SEPTEMBER 15, 2020 UPDATE – LEARN MORE ABOUT YOUR NEW STORMWATER RATES

The TRIM notices recently sent out show, for condos, two charges for stormwater: acreage and trip charges. The trip charge is $18.65 for each condo unit. The acreage charge depends on the percentage of square feet in the unit.

Look Up Stormwater Information for your condo: Visit bit.ly/stormh2o and enter a property address into the GIS database to view the proposed stormwater assessment. For condos, enter street address (no city) and unit number like this: 3900 galt ocean dr #2115

Fort Lauderdale has enacted a new procedure for who pays for stormwater as well as new rates. The good news is that condominium and cooperative associations will no longer have a monthly charge for stormwater management fees. The bad news is individual unit owners will see this charge on their annual tax bill – which is due in November 2020.

The City Commission approved the new billing methodology at two regular commission meetings on June 2 and June 16, 2020 and will vote on the 2021 rates on September 14. The rates quoted in this article are the ones proposed by the consultant.

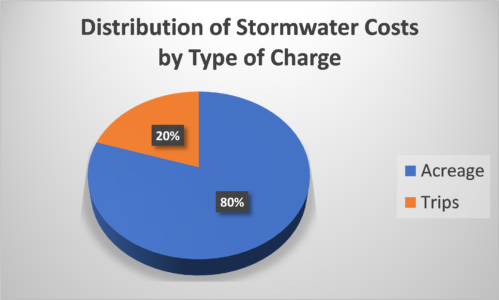

The new Stormwater Utility fee methodology for associations incorporates both acreage (total land square footage) and trip generation rates. An individual unit owner’s stormwater yearly bill will be determined using these two components.

- Acreage: association’s land acreage, and,

- Trip Charge: estimated number of trips generated per day for each unit (based on a trip methodology developed by the Institute of Transportation Engineers). These trips are then assigned a cost per trip.

Togeth er, these two components constitute the yearly stormwater charge for individual unit owners that will appear on their annual tax bill. The plan is the two components share the costs at an 80:20 ratio. This is true for all property types.

er, these two components constitute the yearly stormwater charge for individual unit owners that will appear on their annual tax bill. The plan is the two components share the costs at an 80:20 ratio. This is true for all property types.

BACKGROUND

Currently, Fort Lauderdale residents pay a monthly stormwater fee through their utility bills. Every utility bill has a line that identifies stormwater fees and is assessed as follows:

- Single Family Home (3 or less units): $14/month ($168 yearly)

- Multifamily Dwelling (4 units or more): $141.12 per acre/month ($1,693.44/acre yearly)

- Unimproved Land: $44.73 per acre/month ($536.76/acre yearly)

These fees generate revenues used by the city to protect against water runoff that can accumulate in streets, on property, underpasses, and overflow seawalls. The city Public Works Department oversees the stormwater operations and repairs/replacements to the systems used to drain the stormwater. Operations, maintenance, repair and replacement capital projects cost approximately $15.5 million per year and are funded through the stormwater fees charged to utility customers.

The city is experiencing serious stormwater issues in most areas of Fort Lauderdale. The city commission has identified seven areas of greatest need. In order to provide the capital for these seven projects, the city needs to raise $200 million in FY 2021. The city commission approved a study of the stormwater fees by Stantec (the same firm that did the Water and Sewer Rate Study). Stantec reported back its findings to the city commission in a May 25, 2020 final report.

The goal is to ensure the Stormwater Utility has the resources needed to invest in and maintain the stormwater system that protects the City. The seven identified priority areas are: Edgewood • River Oak • Dorsey Riverbend • Durrs Area • Progresso • Victoria Park • Southeast Isles. According to the City Commission, the challenge was to the find a fair system to finance the needed $200 million stormwater capital improvements, without shifting the burden to one group over another group within the city.

