER

MCCARTY ANNOUNCE ALLSTATE SUBPOENAS |

At Senatorial insurance hearings a few months later, when executives in Allstate�s Florida �dummy� corporations (Allstate Floridian Insurance Co., Allstate Floridian Indemnity Co., etc.) were subpoenaed to explain the evidentiary documentation for a requested 41.9% rate increase, they openly admitted to drawing on relationships with insurance trade associations, insurance rating organizations, affiliated reinsurers and risk modeling companies to �reverse engineer� support for hiking rates. Since more than 33% of Florida�s rated carriers had requested similarly outrageous increases despite experiencing lower costs, the hearings had dramatically outed bald-faced non-compliance with the year-old Statute. After receiving a slap on the wrist, some carriers accepted more modest rate increases although most skipped town, abandoning the Florida property insurance market. It is highly unlikely that this same insurance lobby will suddenly succumb to legislative pressure and pass out discounts. You do the math. Strike three.

In summary, two of the three recommendations restate and then ignore the problem. Having established that associations can ill afford to pass $billions to the fire sprinkler industry, DBPR will pointlessly send out emails to remind association boards that the deadline is 2014 and more emails to remind them that they can choose between a full or partial retrofit. The third recommendation is an unfunded excursion to Fantasy Island. Notwithstanding, the report provides ample political distraction for the Governor to spin this as a serious treatment of the issues at campaign events. In summary, two of the three recommendations restate and then ignore the problem. Having established that associations can ill afford to pass $billions to the fire sprinkler industry, DBPR will pointlessly send out emails to remind association boards that the deadline is 2014 and more emails to remind them that they can choose between a full or partial retrofit. The third recommendation is an unfunded excursion to Fantasy Island. Notwithstanding, the report provides ample political distraction for the Governor to spin this as a serious treatment of the issues at campaign events.

If a special legislative session is convened to ratify a controversial tribal gaming agreement, an SB 714 veto reversal is possible. Don�t hold your breath. It appears that we will have to endure another legislative gauntlet before realizing relief from this big time payday for plumbing contractors and sprinkler distributers. At least the next Governor will not be able to rationalize another veto by claiming the absence of a condo cost impact study. Welcome to Florida! If a special legislative session is convened to ratify a controversial tribal gaming agreement, an SB 714 veto reversal is possible. Don�t hold your breath. It appears that we will have to endure another legislative gauntlet before realizing relief from this big time payday for plumbing contractors and sprinkler distributers. At least the next Governor will not be able to rationalize another veto by claiming the absence of a condo cost impact study. Welcome to Florida!

Related Links

If you would like to let Governor Crist know that his veto of SB 714 was ill advised, click the following email link: [email protected]. If you would like to let Governor Crist know that his veto of SB 714 was ill advised, click the following email link: [email protected].

Click To Top of Page

Rep. Bogdanoff�s Autumn Newsletter

Representative Ellyn Bogdanoff, District 91

| REPRESENTATIVE

ELLYN BOGDANOFF |

September 18, 2009 -  In late 2003, fate handed former District 91 Statehouse Representative Connie Mack IV an opportunity to expedite his planned pursuit of political stardom. When President George W. Bush appointed District 14 Congressman Porter Goss to head the Central Intelligence Agency, Mack closed up shop in Fort Lauderdale and elbowed his way to the empty Congressional seat in Fort Myers, where Mack grew up. Despite being outgunned in name recognition and political support by most of the 6 other candidates for Mack�s vacated House seat, Ellyn Bogdanoff eked out a 12-vote margin of victory, slipping by 8-year Lauderdale-by-the-Sea Mayor Oliver Parker in the January 6, 2004 Special Election. Within two years, the neophyte rookie blossomed into a Statehouse anchor, squaring out a formidable reputation for unrelenting tenacity, fiscal diligence, natural networking skills and a disarming facility for achieving consensus. Few of her Tallahassee peers were surprised when Statehouse Speaker Marco Rubio named Ellyn as his Majority Whip, wherein she shepherded through the Statehouse every major component of Governor Crist's property insurance and tax program. She also singlehandedly revamped and rescued the State�s broken No-Fault insurance legislation just days before its intended dissolution would have burdened every vehicle owner with an additional insurance expense. In late 2003, fate handed former District 91 Statehouse Representative Connie Mack IV an opportunity to expedite his planned pursuit of political stardom. When President George W. Bush appointed District 14 Congressman Porter Goss to head the Central Intelligence Agency, Mack closed up shop in Fort Lauderdale and elbowed his way to the empty Congressional seat in Fort Myers, where Mack grew up. Despite being outgunned in name recognition and political support by most of the 6 other candidates for Mack�s vacated House seat, Ellyn Bogdanoff eked out a 12-vote margin of victory, slipping by 8-year Lauderdale-by-the-Sea Mayor Oliver Parker in the January 6, 2004 Special Election. Within two years, the neophyte rookie blossomed into a Statehouse anchor, squaring out a formidable reputation for unrelenting tenacity, fiscal diligence, natural networking skills and a disarming facility for achieving consensus. Few of her Tallahassee peers were surprised when Statehouse Speaker Marco Rubio named Ellyn as his Majority Whip, wherein she shepherded through the Statehouse every major component of Governor Crist's property insurance and tax program. She also singlehandedly revamped and rescued the State�s broken No-Fault insurance legislation just days before its intended dissolution would have burdened every vehicle owner with an additional insurance expense.

| | HOUSE SPEAKER LARRY CRETUL |

When lawmakers confronted last session�s intimidating $6 billion budgetary shortfall, the Statehouse leadership again summoned Representative Bogdanoff, installing her as Chair of the Finance and Tax Council and Vice Chair of the Rules & Calendar Council - the legislative gatekeeper. In August, House Speaker Larry Cretul asked Florida Tax Watch and concerned legislators to research as yet unexplored cost-cutting measures in preparation for another recessionary budget. Cretul exclaimed �We need to identify efficiencies, where they can be found, maybe some systemic and process changes. I know it�s a high-altitude description, but that�s on our radar screen. I�m going to ask Representative Bogdanoff to be very involved.� When Senate President Jeffrey Atwater threw his hat into the ring for CFO Alex Sink�s job, Ellyn concomitantly targeted Jeff�s District 25 Senate seat. Given the significant political capital she�s amassed in her brief but meteoric legislative career, other prospective candidates will be hard pressed to convince voters that they are better positioned to represent district interests than Bogdanoff.