|

| BOGDANOFF EXPLAINS HB 561 |

June 26, 2010 - On June 7th, an unusual GMCA Presidents Council meeting was convened at L�Hermitage I. Instead of plowing through the planned agenda, this final assemblage before the summer break was largely a tribute to Representative Ellyn Bogdanoff and the successful legislative session. In addition to the recent passage of Bogdanoff�s Sprinkler Retrofit Relief Bill (SB 1196); several bills that would have either driven up unit owner costs or savaged their rights were vetoed by Governor Crist. Joining Bogdanoff were Broward Mayor Ken Keechl and Donna Berger, a managing Partner at Katzman Garfinkel Berger � with historical ties to the Galt Mile Community Association. An activist Association attorney, Berger is the Executive Director of the Community Advocacy Network (CAN), an organization conceived to further the interests of Community Associations. In addition to drafting elements of Bogdanoff�s bill, Berger testified on its behalf before legislative vetting committees.

|

| MEETING AT L�HERMITAGE I |

Following a deferential introduction, Ellyn sought to give the session�s events some historical perspective. She turned back the clock to early 2009, when she filed House Bill 419. HB 419 was the Statehouse version of the ill-fated Senate Bill 714, the Association Glitch bill vetoed by Governor Crist. Calling corrective legislation a �Glitch Bill� implies that some faulty regulation was simply a product of human error. More often than not, lobbyists and lawmakers colluded to suck the blood from an association�s neck.

|

| GOVERNOR CRIST ANNOUNCES SB 714 VETO |

Loaded with a broad spectrum of corrective provisions, the bill sought to undo expensive, pointless and/or damaging regulations (glitches) initially drafted by lobbyists hoping to graze on the fertile condo market. More importantly, it postponed from 2014 to 2025 the deadline for retrofitting high rise association structures with an extremely expensive fire sprinkler system. Ironically, her failed bill was the precursor to this year�s Omnibus Association Bill - Senate Bill 1196.

|

| DONNA BERGER |

Following the frustrating final chapter of last year�s session, flustered supporters of SB 714 lamented their inability to react incisively to the lobbying pressure that �flipped� the Governor into opposing a badly needed bill that was overwhelmingly approved by the legislature. To avoid a repetition of that demotivating experience, associations organized a network that enabled proponents to effectively communicate during the legislative session. At its heart was Donna Berger�s Community Advocacy Network (CAN), which facilitated statewide caucusing among association allies, enabling them to develop and implement timely responses to rapidly changing events. While funneling bill updates to proponents, Berger interpreted their legal impact.

A political achievement in Tallahassee is measured by the strength of its opposition. When asked about the obstacles she successfully circumvented during the session, Bogdanoff downplayed any inference of controversy, mentioning only the flack she took from Fire Marshals employed by the Sprinkler Associations. The audience didn�t buy it. Last year, the Glitch bill�s supporters were kept abreast of its progress by reading questionably accurate media reports or from intermittent Advisory Board briefings. This year was different.

A political achievement in Tallahassee is measured by the strength of its opposition. When asked about the obstacles she successfully circumvented during the session, Bogdanoff downplayed any inference of controversy, mentioning only the flack she took from Fire Marshals employed by the Sprinkler Associations. The audience didn�t buy it. Last year, the Glitch bill�s supporters were kept abreast of its progress by reading questionably accurate media reports or from intermittent Advisory Board briefings. This year was different.

Due primarily to Berger�s efforts, a majority of the audience was already familiar with the battles fought by their Statehouse Representative en route to passing of this year�s Omnibus Association bill. Since Representative Bogdanoff is running for the District 25 Senate seat vacated by Florida CFO Candidate Jeffrey Atwater, she sought to avoid what her opponent might paint as gloating. When she hesitated to �sensationalize� her efforts, Donna Berger, Mayor Keechl, and GMCA officials filled in the blanks.

Due primarily to Berger�s efforts, a majority of the audience was already familiar with the battles fought by their Statehouse Representative en route to passing of this year�s Omnibus Association bill. Since Representative Bogdanoff is running for the District 25 Senate seat vacated by Florida CFO Candidate Jeffrey Atwater, she sought to avoid what her opponent might paint as gloating. When she hesitated to �sensationalize� her efforts, Donna Berger, Mayor Keechl, and GMCA officials filled in the blanks.

Having tracked and documented the 2010 session�s twists and turns, GMCA V.P. Eric Berkowitz declared that Bogdanoff had to overcome the State�s most powerful special interests to succeed, not just a few Fire Marshals. He said �When she doubled the existing statutory cap for foreclosing lenders and released millions of association members from a forced purchase of HO-6 unit owner insurance by their associations, she upended the Banking lobby and the insurance industry, arguably the two most powerful special interests in Tallahassee.� He continued, �Until SB 1196 was passed, every bill proposing foreclosure relief was summarily stomped into oblivion by the Bankers Association.�

Having tracked and documented the 2010 session�s twists and turns, GMCA V.P. Eric Berkowitz declared that Bogdanoff had to overcome the State�s most powerful special interests to succeed, not just a few Fire Marshals. He said �When she doubled the existing statutory cap for foreclosing lenders and released millions of association members from a forced purchase of HO-6 unit owner insurance by their associations, she upended the Banking lobby and the insurance industry, arguably the two most powerful special interests in Tallahassee.� He continued, �Until SB 1196 was passed, every bill proposing foreclosure relief was summarily stomped into oblivion by the Bankers Association.�

|

| V.P. ERIC BERKOWITZ |

Donna Berger added, �Ellyn�s bill reversed the mandate requiring every association member to name their association as a beneficiary on their individual unit owner condo policy. It also removed the right of associations to force place coverage if the unit owner doesn�t produce an evidentiary certificate of insurance. By returning these decisions to unit owners, Ellyn�s bill truncated an income stream for the insurance industry.� Berger warned that the bill doesn�t alter unit owners� liability for their own properties. �Make no mistake, unit owners are still responsible for damage to any element ordinarily covered in an HO-6 policy. In fact, SB 1196 provides in greater detail what these policies must include, shedding light on longstanding coverage gray areas.�

Berger angrily lashed out at a small group of bloggers she called �naysayers�, who complained that doubling a foreclosing lender�s liability from 6 to 12 months of association dues was a meaningless gesture. �These people that attacked Ellyn�s bill are unaware of the political climate in Tallahassee. Had she attempted to also increase the 1% cap, it wouldn�t have had the votes in the legislature - period.� Alluding to the annual lending industry policy of blocking any form of foreclosure relief, Berger was perplexed by blog entries that seemed to expound �If you can�t eat steak, why eat?�

Berger angrily lashed out at a small group of bloggers she called �naysayers�, who complained that doubling a foreclosing lender�s liability from 6 to 12 months of association dues was a meaningless gesture. �These people that attacked Ellyn�s bill are unaware of the political climate in Tallahassee. Had she attempted to also increase the 1% cap, it wouldn�t have had the votes in the legislature - period.� Alluding to the annual lending industry policy of blocking any form of foreclosure relief, Berger was perplexed by blog entries that seemed to expound �If you can�t eat steak, why eat?�

The anonymous �naysayers� also contended that, under certain circumstances, the bill may only add one or two extra months to the lender�s liability. Berger asked �Have we become so jaded that we can afford to turn down one or two extra payments? This year, we broke a longstanding barrier. Hopefully, we can add to this with additional improvements next year. However, anyone implying that getting nothing is better than getting a little is living in a dream world. Many associations are hanging on by their fingernails. Receiving several additional payments from otherwise non-producing units could spell the difference between survival and receivership for these associations� unit owners."

The anonymous �naysayers� also contended that, under certain circumstances, the bill may only add one or two extra months to the lender�s liability. Berger asked �Have we become so jaded that we can afford to turn down one or two extra payments? This year, we broke a longstanding barrier. Hopefully, we can add to this with additional improvements next year. However, anyone implying that getting nothing is better than getting a little is living in a dream world. Many associations are hanging on by their fingernails. Receiving several additional payments from otherwise non-producing units could spell the difference between survival and receivership for these associations� unit owners."