STORMWATER SYSTEM

The Stormwater Operations program was developed to provide a dedicated operational focus to maintaining and improving the City of Fort Lauderdale’s stormwater infrastructure. The adoption of these fees and new fee structure are necessary to allow a special assessment to be imposed by the City to fund the capital costs to construct, reconstruct, repair, improve, and extend Stormwater Management Systems within the City of Fort Lauderdale. Stormwater is a multi-jurisdictional operation, but the City operates, repairs, and maintains much of the stormwater infrastructure within City limits, including:

- 183.5 miles of stormwater pipe

- 1,151 manholes

- 1,038 outfalls

- 6 drainage wells

- 8,848 catch basins

BILLING CHANGES

Currently, the stormwater charge is part of the utility bill received monthly by the association. It is the bill for water, wastewater, irrigation, sanitation (not applicable to associations) and stormwater. The cost is paid by the individual or organization named on the utility account. In the case of an association, the bill comes to the association and is paid by the association since they do not have individual meters for each unit.

That will change on October 1, 2020. The new stormwater charges will appear on the individual’s annual tax bill as a non-ad valorem assessment. The annual Fire-Rescue fee is an example of a non-ad valorem assessment.

NEW STORMWATER RATES

The City Commission will vote on the new stormwater rates on September 14, 2020 at a special meeting. The proposed rates for single family homes will be a fixed, yearly charge of $258.26.

For condominium and cooperative individual owners, the charge will consist of two components: Acreage and Trip Charge.

A unit owner’s yearly stormwater assessment will be calculated as follow, using the above two components.

- ACREAGE: Individual’s unit living area DIVIDED by total of all units’ living area (excluding common areas) to arrive at a percentage of ownership. This percentage will then be multiplied TIMES parcel charge ($2,273.01/acre).

- TRIP CHARGE: 4.45 average annual daily trips generated from each condo unit X $4.19 per trip = $18.65 yearly (Trip rate is the average daily trips during a weekday from Institute of Transportation Engineers (ITE), Trip Generation, 10th ed, 2017.)

Example: If the unit owner’s living area is 1,000 sq ft and the total living area of all units in the building is 100,000 sq ft – then 1,000 divided by 100,000 = 1% (unit owner’s share). If the association’s land acreage is 2 acres – then multiply 2 times $2,273.01/acre = $4,546.02 (total acreage charge). This amount is then multiplied by the individual owner’s share of 1% (.01 x $4,546.02) = $45.46. Combining the two: $45.46 (acreage) + $18.65 (trip charge) = $64.11 – annual fee for stormwater on an individual’s tax bill for 2021.

These two added together will be an individual unit owner’s yearly stormwater bill. Each year, the city commission will set the acreage and trip charge – and will have to recalculate each association unit owner’s assessment.

There are similar fee structures for churches, businesses, commercial establishments, and others. Currently, the renters or lessees of property pay the stormwater charge as part of the water and sewer utility bill (not in an association). This new ordinance will shift that cost to the property owner’s tax bill.

The city’s website will have a GIS mapping system that shows each property in Fort Lauderdale and that property owner’s stormwater assessment. This is expected to be available by August.

CONCLUSIONS

A one-page summary of this article is attached – and can be downloaded for distribution to owners to educate them on the new stormwater assessment they will see on this year’s tax bill and all future tax bills.

The Galt Mile Community Association (GMCA) met with and provided city commissioners, the mayor and staff background materials on this issue, making strong arguments that association individual owners should not bear an unfair share of the costs of the $200 million capital improvement projects and yearly maintenance. While single family owners’ fees are increasing 54% – association fees (total of all individuals in the building) are increasing a greater percentage.

GMCA also made the argument that while having roadways free of water and always being passable would benefit property owners, it was pointed out that many others would greatly benefit, but not pay any of the costs. These include vendors and contractors living outside of Fort Lauderdale, commuters, visitors, and delivery companies (FedEx, UPS, Amazon).

Unfortunately, the city has no way to tax or assess these users of our roadways for stormwater maintenance and improvements if they don’t own property in the city. GMCA will continue to monitor this assessment to ensure associations are treated fairly and not over burdened by disproportionate costs.