Seeking to address a misconception about the legislation, Bogdanoff said �Most media depictions of the bill focus on the fiscal relief it provides to hard-pressed unit owners and struggling associations trying to outlast the recession. As a result, many people misunderstand its rationale.� She explained that the bill doesn�t recommend that associations opt-out of installing sprinklers or purchase alternative insurance products. Bogdanoff clarified �The legislation simply returns critical association decisions to the association�s homeowners. It is based on the premise that an association�s unit owners are better equipped to make decisions about their life safety and insurance needs than lobbyists or lawmakers in Tallahassee.�

Seeking to address a misconception about the legislation, Bogdanoff said �Most media depictions of the bill focus on the fiscal relief it provides to hard-pressed unit owners and struggling associations trying to outlast the recession. As a result, many people misunderstand its rationale.� She explained that the bill doesn�t recommend that associations opt-out of installing sprinklers or purchase alternative insurance products. Bogdanoff clarified �The legislation simply returns critical association decisions to the association�s homeowners. It is based on the premise that an association�s unit owners are better equipped to make decisions about their life safety and insurance needs than lobbyists or lawmakers in Tallahassee.�

|

| BROWARD MAYOR KEN KEECHL |

Broward Mayor Ken Keechl agreed that the bill was about self-governance. �When I visited Tallahassee, I met with Ellyn to ask her assistance with enacting a legislative basis for our new ethics code.� The Mayor pointed out that since he is a Democrat, her help navigating the predominantly Republican Capital was invaluable. �When it involves her constituents, Ellyn is non-partisan. I feel the same way. When addressing District issues, the last thing I care about is a constituent�s political affiliation.� Every year, Broward�s Mayor visits Tallahassee and Washington D.C. to press the County�s State and Federal legislative agenda and explore potential funding opportunities. �Ellyn also took the time to explain the terms of her bill. It allows homeowners to decide whether or not they need a sprinkler system. In fact, the Broward Commission passed a resolution supporting her legislation.�

|

BEACH CHIEF

STEVE HIGGINS |

A L�Hermitage I resident surprised the Mayor when she abruptly asked, �Where is our sand?� The nearly 70 association representatives in the room snapped to attention. Mayor Keechl thanked her for asking about the long delayed Beach Renourishment Project. Keechl explained �Our Beach Administrator is actively pursuing the new Segment II permitting requirements and the actual renourishment of Fort Lauderdale�s Beaches is scheduled for late 2011."

|

FDEP SECRETARY

MICHAEL W. SOLE |

Unfortunately, the project hit a snag last year when communications between the Broward Biological Resources Division and the Florida Department of Environmental Protection broke down. While the two agencies were locked in an enigmatic bureaucratic limbo, the Federal permit authorizing the project expired. Before the renourishment could proceed, the tests required to support a new permit had to be repeated. Since Florida DEP Chief Mike Sole came to Tallahassee by way of Broward County, he is intimately familiar with the project�s scientific and engineering parameters. He agreed to personally oversee future interagency communications. To insure that its Broward counterpart moves expeditiously, Mayor Keechl also agreed to monitor their efforts.

Keechl continued, �Broward�s Beach Renourishment is wholly dependent on the State and Federal resources allocated to fund the project. When I traveled to Tallahassee, I checked on that funding. I did the same during my trip to Washington. While the money is theoretically dedicated to the project, it is continuously under siege by lawmakers with other agendas. I am pleased to report that the renourishment funds in Tallahassee and Washington D.C. remain intact.�

Keechl continued, �Broward�s Beach Renourishment is wholly dependent on the State and Federal resources allocated to fund the project. When I traveled to Tallahassee, I checked on that funding. I did the same during my trip to Washington. While the money is theoretically dedicated to the project, it is continuously under siege by lawmakers with other agendas. I am pleased to report that the renourishment funds in Tallahassee and Washington D.C. remain intact.�

Digressing, the Mayor asked, �I wonder if many of you know just how unique this neighborhood is.� He said that the devastating B.P. oil spill reminds him of the Calypso Project. �Every time I hear anything about the terrible damage caused by the spreading oil, I am so grateful that we won our fight with Suez to thwart installation of the Liquefied Natural Gas plant just off our beach. I keep remembering the Suez spokespersons promising that disasters were �absolutely impossible� and that we were �paranoid�. We won because they made a terrible mistake. They chose a site next to the most organized, determined and politically active community in the entire State.� Turning to Ellyn Bogdanoff, the Mayor added, �Ellyn and I have often discussed how nobody messes with the Galt Mile neighborhood.�

Digressing, the Mayor asked, �I wonder if many of you know just how unique this neighborhood is.� He said that the devastating B.P. oil spill reminds him of the Calypso Project. �Every time I hear anything about the terrible damage caused by the spreading oil, I am so grateful that we won our fight with Suez to thwart installation of the Liquefied Natural Gas plant just off our beach. I keep remembering the Suez spokespersons promising that disasters were �absolutely impossible� and that we were �paranoid�. We won because they made a terrible mistake. They chose a site next to the most organized, determined and politically active community in the entire State.� Turning to Ellyn Bogdanoff, the Mayor added, �Ellyn and I have often discussed how nobody messes with the Galt Mile neighborhood.�

Turning to the upcoming County budget, Keechl confirmed that Broward will see some painful cuts. Paying for threatened services with funds diverted from planned Capital Improvement Projects is not an option, since enhancing the Airport and Port Everglades are necessary to maintain Broward�s competitive edge - an unconditional requirement for pulling the County out of this recession. He explained that the new scaled-down Courthouse will be built primarily with funds made available by retiring $36.4 million in debt originally incurred to build parks and libraries - not with tax dollars. Keechl reminded the members that, over the past 3 years, the County Commission cut the annual recurring tax burden by $385 million.

Turning to the upcoming County budget, Keechl confirmed that Broward will see some painful cuts. Paying for threatened services with funds diverted from planned Capital Improvement Projects is not an option, since enhancing the Airport and Port Everglades are necessary to maintain Broward�s competitive edge - an unconditional requirement for pulling the County out of this recession. He explained that the new scaled-down Courthouse will be built primarily with funds made available by retiring $36.4 million in debt originally incurred to build parks and libraries - not with tax dollars. Keechl reminded the members that, over the past 3 years, the County Commission cut the annual recurring tax burden by $385 million.

|

| GALT OCEAN MILE READING CENTER |

Having played an integral part in saving the Galt Mile Reading Center from last year�s budget axe, Keechl warned the attending representatives that parks and libraries are generic candidates for the annual budget block. Since about 88,000 items were checked out during the roughly 125,000 resident visits in 2009, the Galt Ocean Mile Reading Center is arguably the most popular local resource on Galt Ocean Drive. The modest Reading Center is also the only County amenity received by Galt Mile taxpayers in exchange for their huge annual revenue contribution. Mayor Keechl invited the attendees to a July 1st meeting at the Reading Center that he planned to attend. Characterizing the event as first in a series of survival strategy planning sessions organized by Friends of the Galt Mile Library President Herman Gardner, the Mayor added �Anyone concerned with keeping the Galt Library�s doors open is welcome to participate.�

As a parting shot, Berger described a serendipitous post-session premium. While flooding the Capitol with correspondences supportive of SB 1196, thousands of unit owners added their concerns about other bills that would have adversely impacted their homes, ultimately contributing to the Governor�s decision to veto an insurance bill guaranteed to hike rates (SB 2044) and a Design Professionals Bill that would have insulated Engineers and Architects from legal redress for blatant malpractice, breach of contract or failure to perform (SB 1964). Had either of these pork byproducts slipped by the Governor, they would have provided the ingredients for another Glitch Bill.

As a parting shot, Berger described a serendipitous post-session premium. While flooding the Capitol with correspondences supportive of SB 1196, thousands of unit owners added their concerns about other bills that would have adversely impacted their homes, ultimately contributing to the Governor�s decision to veto an insurance bill guaranteed to hike rates (SB 2044) and a Design Professionals Bill that would have insulated Engineers and Architects from legal redress for blatant malpractice, breach of contract or failure to perform (SB 1964). Had either of these pork byproducts slipped by the Governor, they would have provided the ingredients for another Glitch Bill.

|

DIRECTOR BARBARA ZEE

ALLIANCE OF DELRAY |

Prior to adjourning the meeting, GMCA President Pio Ieraci introduced Alliance of Delray Board member Barbara Zee, who serves with Ieraci on the CAN Advisory Council. Representing 72 Delray associations with 70,000 residents, she was last here in 2008 when Congressman Ron Klein was collecting data for a national catastrophe insurance bill. Ms. Zee was instrumental in soliciting her Delray neighbors� support for Bogdanoff�s legislation. In addition to praising Bogdanoff for her unrelenting support of home rule, Barbara credited her for catalyzing statewide participation in this year�s legislative process by tens of thousands of ordinarily passive unit owners (for example, your emails).

After thanking the audience members for the tribute and their support, Representative Bogdanoff verified Mayor Keechl�s observation about the Galt Ocean Mile neighborhood. Bogdanoff exclaimed, �It�s very rewarding to represent a community whose residents set aside their differences to face adversity with a single voice.� While appreciative of her compliment, longtime association representatives in the audience knew that the community�s residents never set aside their differences, they celebrate them. While there are unfortunate exceptions in every association, most Galt Mile residents are well aware that the neighborhood�s strength draws from its diversity - not unlike an extended family.

After thanking the audience members for the tribute and their support, Representative Bogdanoff verified Mayor Keechl�s observation about the Galt Ocean Mile neighborhood. Bogdanoff exclaimed, �It�s very rewarding to represent a community whose residents set aside their differences to face adversity with a single voice.� While appreciative of her compliment, longtime association representatives in the audience knew that the community�s residents never set aside their differences, they celebrate them. While there are unfortunate exceptions in every association, most Galt Mile residents are well aware that the neighborhood�s strength draws from its diversity - not unlike an extended family.

|

| GOVERNOR ENDS SESSION WITH STATE OF THE STATE ADDRESS |

May 29, 2010 - Passage of the long awaited Omnibus Association bill could determine whether many of our friends and neighbors will be forced from their homes. Others may have to choose between filling a prescription and eating dinner. While most condo and co-op owners are numbed silly by Tallahassee�s annual theatrics, when the fate of a relief bill forebodes such far-reaching consequences, it becomes the session�s legislative �headliner� for the target constituency � unit owners.

While apprehensively preoccupied with the progress of Senate Bill 1196, most unit owners have been oblivious to the other association bills passed during the 2010 legislative session. Many contain provisions that are either similar or identical to elements of failed bills. While some of the surviving association bills portend chronic migraines for unit owners, others are tantamount to regulatory dandruff. There are also several disheartening reminders that lawmakers are often fitted with price tags. The following �other� Association bills were enrolled (approved in both houses and signed by the legislative officers) and sent to the Governor.

While apprehensively preoccupied with the progress of Senate Bill 1196, most unit owners have been oblivious to the other association bills passed during the 2010 legislative session. Many contain provisions that are either similar or identical to elements of failed bills. While some of the surviving association bills portend chronic migraines for unit owners, others are tantamount to regulatory dandruff. There are also several disheartening reminders that lawmakers are often fitted with price tags. The following �other� Association bills were enrolled (approved in both houses and signed by the legislative officers) and sent to the Governor.

|

| REP. GARY AUBUCHON |

HB 663: Senate Bill 648 by Bradenton Senator Michael Bennett & House Bill 663 by Cape Coral Representative Gary Aubuchon are comprehensive building safety bills. On April 29th, Bennett�s Senate Bill was folded into Aubuchon�s HB 663, which was enrolled the next day and sent to the Governor on May 17th. Among its many provisions are several sections of particular significance to community associations.

|

| SEN. MICHAEL BENNETT |

Section 2 provides relief similar to that included in SB 1196, amending s. 399.02, F.S., to prohibit enforcement of updates to the Elevator Safety Code (including A17.1 and A17.3) concerning modifications for Phase II Firefighter Services controls on existing elevators in condominiums or multifamily residential buildings until July 1, 2015, or until the elevator is replaced or requires major modification.

What does this Lego-babble mean? Elevator systems are designed with safety features for firefighters to use during an emergency. Phase I emergency recall systems are designed to automatically or manually recall the elevator to the lobby of a high rise building to prevent its general use during a fire. Phase II emergency in-call operation systems are designed to allow a firefighter exclusive operation and control of the elevator during a fire.

What does this Lego-babble mean? Elevator systems are designed with safety features for firefighters to use during an emergency. Phase I emergency recall systems are designed to automatically or manually recall the elevator to the lobby of a high rise building to prevent its general use during a fire. Phase II emergency in-call operation systems are designed to allow a firefighter exclusive operation and control of the elevator during a fire.

Recently, the Division of Administrative Hearings held that the Bureau of Elevator Safety (which enforces the Elevator Safety Act) could require elevator owners to retrofit their elevators to meet revisions of the Building Code that mandate Phase II firefighter service. Although the bureau maintains that no injuries or deaths have been attributed to the lack of these systems, elevator owners have been forced to retrofit their systems to meet the revised code - an extremely expensive undertaking.

Recently, the Division of Administrative Hearings held that the Bureau of Elevator Safety (which enforces the Elevator Safety Act) could require elevator owners to retrofit their elevators to meet revisions of the Building Code that mandate Phase II firefighter service. Although the bureau maintains that no injuries or deaths have been attributed to the lack of these systems, elevator owners have been forced to retrofit their systems to meet the revised code - an extremely expensive undertaking.

This actually gets screwier. Elevators constructed to accommodate Phase I emergency recall systems (like those on the Galt Mile) are already fitted with access keys. However, since copies are often held by the owner, the licensed servicer, state-certified inspectors, the local Fire Department and DBPR officials (the parent agency of the Bureau of Elevator Safety) as currently permitted in s. 399.15(3), F.S., they are technically non-compliant with the Phase II firefighter service requirement that restricts sole possession of a regional master access key (a universal key that allows all elevators within each of the seven state emergency response regions to operate in fire emergencies) to the local fire department. In Section 3, the bill alternatively allows placement of all the elevator keys into a lock box accessible by the master key of the relevant emergency response region.

This actually gets screwier. Elevators constructed to accommodate Phase I emergency recall systems (like those on the Galt Mile) are already fitted with access keys. However, since copies are often held by the owner, the licensed servicer, state-certified inspectors, the local Fire Department and DBPR officials (the parent agency of the Bureau of Elevator Safety) as currently permitted in s. 399.15(3), F.S., they are technically non-compliant with the Phase II firefighter service requirement that restricts sole possession of a regional master access key (a universal key that allows all elevators within each of the seven state emergency response regions to operate in fire emergencies) to the local fire department. In Section 3, the bill alternatively allows placement of all the elevator keys into a lock box accessible by the master key of the relevant emergency response region.

|

| REGULATES MOLD REMEDIATORS |

Section 24 aspires to quash a cottage industry of unqualified mold assessors and remediators that blackmail associations and defraud homeowners. Although it postpones license enforcement until July 1, 2011, mold scammers currently operating under corporate sponsorship must submit to new education-based individual licensing requirements and pass FDLE scrutiny (a nice touch).

Section 47 of the bill exempts one and two story buildings with exterior egress corridors from the requirement to install a manual alarm system. In Senate Bill 1196, the same exemption is granted to buildings of less than four stories.

Section 47 of the bill exempts one and two story buildings with exterior egress corridors from the requirement to install a manual alarm system. In Senate Bill 1196, the same exemption is granted to buildings of less than four stories.

Section 59 of the bill repeals section 718.113(6), F.S. which provides that condominium associations in buildings greater than three stories must contract for a building report every five (5) years unless the membership votes to waive that requirement. The exact language is as follows:

Section 59 of the bill repeals section 718.113(6), F.S. which provides that condominium associations in buildings greater than three stories must contract for a building report every five (5) years unless the membership votes to waive that requirement. The exact language is as follows:

�6) As to any condominium building greater than three stories in height, at least every 5 years, and within 5 years if not available for inspection on October 1, 2008, the board shall have the condominium building inspected to provide a report under seal of an architect or engineer authorized to practice in this state attesting to required maintenance, useful life, and replacement costs of the common elements. However, if approved by a majority of the voting interests present at a properly called meeting of the association, an association may waive this requirement. Such meeting and approval must occur prior to the end of the 5-year period and is effective only for that 5-year period.�

�6) As to any condominium building greater than three stories in height, at least every 5 years, and within 5 years if not available for inspection on October 1, 2008, the board shall have the condominium building inspected to provide a report under seal of an architect or engineer authorized to practice in this state attesting to required maintenance, useful life, and replacement costs of the common elements. However, if approved by a majority of the voting interests present at a properly called meeting of the association, an association may waive this requirement. Such meeting and approval must occur prior to the end of the 5-year period and is effective only for that 5-year period.�

Does this look familiar? In 2008, Miami Representative Julio Robaina�s Association Bill (HB 995) originally required associations to undergo this pointless review every 5 years. When then Majority Whip Bogdanoff read this provision, she asked its purpose, given the absence of any subsequent requirement to address threats to safety or reconsider the reserve assessments expected to ultimately fund an item�s replacement cost. Associations that simply pay tens of thousands of dollars for the investigation and file the report away will have fully complied with this poorly drafted exercise in misdirecting resources. The inspections would be incremental to the 40-year inspections ordained in Broward and Miami-Dade Counties and would also apply to new buildings that recently passed the more stringent standards precedent to approval for a Certificate of Occupancy. As such, she refused to approve the bill unless amended with the opt-out waiver it currently includes. Since every association in the State either has or plans to opt-out of this screwball expense, even Robaina joined the overwhelming majority of lawmakers that voted to remand this pointless provision to the nearest cornfield.

Does this look familiar? In 2008, Miami Representative Julio Robaina�s Association Bill (HB 995) originally required associations to undergo this pointless review every 5 years. When then Majority Whip Bogdanoff read this provision, she asked its purpose, given the absence of any subsequent requirement to address threats to safety or reconsider the reserve assessments expected to ultimately fund an item�s replacement cost. Associations that simply pay tens of thousands of dollars for the investigation and file the report away will have fully complied with this poorly drafted exercise in misdirecting resources. The inspections would be incremental to the 40-year inspections ordained in Broward and Miami-Dade Counties and would also apply to new buildings that recently passed the more stringent standards precedent to approval for a Certificate of Occupancy. As such, she refused to approve the bill unless amended with the opt-out waiver it currently includes. Since every association in the State either has or plans to opt-out of this screwball expense, even Robaina joined the overwhelming majority of lawmakers that voted to remand this pointless provision to the nearest cornfield.

|

| REP. PAT PATTERSON |

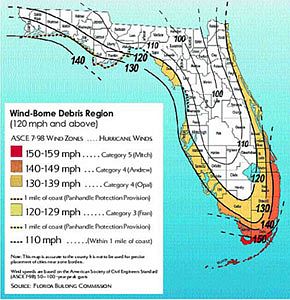

HB 545: After Deland Representative Pat Patterson filed House Bill 545, Senator Thad Altman sponsored companion bill SB 2190. HB 545 repeals section 689.262, F.S. that currently requires contract disclosures of residential property windstorm mitigation ratings to purchasers for homes and condominium units in wind-borne debris regions.

In 2008, the Legislature passed a law that established a two-part phase-in of a requirement that sellers of homes located in the state�s wind borne debris region disclose to buyers the home�s windstorm mitigation rating based on a home grading scale adopted by the Financial Services Commission (FSC) in 2007.

In 2008, the Legislature passed a law that established a two-part phase-in of a requirement that sellers of homes located in the state�s wind borne debris region disclose to buyers the home�s windstorm mitigation rating based on a home grading scale adopted by the Financial Services Commission (FSC) in 2007.

|

| SENATOR THAD ALTMAN |

Since current law doesn�t outline a framework for a home to be inspected and rated under the FSC grading scale, no one is technically qualified to perform this function. As such, the first part was repealed in 2009, immediately before it took effect.

The second part of the phase-in, which is scheduled to take effect beginning January 2011, faces the same problem. Since there are still no qualified inspectors for this purpose, unless the remaining requirement is repealed, the statute will criminalize most of Florida�s coastal home sellers. Enrolled on April 30th, HB 545 was sent to the Governor on May 17th.

The second part of the phase-in, which is scheduled to take effect beginning January 2011, faces the same problem. Since there are still no qualified inspectors for this purpose, unless the remaining requirement is repealed, the statute will criminalize most of Florida�s coastal home sellers. Enrolled on April 30th, HB 545 was sent to the Governor on May 17th.

|

| REP. MARTIN KIAR |

HB 927: Filed by Davie Representative Martin Kiar, HB 927 was rubber stamped in the Senate by Thad Altman�s SB 1884, amending and clarifying section 193.155(3), F.S. to permit the transfer of homestead property to a person�s spouse without losing the benefits under Save Our Homes. This no brainer passed unanimously in both bodies, was enrolled on April 30th and sent to the Governor on May 17th.

|

| CHINESE DRYWALL TAX BREAK |

HB 965: Lakeland Representative Seth McKeel�s HB 965, along with Rhonda Storms� Senate Bill 2160, would direct the County Property Appraiser to reduce the value of real property requiring remediation as a result of �Chinese Drywall� during the process of remediation. Since the prospective loss in tax revenues was unable to be determined, the bill technically required a two-thirds majority for passage. After passing unanimously in both bodies, HB 965 was enrolled on April 30th and sent to the Governor on May 17th. (The silver lining to Chinese Drywall)

SB 1166: Thad Altman�s Senate Bill 1166 absorbed Lakeland Representative Kelli Stargel�s House Bill 645, clearing the way for the placement of group homes. People misconstrued the bill�s intent, assuming it sought to implant group adult homes into private residential communities. In fact, the bill allows greater leeway when organizing a local government-approved, planned unit development for kids with developmental disabilities.

SB 1166: Thad Altman�s Senate Bill 1166 absorbed Lakeland Representative Kelli Stargel�s House Bill 645, clearing the way for the placement of group homes. People misconstrued the bill�s intent, assuming it sought to implant group adult homes into private residential communities. In fact, the bill allows greater leeway when organizing a local government-approved, planned unit development for kids with developmental disabilities.

|

| SENATOR JOE NEGRON |

SB 1964: Joe Negron�s Senate Bill 1964 and Orlando Representative Stephen Precourt�s HB 701 deifies Design Professionals, immunizing architects, interior designers, landscape architects, engineers, & surveyors to legal redress. While the legislation allows recovery of economic damages up to the amount of the professional�s liability insurance coverage, since Florida law doesn�t require this insurance and the bill renders these professionals judgment-proof, there is no incentive for them to purchase malpractice coverage after July 1, 2010 � thereby eliminating any chance of financial recovery. If the association roof designed by your engineer turns into scrubbing bubbles on the day it was completed, you would not even be entitled to an apology. Not surprisingly, Negron is an amateur architect and Precourt is a Transportation Engineer. This bill is frontrunner for the session�s �flip the public� award. If enough people email their opposition to the Governor, he will pull the plug. DO IT!

SB 1964: Joe Negron�s Senate Bill 1964 and Orlando Representative Stephen Precourt�s HB 701 deifies Design Professionals, immunizing architects, interior designers, landscape architects, engineers, & surveyors to legal redress. While the legislation allows recovery of economic damages up to the amount of the professional�s liability insurance coverage, since Florida law doesn�t require this insurance and the bill renders these professionals judgment-proof, there is no incentive for them to purchase malpractice coverage after July 1, 2010 � thereby eliminating any chance of financial recovery. If the association roof designed by your engineer turns into scrubbing bubbles on the day it was completed, you would not even be entitled to an apology. Not surprisingly, Negron is an amateur architect and Precourt is a Transportation Engineer. This bill is frontrunner for the session�s �flip the public� award. If enough people email their opposition to the Governor, he will pull the plug. DO IT!

|

| SEN. GARRETT RICHTER |

SB 2044: Banking and Insurance Chair Senator Garrett S. Richter (Florida Insurance Council 2009 Legislator of the Year) sponsored this 110-page property insurance monstrosity. SB 2044 limits payments to public adjusters for supplemental or reopened claims to 20% of additional insurance proceeds obtained and 10% of those proceeds if the covered event prompted the Governor to declare of a state of emergency. It regulates advertising or solicitation by public adjusters and the form of contract between the public adjuster and the insured.

Now the fun starts. SB 2044 would allow insurers to bypass current Office of Insurance Regulation (OIR) petition procedures when raising their rates by more than 10%.

This bald-faced insurance industry kiss-AXX would also reduce the time frame within which all windstorm or hurricane claims can be filed by property owners and associations. It requires that the insured file any windstorm or hurricane loss claim (including supplemental or reopened claims) within three (3) years of the storm date. Since homeowners rarely know the full extent of windstorm/hurricane damages until after demolition and reconstruction is underway, if the homeowner isn�t able to commence reconstruction immediately following an event, the three (3) year time frame will auger a loss of insurance proceeds (many associations are still fighting with QBE over Hurricane Katrina and Hurricane Wilma claims).

This bald-faced insurance industry kiss-AXX would also reduce the time frame within which all windstorm or hurricane claims can be filed by property owners and associations. It requires that the insured file any windstorm or hurricane loss claim (including supplemental or reopened claims) within three (3) years of the storm date. Since homeowners rarely know the full extent of windstorm/hurricane damages until after demolition and reconstruction is underway, if the homeowner isn�t able to commence reconstruction immediately following an event, the three (3) year time frame will auger a loss of insurance proceeds (many associations are still fighting with QBE over Hurricane Katrina and Hurricane Wilma claims).

Another section of the bill empowers an insurance carrier to almost imperceptibly change the terms of a policy upon renewal by use of a notice entitled �Notice of Change in Policy Terms�. Since payment of the renewal premium constitutes acceptance of the new terms, this stealth �bait and switch� tactic will allow carriers to covertly lace policies with a host of unreasonable preconditions and benefit exemptions unbeknownst to the vast majority of policyholders.

Another section of the bill empowers an insurance carrier to almost imperceptibly change the terms of a policy upon renewal by use of a notice entitled �Notice of Change in Policy Terms�. Since payment of the renewal premium constitutes acceptance of the new terms, this stealth �bait and switch� tactic will allow carriers to covertly lace policies with a host of unreasonable preconditions and benefit exemptions unbeknownst to the vast majority of policyholders.

Of greatest importance to associations, the bill removes the prompt payment requirements on the part of carriers. A carrier will only be required to pay �actual cash value� less the deductible, regardless of whether or not the homeowner purchased �replacement cost� coverage. The carrier is only required to pay the balance of replacement cost funds after the insured has replaced or repaired the property. In essence, the policyholder must somehow finance the reconstruction and/or replacement of personal property without insurance proceeds (along with all the non-insured items) and patiently await reimbursement. Individual or association policyholders unable to self-finance the reconstruction of their covered property will be precluded from collecting their replacement cost benefit.

This policy was in effect until 2005, when the legislature determined that carriers were using this tactic as a strategy to limit their payouts for replacement cost policies to the less expensive actual cash value - functionally cheating the clients. In the insurance industry�s twisted universe, when carriers are forced to pay claims on replacement cost policies for which they collected higher premiums, they actually believe that they are being defrauded. By turning the clock back, the bill will allow them to resume paying actual cash value to settle claims filed by many of their policyholders who purchased replacement cost coverage.

This policy was in effect until 2005, when the legislature determined that carriers were using this tactic as a strategy to limit their payouts for replacement cost policies to the less expensive actual cash value - functionally cheating the clients. In the insurance industry�s twisted universe, when carriers are forced to pay claims on replacement cost policies for which they collected higher premiums, they actually believe that they are being defrauded. By turning the clock back, the bill will allow them to resume paying actual cash value to settle claims filed by many of their policyholders who purchased replacement cost coverage.

Optimistically, the Governor might veto this excursion into the Twilight Zone.

|

| REP ELLYN BOGDANOFF |

HB 7203: Representative Bogdanoff's obscure House Bill 7203, which ultimately absorbed Thad Altman�s Senate Bill 1866, would permit Community Development Districts (CDDs) without qualified electors to levy a tax of up to 1% on commercial rental transactions within the district subject to s. 212.031 to promote and support commercial activity, including festivals and special events that enhance the commercial activity. The tax must be approved by a 4/5 vote of the board of supervisors and two-thirds of the CDD�s landowners. (Don�t worry � this doesn�t affect you!)

|

| REP. YOLLY ROBERSON |

Association members should be delighted by the demise of House Bill 337 by Representative Yolly Roberson and companion Senate Bill 968 by Senator Charlie Justice. The bills contain a �poison pill� that could enable delinquent unit owners to force their neighbors to pay their bills in perpetuity. If the delinquent simply objects to paying an obligation, the association must resolve the objection before taking any action. Since the bill deliberately omits any clarification of what constitutes an acceptable resolution, the decision is incredibly left to the deadbeat. WOOF! Fortunately, the bills died on April 30th in committee.

To promote world peace and a universe in balance, please contact the governor and express your support for SB 1196, the Sprinkler Retrofit Relief bill. While you have his ear, please convey your objections to SB 1964, which enables Design Professionals to screw up with impunity, and SB 2044, the Insurance Industry-drafted �Bait & Switch Disappearing Benefit Act.� It�s either a quick email or phone call now or a 10% rate increase next month.

To promote world peace and a universe in balance, please contact the governor and express your support for SB 1196, the Sprinkler Retrofit Relief bill. While you have his ear, please convey your objections to SB 1964, which enables Design Professionals to screw up with impunity, and SB 2044, the Insurance Industry-drafted �Bait & Switch Disappearing Benefit Act.� It�s either a quick email or phone call now or a 10% rate increase next month.

|

| | Governor Charlie Crist |

| |

| The Capitol | Click Below  Email Governor! Email Governor! |

| 400 South Monroe Street | Yes to SB 1196  YES! YES! |

| Tallahassee, Florida 32399 | No to SB 1964  NO! NO! |

| Phone: (850) 488-7146, Fax: (850) 487-0801 | No to SB 2044  NO! NO! |

|

Click To Top of Page

Rep. Ellyn Bogdanoff

Galt Mile Legislative Update

|

| REPRESENTATIVE ELLYN BOGDANOFF |

May 14, 2010 - A few days after the Sergeants-at-Arms of the Florida Statehouse and Senate simultaneously dropped their handkerchiefs in celebration of the session-ending Sine Die ceremony, Statehouse Representative Ellyn Bogdanoff addressed the May 3, 2010 Presidents Council meeting at the Commodore Condominium. An important member of the State�s legislative leadership, the District 91 Statehouse Representative chaired the influential Finance & Tax Council and served as Vice Chair of the Rules & Calendar Council � the Statehouse gatekeeper committee. Seeking to exploit her intimate familiarity with the State�s soft white fiscal underbelly, House Speaker Larry Cretul also placed Bogdanoff on the bicameral Joint Legislative Budget Commission, the Full Appropriations Council on Education & Economic Development and the Full Appropriations Council on General Government & Health Care.

|

FORMER REPRESENTATIVE

CONNIE MACK IV |

After claiming Connie Mack IV�s vacated District 91 Statehouse seat by a 12-vote margin in a 7-candidate January 2004 special election, Ellyn Bogdanoff spent her first few years in the state capital making friends and learning how to play well with others. In an all-consuming effort to preserve a �collegial� political persona, the neophyte lawmaker declined participation in issues contaminated by controversy, limiting her personal legislative productivity to bills that regulate wine imports and give pause to schoolyard bullies. The Legislature�s Republican leadership noticed that her arguments were always meticulously researched, eminently logical and emotionally compelling.

|

| REP. BOGDANOFF & SPEAKER RUBIO |

When Marco Rubio was tagged for the Speaker�s seat, he installed Bogdanoff as his Majority Whip, citing her networking skill and bi-partisan access as requirements for actualizing his vision for Florida. As Majority Whip, she finally exercised negotiating and networking skills originally honed as an insurance diva and a political consultant. When Rubio charged her with responsibilities he was politically precluded from managing, she delivered. Commenting on Bogdanoff�s job of aligning votes for the Speaker�s agenda, Rubio cynically remarked, �You know it�s a good day in the Florida Legislature when you haven�t been visited by Ellyn Bogdanoff,� characterizing his legislative troubleshooter as �The Angel of Death.� When the new Governor�s legislative agenda was threatened by partisan bickering, Charlie Crist also reached out to Bogdanoff. She cleared the way for a property insurance bill and single-handedly rehabilitated and rescued Florida�s failing no-fault insurance program.

As the legislative session winds down, dozens of Association bills are generally tailored and merged into a single huge confection - an omnibus association bill. It historically contains regulations governing disparate relevant categories including insurance, elections, reserves, maintenance, operational guidelines, etc. In 2008, Associations were being assailed by waves of screwball Condo legislation. A bill was filed that actually required Associations to subsidize unit owners unwilling to pay assessments. Another bill sought to create a 30 to 60 day delay when enforcing any association rule. Other legislation would have forced every association (even new ones) to finance a costly report by an architect or engineer every 5 years attesting to its required maintenance, useful life, and replacement costs (in addition to the report understandably mandated for structures 40 years or older).

As the legislative session winds down, dozens of Association bills are generally tailored and merged into a single huge confection - an omnibus association bill. It historically contains regulations governing disparate relevant categories including insurance, elections, reserves, maintenance, operational guidelines, etc. In 2008, Associations were being assailed by waves of screwball Condo legislation. A bill was filed that actually required Associations to subsidize unit owners unwilling to pay assessments. Another bill sought to create a 30 to 60 day delay when enforcing any association rule. Other legislation would have forced every association (even new ones) to finance a costly report by an architect or engineer every 5 years attesting to its required maintenance, useful life, and replacement costs (in addition to the report understandably mandated for structures 40 years or older).

While juggling her duties as Majority Whip and her District 91 responsibilities, her sizable constituency of association unit owners called on Bogdanoff to defend their right to self-governance. As legislative gatekeeper, Bogdanoff insisted that the bill sponsors demonstrate how depriving an Association�s homeowners of the right to make these decisions would inure to their benefit. By applying this standard to literally hundreds of counterproductive and costly provisions, she was able to either excise or acceptably amend those threatening the greatest damage. Roundly applauded by condo and co-op owners across the State, Representative Bogdanoff has since undertaken to personally sponsor critical association legislation, spearheading last year�s vetoed omnibus bill (HB 419 � SB 714), which provided unit owners with sprinkler retrofit relief and zapped unworkable and expensive insurance regulations. Undeterred by the Governor�s ill advised veto of the popular bill, she sponsored the improved 2010 version (HB 561 � SB 1196).

While juggling her duties as Majority Whip and her District 91 responsibilities, her sizable constituency of association unit owners called on Bogdanoff to defend their right to self-governance. As legislative gatekeeper, Bogdanoff insisted that the bill sponsors demonstrate how depriving an Association�s homeowners of the right to make these decisions would inure to their benefit. By applying this standard to literally hundreds of counterproductive and costly provisions, she was able to either excise or acceptably amend those threatening the greatest damage. Roundly applauded by condo and co-op owners across the State, Representative Bogdanoff has since undertaken to personally sponsor critical association legislation, spearheading last year�s vetoed omnibus bill (HB 419 � SB 714), which provided unit owners with sprinkler retrofit relief and zapped unworkable and expensive insurance regulations. Undeterred by the Governor�s ill advised veto of the popular bill, she sponsored the improved 2010 version (HB 561 � SB 1196).

Following a spontaneous ovation, the former Statehouse Majority Whip briefly ran down some of the painful cuts and compromises used to offset a $3.2 billion State budget shortfall. Competing House and Senate Medicare overhauls fizzled, one-third of the Healthy Families child abuse funding was cut ($10 million) and the 8% hike in college tuition is incremental to last year�s optional 7% increase for Universities. Although a roughly $1.4 billion cushion was nested into the $70.4 billion State budget (plus $730 million if Congress approves Federal Medical Assistance Percentages funds � FMAP), Bogdanoff doesn�t think the Federal Government will provide another $2.3 billion in stimulus subsidies next year. She said that the State�s recovery depends on attracting new business.

Following a spontaneous ovation, the former Statehouse Majority Whip briefly ran down some of the painful cuts and compromises used to offset a $3.2 billion State budget shortfall. Competing House and Senate Medicare overhauls fizzled, one-third of the Healthy Families child abuse funding was cut ($10 million) and the 8% hike in college tuition is incremental to last year�s optional 7% increase for Universities. Although a roughly $1.4 billion cushion was nested into the $70.4 billion State budget (plus $730 million if Congress approves Federal Medical Assistance Percentages funds � FMAP), Bogdanoff doesn�t think the Federal Government will provide another $2.3 billion in stimulus subsidies next year. She said that the State�s recovery depends on attracting new business.

Florida has long been dependent on population growth to finance government spending. While the legislature dodged a hike in State taxes and fees, next year�s anticipated stimulus flameout and the ongoing recessionary growth constriction forebodes a 2011 economic tightrope walk between spending cuts (service reductions) and tax increases. Instead of using the State�s current �wolf at the door� economic scenario to aggressively plug �non-producing� corporate loopholes and broaden the tax base, lawmakers raided theoretically dedicated trust funds, sweeping $506.9 million into general revenue. Creating favorable tax environments and other incentives for drawing new or budding commercial enterprise to Florida is Bogdanoff�s alternative to holding our breath and gutting out the recession via a Chinese menu of service cuts and tax increases. She moved on to some of the session�s regulatory end products, concentrating her review on bills with heightened local impact.

Florida has long been dependent on population growth to finance government spending. While the legislature dodged a hike in State taxes and fees, next year�s anticipated stimulus flameout and the ongoing recessionary growth constriction forebodes a 2011 economic tightrope walk between spending cuts (service reductions) and tax increases. Instead of using the State�s current �wolf at the door� economic scenario to aggressively plug �non-producing� corporate loopholes and broaden the tax base, lawmakers raided theoretically dedicated trust funds, sweeping $506.9 million into general revenue. Creating favorable tax environments and other incentives for drawing new or budding commercial enterprise to Florida is Bogdanoff�s alternative to holding our breath and gutting out the recession via a Chinese menu of service cuts and tax increases. She moved on to some of the session�s regulatory end products, concentrating her review on bills with heightened local impact.

As twice mandated by Broward voters since 2002, the Broward County Ethics Commission finalized the 27-page Broward ethics code on February 19, 2010. An Inspector General with the power to seek fines of up to $5,000 and refer cases to state and federal prosecutors would enforce the new rules. The I.G.'s office would have subpoena power, take testimony under oath from witnesses and investigate any reasonable suspicion of misconduct.

As twice mandated by Broward voters since 2002, the Broward County Ethics Commission finalized the 27-page Broward ethics code on February 19, 2010. An Inspector General with the power to seek fines of up to $5,000 and refer cases to state and federal prosecutors would enforce the new rules. The I.G.'s office would have subpoena power, take testimony under oath from witnesses and investigate any reasonable suspicion of misconduct.

The Broward Legislative Delegation asked Bogdanoff, the panel�s sole active Republican, and Coral Springs Democrat Ari Porth to sponsor the legislative basis for the new office. House Bill 1425, creating the Broward County Office of Inspector General, was filed on February 26th. Despite a blast of unprovoked personal partisan pot shots from Coconut Creek Democrat Jim Waldman and Fort Lauderdale Senator Chris Smith�s public proclamations that a Broward Inspector General was redundant and unnecessary, the bill whizzed through the Statehouse by a vote of 113 Yeas vs. 0 Nays on April 23rd. However, Senator Dennis Jones held the bill hostage in the Senate Rules Committee, setting as ransom Bogdanoff�s blind support for his controversial Tampa Water Management Board legislation. Exclaiming �What goes around comes around,� Jones made it clear that Broward�s ethics concerns would have to wait until next year.

The Broward Legislative Delegation asked Bogdanoff, the panel�s sole active Republican, and Coral Springs Democrat Ari Porth to sponsor the legislative basis for the new office. House Bill 1425, creating the Broward County Office of Inspector General, was filed on February 26th. Despite a blast of unprovoked personal partisan pot shots from Coconut Creek Democrat Jim Waldman and Fort Lauderdale Senator Chris Smith�s public proclamations that a Broward Inspector General was redundant and unnecessary, the bill whizzed through the Statehouse by a vote of 113 Yeas vs. 0 Nays on April 23rd. However, Senator Dennis Jones held the bill hostage in the Senate Rules Committee, setting as ransom Bogdanoff�s blind support for his controversial Tampa Water Management Board legislation. Exclaiming �What goes around comes around,� Jones made it clear that Broward�s ethics concerns would have to wait until next year.

|

| SENATOR MIKE FASANO |

Representative Bogdanoff next described legislation designed to dispel the State�s reputation as the nation�s �Painkiller Capital� by regulating the distribution-intensive cottage industry of storefront pain clinics (Pill Mills) that supply a flourishing South Florida black market. She applauded Senate president pro tempore Mike Fasano for sponsoring Senate Bill 2272, which targets the clinics without interfering with doctor-patient relationships. DEA statistics confirm that in 2006, more oxycodone was distributed in Florida than in any other state - 40 percent more than in second-ranked California. In 2008, Florida was home to the nation�s top 25 pain clinic dispensers of prescription drugs as well as the top 50 physicians for dispensing the most oxycodone in the United States. Hoping that the current legislative session would produce an effective statutory deterrent, on March 2nd, the City of Fort Lauderdale enacted a temporary stopgap � Ordinance No. C-10-07 � establishing a 180-day moratorium on licensing Pain Management Clinics.

Unanimously passed in both bodies, Fasano�s �Pill Mill Bill� prohibits clinics from dispensing more than a 72-hour supply of a controlled substance to patients who pay in cash, check or credit card. Since third party carriers maintain current client and provider utilization databases, providers billing insurance coverage or worker compensation can dispense larger amounts of the regulated medications. Practicing medicine in a pain clinic will require completion of a pain medicine fellowship or residency, or recognition as a pain management specialist by the appropriate licensing board. As with the pain clinics, physicians cannot directly dispense more than a 3 day (72-hour) supply of controlled substances to a patient without a prescription. Additionally, Pill Mills must register with the Department of Healthcare and are precluded from advertizing their products and services.

Unanimously passed in both bodies, Fasano�s �Pill Mill Bill� prohibits clinics from dispensing more than a 72-hour supply of a controlled substance to patients who pay in cash, check or credit card. Since third party carriers maintain current client and provider utilization databases, providers billing insurance coverage or worker compensation can dispense larger amounts of the regulated medications. Practicing medicine in a pain clinic will require completion of a pain medicine fellowship or residency, or recognition as a pain management specialist by the appropriate licensing board. As with the pain clinics, physicians cannot directly dispense more than a 3 day (72-hour) supply of controlled substances to a patient without a prescription. Additionally, Pill Mills must register with the Department of Healthcare and are precluded from advertizing their products and services.

| | REP. RON REAGAN |

Given its direct impact on many of her constituent municipalities, Bogdanoff focused on a bill enabling local jurisdictions to ticket red light violators caught on camera. Bradenton Representative Ron Reagan�s House Bill 325 will relieve a legal dilemma for scores of Florida counties and municipalities in various stages of implementing a red light camera enforcement system - including Fort Lauderdale. When Pembroke Pines initially considered installing their red light camera system in 2005, City Attorney Sam Goren asked then-Attorney General Charlie Crist for a legal opinion. Crist said that while local governments could set up cameras, take pictures and let drivers know when they had run red lights, they couldn�t issue red-light tickets without changes to state law. According to Crist, the state�s uniform traffic code required that �an officer enforcing the traffic law personally observe or have personal knowledge of the particular infraction that serves as the basis for issuing the citation.�

Until now, Florida municipalities have circumvented this support vacuum in state law by ordaining red light infractions as local code violations - and installing the relevant equipment on land not controlled by the state. They also contrived a strategy in which the municipality maintains an arms distance relationship with the event. Generally, the system vendor gathers the video evidence and submits it to local law enforcement for review and evaluation prior to the mailing of code violation fines. Cited as the �Mark Wandall Traffic Safety Act�, Reagan�s bill enables the uniform traffic code to recognize the image evidence as independently sufficient for issuing a ticket. The $158 local fine is shared with the State ($65), trauma centers ($10) and the Miami Project to Cure Paralysis ($3) for brain and spinal cord research. Since the vehicle owner � not the driver � is targeted by red light camera infractions, no points are added to the driving record, avoiding insurance repercussions. The bill specifically exempts legal turns at a red light from camera violations.

Until now, Florida municipalities have circumvented this support vacuum in state law by ordaining red light infractions as local code violations - and installing the relevant equipment on land not controlled by the state. They also contrived a strategy in which the municipality maintains an arms distance relationship with the event. Generally, the system vendor gathers the video evidence and submits it to local law enforcement for review and evaluation prior to the mailing of code violation fines. Cited as the �Mark Wandall Traffic Safety Act�, Reagan�s bill enables the uniform traffic code to recognize the image evidence as independently sufficient for issuing a ticket. The $158 local fine is shared with the State ($65), trauma centers ($10) and the Miami Project to Cure Paralysis ($3) for brain and spinal cord research. Since the vehicle owner � not the driver � is targeted by red light camera infractions, no points are added to the driving record, avoiding insurance repercussions. The bill specifically exempts legal turns at a red light from camera violations.

Seeking to clarify a controversy surrounding related legislation that died in her overburdened Tax and Finance Council, Representative Bogdanoff explained the fate of HB 41, a House bill that sought to ban �texting� while driving. While agreeing that the activity is dangerous, Bogdanoff exclaimed that �there are better ways to deal with driving distractions than to ban a particular activity.� She supported its being fleshed out to penalize using cell phones and other devices while driving, which are implicated in far more accidents. Several other traffic bills died awaiting review in various committees, including Senator Michael Bennett�s SB 482, which addressed road rage and careless driving.

Seeking to clarify a controversy surrounding related legislation that died in her overburdened Tax and Finance Council, Representative Bogdanoff explained the fate of HB 41, a House bill that sought to ban �texting� while driving. While agreeing that the activity is dangerous, Bogdanoff exclaimed that �there are better ways to deal with driving distractions than to ban a particular activity.� She supported its being fleshed out to penalize using cell phones and other devices while driving, which are implicated in far more accidents. Several other traffic bills died awaiting review in various committees, including Senator Michael Bennett�s SB 482, which addressed road rage and careless driving.

|

| BRITISH PETROLEUM IMMORTALIZES THE GULF IN OILS |

When the bill supporting oil drilling on Florida beaches hit a brick wall, Bogdanoff explained that most of her constituents were understandably delighted. Filed by Lakeland Representative Seth McKeel and heavily lobbied by energy trade organizations in Tallahassee and Washington, House Memorial 563 urged Congress to support the removal of protective moratoria currently prohibiting the expansion of oil exploration (drilling) and production in Florida waters. Inland lawmakers reacted to the bill with tacit approval until British Petroleum fell asleep at the wheel and painted the Gulf black. Abandoned overnight, Bogdanoff shares the sentiment expressed by Senate President-elect Mike Haridopolos, �We have no agenda whatsoever for 2011, we�ve permanently tabled this issue.�

|

COUNCIL CHAIR MITCH CYPRESS, GOV. CRIST

& LEGISLATORS ANNOUNCE 2010 PACT |

Since Representative Bogdanoff sat on the �Select Committee on Seminole Indian Compact Review�, she participated in the State�s groundbreaking gambling deal with the Seminole Tribal Council. With four pari-mutuel venues and one of the two flagship Seminole Hard Rock casino resorts located in Broward County, the $1.5 billion agreement prospectively portends the session�s single greatest fiscal benefit to Broward residents. The legislation, SB 622, codifies the terms of the compact and serves to legitimatize heretofore legally murky gaming practices. Since the payouts will be divided among the State and those local jurisdictions wherein the gambling venues reside; Broward County, Hallandale, Pompano Beach, Hollywood and a few adjacent communities all have their thumbs in the pie.

Since Representative Bogdanoff sat on the �Select Committee on Seminole Indian Compact Review�, she participated in the State�s groundbreaking gambling deal with the Seminole Tribal Council. With four pari-mutuel venues and one of the two flagship Seminole Hard Rock casino resorts located in Broward County, the $1.5 billion agreement prospectively portends the session�s single greatest fiscal benefit to Broward residents. The legislation, SB 622, codifies the terms of the compact and serves to legitimatize heretofore legally murky gaming practices. Since the payouts will be divided among the State and those local jurisdictions wherein the gambling venues reside; Broward County, Hallandale, Pompano Beach, Hollywood and a few adjacent communities all have their thumbs in the pie.

Although Bogdanoff originally expressed concerns about the social repercussions and local fiscal drawbacks of a gambling pact, once it was approved by county voters, she redrew her priorities. Preoccupied with expanding the tax base and creating jobs by attracting new business, Bogdanoff currently perceives gambling as an opportunity.

Although Bogdanoff originally expressed concerns about the social repercussions and local fiscal drawbacks of a gambling pact, once it was approved by county voters, she redrew her priorities. Preoccupied with expanding the tax base and creating jobs by attracting new business, Bogdanoff currently perceives gambling as an opportunity.

|

| WILL VENETIAN COME TO FORT LAUDERDALE? |

Having observed that �There�s one place that could compete with Las Vegas: South Florida,� she recommends the type of comprehensive gambling legislation that would attract casino-based mega-resorts comparable to those in Las Vegas, Macau and Singapore; vacation complexes that offer theaters, shopping, restaurants, hotels, spas, convention space and every type of gaming format. She summarized her current outlook, �If we�re going to do it, we should do it right; do it with class.�

|

REP. ELLYN BOGDANOFF PROPOSES

RETROFIT RELIEF BILL |

When Bogdanoff finally focused on her bill providing long-awaited sprinkler retrofit relief, she was interrupted by another enthusiastic ovation. The key provisions in this year�s omnibus association bill, SB 1196, were shepherded through the Statehouse as House Bill 561, filed by Bogdanoff and Representative Matt Hudson.

| | REP. MATT HUDSON |

The bill initially reincarnated last year�s vetoed Senate Bill 714, with a critical improvement. Instead of providing associations with the right to extend the statutory deadline for installing a $million+ sprinkler retrofit from 2014 to 2025, this year�s version vests associations with the right to opt out of the retrofit requirement altogether, thereby eliminating the attendant assessment. The bill also reverses many of the counterproductive and/or expensive regulations that were piggy-backed onto a large omnibus association and insurance bill during the frenetic last weeks of the 2008 session (House Bill 601).

It primarily targets inequitable insurance provisions, such as the right of an association to force every unit owner to purchase HO-6 insurance (condominium unit insurance) and name the association as a beneficiary (you file the claim, the association gets the check). It also eliminates the right of associations to �force place� such coverage if the unit owner fails to produce an evidentiary insurance certificate. It rescinds the requirement that a unit owner�s �hazard insurance� policy include at least $2,000 of �special assessment� coverage � given that no such product exists! SB 1196 redrafts the language to �loss assessment� coverage in a �property insurance� policy and clarifies that it is excess coverage, curing a defect that allows insurance companies to require a second deductible for property damaged during a covered event. It relieves associations of the responsibility to insure �improvements and additions� that benefit fewer than all the owners and updates the statutory standard for the association�s insurance coverage from �full insurable value� to �replacement cost�.

It primarily targets inequitable insurance provisions, such as the right of an association to force every unit owner to purchase HO-6 insurance (condominium unit insurance) and name the association as a beneficiary (you file the claim, the association gets the check). It also eliminates the right of associations to �force place� such coverage if the unit owner fails to produce an evidentiary insurance certificate. It rescinds the requirement that a unit owner�s �hazard insurance� policy include at least $2,000 of �special assessment� coverage � given that no such product exists! SB 1196 redrafts the language to �loss assessment� coverage in a �property insurance� policy and clarifies that it is excess coverage, curing a defect that allows insurance companies to require a second deductible for property damaged during a covered event. It relieves associations of the responsibility to insure �improvements and additions� that benefit fewer than all the owners and updates the statutory standard for the association�s insurance coverage from �full insurable value� to �replacement cost�.

The bill additionally exempts buildings less than four stories in height with exterior corridor egress from being forced to install an expensive manual fire alarm system, allows associations to opt out of installing back-up generators for elevators and delays a requirement to retrofit a special access key for association elevators until the elevator is replaced or requires major modification.

The bill additionally exempts buildings less than four stories in height with exterior corridor egress from being forced to install an expensive manual fire alarm system, allows associations to opt out of installing back-up generators for elevators and delays a requirement to retrofit a special access key for association elevators until the elevator is replaced or requires major modification.

| | COMMON AREA SANCTION FOR DELINQUENCY |

The legislation doubles a foreclosing lender�s �statutory cap� from six months of past due assessments/one percent of original mortgage debt (whichever is less) to twelve months past due assessments/one percent of original mortgage debt (whichever is less). It provides associations with the right to optionally affix consequences for unit owner delinquencies and defaults, including suspension of common area use rights, voting rights or the right to serve on the association board. The association may demand that tenants who occupy units wherein the owner is delinquent pay rent directly to the association.

The bill protects association members and employees from identity theft by safeguarding personal information in the association records. It exempts from unit owner access: e-mail addresses, telephone numbers, emergency contact information, and any addresses of a unit owner that are not provided to fulfill the association�s notice requirements. It also exempts personnel records (disciplinary, payroll, health and insurance records). In addition to the member�s name, lot or unit designation, mailing address and property address, the only other data that must be made available to unit owners is the standard contact information used by the association for official notices.

The bill protects association members and employees from identity theft by safeguarding personal information in the association records. It exempts from unit owner access: e-mail addresses, telephone numbers, emergency contact information, and any addresses of a unit owner that are not provided to fulfill the association�s notice requirements. It also exempts personnel records (disciplinary, payroll, health and insurance records). In addition to the member�s name, lot or unit designation, mailing address and property address, the only other data that must be made available to unit owners is the standard contact information used by the association for official notices.

To help stimulate the condominium market, Bogdanoff created the �Distressed Condominium Relief Act� (also known as bulk-buyer law). By squelching regulatory fiscal obstacles originally intended for developers, SB 1196 smoothes the way for bulk purchasers to thin the currently bloated inventory of units.

To help stimulate the condominium market, Bogdanoff created the �Distressed Condominium Relief Act� (also known as bulk-buyer law). By squelching regulatory fiscal obstacles originally intended for developers, SB 1196 smoothes the way for bulk purchasers to thin the currently bloated inventory of units.

In 2006, Bogdanoff filed an anti-bullying bill for schoolchildren (HB 535) that passed unanimously in the House and was recognized as model legislation by the national movement. When it enigmatically died on the Calendar, she was asked why a bill so well-credentialed bit the dust. Bogdanoff explained that when several of her colleagues told her that they would consider it a personal favor if she would permit them to amend her bill with unrelated �politically neutral� provisions, she na�vely agreed. She concluded, �I will not make that mistake again.� (Filed again as HB 669 in 2008, Bogdanoff�s bill passed both houses unanimously and was signed by Governor Crist on Tuesday, June 10, 2008 at 7:35 AM, enacted as Chapter No. 2008-123.)